WASHINGTON — Further evidence the recession is ending came in a report Thursday confirming that the economy shrank at an annual rate of just 1 percent in the spring.

Many analysts say growth likely returned in the current quarter. Smaller dips in consumer spending and other areas during the April-June period led some economists to raise their forecasts for the July-September quarter.

"We're on a pretty decent recovery path," said Bruce Kasman, chief economist at JPMorgan Chase & Co. in New York. "There was a better mix last quarter with almost every major component of final demand being revised up and inventories being revised down.That puts us in a pretty decent position going into the third quarter."

But with unemployment-aid claims stubbornly high, Americans may benefit little from a recovery if jobs remain scarce and spending stays too low to fuel a strong rebound.

The Commerce Department estimated that the U.S. gross domestic product, the broadest gauge of economic health, shrank at an annual rate of 1 percent in the second quarter.

The estimate of the nation's output of goods and services was the same as an earlier estimate released last month.

The negative figure marks a record fourth consecutive quarterly decline.

But it was far smaller than the nose dive the economy had taken during the previous two quarters.

Businesses slashed inventories at an even greater rate than had been expected in the spring. But economists were encouraged by upward revisions to consumer spending, exports and housing construction. Analysts had expected the second-quarter economic figure to show a drop of 1.5 percent,

"The big surprise in this report was that there was enough spending in the consumer sector and elsewhere to offset all the loss from inventory reductions," said Nigel Gault, chief U.S. economist at IHS GlobalInsight.

Consumer spending, which accounts for about 70 percent of total economic activity, fell at an annual rate of 1 percent in second quarter. It was a slight improvement from the 1.2 percent decline reported last month.

Gault predicted the economy will gain momentum in the current quarter and final three months of this year as businesses switch from trimming stockpiles to rebuilding inventories. He expects the gross domestic product to jump to above 3 percent in the July-September quarter, boosted by the "cash from clunkers" auto program.

Growth likely will remain around 3 percent in the fourth quarter, Gault said. But then it could slip in the first half of next year as the support from inventory rebuilding begins to fade. Consumers, faced with bleak job prospects, won't likely be able to take up the slack, he said.

Unemployment is not expected to peak until next spring, probably somewhere above 10 percent. The jobless rate is now 9.4 percent. In Arkansas, the unemployment rate rose in July to 7.4 percent, up from 7.2 percent in June.

White House economic adviser Christina Romer earlier this week said the unemployment rate is likely to hit 10 percent this year. Economists think the unemployment rate will inch up to 9.5 percent for August, with 220,000 more jobs lost, down a bit from 247,000 in July.

That report is scheduled for release next week.

Federal Reserve Bank of St. Louis President James Bullard said Thursday that he's optimistic that the worst of the economic crisis is over, citing signs that the housing industry may be nearing a bottom.

"Recent data suggest the economy is stabilizing, and there should be positive economic growth in the second half of 2009," Bullard said, according to a news release issued before a speech at the University of Arkansas at Little Rock.

The 1 percent dip in gross domestic product in the April-June quarter followed declines of 6.4 percent in the first quarter and 5.4 percent in the final three months of 2008, the sharpest back-to-back declines in a half century. The four straight quarterly declines in gross domestic product mark the first time that has occurred on government records dating from 1947.

The recession that began in December 2007 is the longest since the Great Depression. It's also the deepest as measured by the drop in gross domestic product, which is down 3.9 percent from its previous peak.

Even though economists expect the economy to start growing again in the current quarter, signaling the end of the recession, that won't mean the end of job losses.

Businesses likely will continue to keep tight control over labor costs until they see more evidence that the recovery will not falter.

Some analysts worry that the country could face a double-dip recession in which growth returns for a while, only to falter again as beleaguered consumers remain reluctant to increase spending.

"This recovery has a lot going for it, but one thing it does not have going for it is an anticipation of a normalization for consumers," JPMorgan's Kasman said.

"The economy will do better, but we aren't going to have a full-bodied, strong recovery coming out of what has been a very damaging, deep recession."

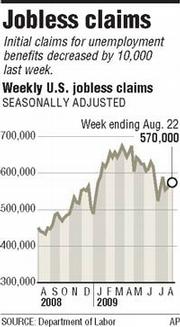

First-time unemployment claims last week fell to a seasonally adjusted 570,000, from an upwardly revised 580,000 the previous week, the Labor Department said Thursday.

The number of those continuing to claim benefits dropped from 6.25 million to 6.13 million, the lowest level since early April.

The weekly figures remain far above the roughly 325,000 claims that analysts say is consistent with a healthy economy. New claims last fell below 300,000 in early 2007.

Reports released Wednesday showed that new-home sales jumped almost 10 percent from June, and orders for durable goods like appliances, planes and computers rose nearly 5 percent in July. Those increases, however, came from extraordinarily low levels and were fueled by temporary government programs and tax credits for home sales.

On Wall Street, stocks overcame early losses and moved slightly higher in afternoon trading. For the session, the Dow Jones industrial average rose 37.11 to close at 9,580.63. Broader indexes were mixed.

Included in Thursday's report was the first look at corporate profit for the second quarter. The government estimated that profit rose 5.7 percent in the second quarter, the biggest increase since the first quarter of 2005. Analysts said the gain came primarily from widespread layoffs and other attempts to trim costs.

"The corporate cost cutting led to the solid increase in earnings despite the decline in [economic] growth," said Joel Naroff, chief economist at Naroff Economic Advisers.

The government makes three estimates of the economy's performance for any given quarter. Each new gross domestic product estimate is based on more complete information.

Federal Reserve Chairman Ben Bernanke said last week that the economy appeared to be "leveling out" and was likely to begin growing again soon.

President Barack Obama appointed Bernanke to another four-year term Tuesday.

Information for this article was contributed by Martin Crutsinger of The Associated Press and Vivien Lou Chen and Timothy R. Homan of Bloomberg News.

Front Section, Pages 1, 10 on 08/28/2009