LITTLE ROCK — The fledgling Arkansas biodiesel industry is at a standstill until a $1 per gallon tax credit for blending the renewable fuel with standard diesel is approved by Congress, energy experts say.

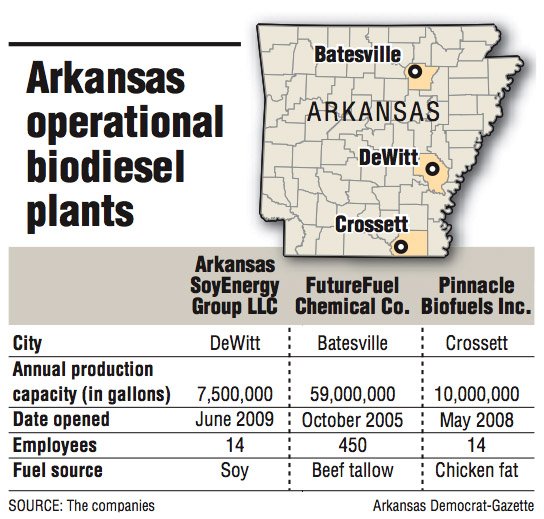

Arkansas has three operational biodiesel manufacturing plants, state Agriculture Secretary Richard Bell said Thursday.

Arkansas SoyEnergy Group LLC operates a soybean-crushing facility and biodiesel plant in DeWitt, Pinnacle Biofuels Inc. converts chicken fat to biodiesel in Crossett and FutureFuel Chemical Co. in Batesville converts beef tallow into biodiesel as a part of its larger chemical operations. Altogether, the three plants have an annual production capacity of 76.5 million gallons.

Biodiesel is the name given to a fuel made from renewable sources such as soybeans and sawgrass, or from secondary byproducts of livestock such as beef tallow or other animal fats. It can be used in any diesel engine without modification. It is usually used as a blend with traditional diesel fuels, ranging from 2 percent to 20 percent biodiesel content.

But it’s not commonly available for all purposes yet. In Arkansas, just 14 gas stations sell biodiesel to motorists, according to National Biodiesel Board data at www.biodiesel.org. Some other Web sites put the number slightly higher.

Bell said the current production is only 20 percent of capacity as plants and buyers wait to see what Congress does with the tax credit.

The tax credit, an incentive for blending biodiesel with conventional dieselfuel, reduces the price of biodiesel and makes it competitive with the price of conventional petroleum products, wrote John Urbanchuk, economist and director of LECG, a global expert service and consulting firm in Emeryville, Calif.

Two other plants, Delta American Fuel LLC in Helena-West Helena and Diamond Valley Ventures Inc. in Rohwer, are still being developed, Bell said. They will add another 50 million gallons to the state’s annual production capacity.

“I think [the tax credit] will be extended and will be made retroactive back to Jan. 1. It would have been done in September last year but the health initiative slowed everything down,” Bell said.

The House of Representatives passed the Tax Extenders Act of 2009, which includes the biodiesel tax credit, before it adjourned for Christmas. The Senate did not take up any legislation before adjournment. It is scheduled to reconvene on Tuesday.

Brad Dobson, plant manager for Pinnacle Biofuels Inc., said the tax-credit lapse has put a strain on trying to sell the fuel to companies for blending with traditional diesel.

“It is all on hold right now,” Dobson said Thursday.

Terry McCullars, biodiesel salesman for Arkansas SoyEnergy Group, said the market is at a standstill until the credit can be reinstated.

SoyEnergy has lost jobs since employing 21 at full operational capacity in June 2008. It has 14 employees now, McCullars said Thursday.

The plant’s soy-crushing facility is keeping the company going in the meantime,McCullars said.

FutureFuel Chemical Co. biodiesel manager Rich Byers said the timing of the taxcredit lapse was advantageous for the Batesville plant.

“We have a lot of capital projects going on right now. Winter is usually the slowest part of the year for biodiesel production and sales, so we scheduled the projects for right now. So the slowdown has had no detrimental effect on our facility,” McCullars said.

The plant employs about 450 people who work both in biodiesel and the chemical production lines, he said.

“It is frustrating and aggravating to have Congress not approve that dollar,” Mc-Cullars said, “But we will beready and waiting for the industry to start up again when it does happen.” Tyson Foods Inc. in Springdale and Syntroleum Corp. in Tulsa, partners on the Dynamic Fuels project, are building a fuel-production facility in Geismar, La., that will not be affected by the tax-credit loss, said Tyson spokesman Gary Mickelson in an e-mailed statement Thursday. The partnership’s plant is still under construction and is not expected to begin production for a few months.

The tax incentive is key to Dynamic Fuels’ profitability in the long run, Bob Ames, who oversees Tyson Foods’ Renewable Energy group, said at the plant’s groundbreaking ceremony in May.

The original biodiesel tax credit was passed in 2004 and has been extended twice, mostrecently in October 2008, and expired on Dec. 31. Credit of $1 per gallon was granted to biodiesel produced from virgin feedstocks such as soybean oil and nonvirgin feedstock such as yellow grease and animal fats, according to the report by Urbanchuk.

Urbanchuk’s report was presented to the National Biodiesel Board in December and outlined the economic impact of eliminating the tax credit would have on the industry.

In 2008, Urbanchuk states that the biodiesel industry supported 51,893 jobs in all sectors of the economy and added $4.287 billion to the nation’s gross domestic product. In that same year, the industry generated $866.2 million in tax revenue for federal, state and local governments, Urbanchuk wrote.

In 2009, the volatile commodity prices and weak motor-fuel demand caused by the recession have slowed the biodiesel industry, Urbanchuk wrote. Nearly 29,000 jobs were lost during the year and all profitability in the industry was essentially erased, he stated.

Manning Feraci, vice president of federal affairs for the National Biodiesel Board, said in a December statement that failure to renew the tax credit could result in another 23,000 environmentally friendly jobs lost in 2010.

Senate Finance Committee Chairman Max Baucus, DMont., and Committee Ranking Member Chuck Grassley, R-Iowa, have pledged to bring up the extenders package early in 2010, according to a statement on the National Biodiesel Board’s Web site.

Business, Pages 67 on 01/17/2010