WASHINGTON — Democrats pushed a year-long extension of tax cuts for all but the highest-earning Americans through the Senate on Wednesday.

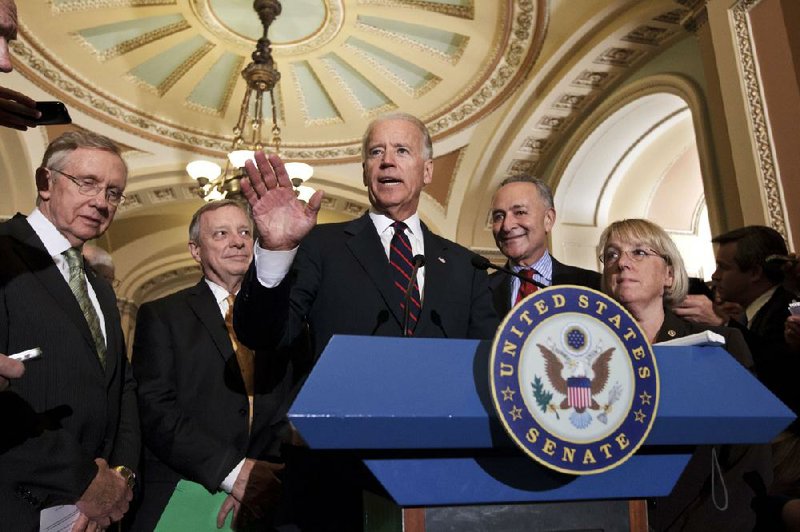

Senators approved the Democratic bill by a near party-line 51-48 vote, with Vice President Joe Biden presiding over the chamber in case his vote was needed to break a tie. Minutes earlier, lawmakers voted 54-45 to kill a rival Republican package that would have included the highest earners in the tax reductions.

The $250 billion Democratic measure would extend tax cuts in 2013 for millions of Americans that otherwise would expire in January. But it would deny those reductions to the earnings of individuals exceeding $200,000 yearly and of couples surpassing $250,000.

The Senate’s action was not expected to result in a congressional agreement on taxes anytime soon. But the frantic give-and-take over tax cuts set to expire Jan. 1 illustrated how anxious both sides were to provide a way for senators to weigh in on the tax fight.

“This is not a serious piece of legislation because it is not going anywhere,” said Sen. Mitch McConnell of Kentucky, the Republican leader, who opened the door to the showdown by dropping a Republican filibuster threat.

President Barack Obama countered, “It’s time for House Republicans to drop their demand for another $1 trillion giveaway to the wealthiest Americans and give our families and small businesses the financial security and certainty that they need.”

In Wednesday’s vote, two senators who will retire next year — Jim Webb, D-Va., and Joe Lieberman, a Connecticut independent who usually votes with Democrats — voted against the Democrats’ measure.

Opposing the GOP measure were Sen. Scott Brown, R-Mass., who faces a tough re-election fight in November, and Sen. Susan Collins, R-Maine. Sen. Mark Pryor, D-Ark., who faces re-election in 2014, voted for both the Republican and Democratic plans. Sen. John Boozman, RArk., voted for the Republican plan and against the Democratic one.

“If the wealthiest people in America can’t get a tax break, the Senate Republicans say, ‘No one gets a tax break,”’ Sen. Richard Durbin of Illinois, Senate Democrats’ No. 2 leader, said after the roll calls. “That was what these two votes tell us.”

Republicans said the measure was all about Democratic posturing for the coming elections and would hurt the economy.

“Thank goodness it’s not going anywhere because it would be bad for the economy, the single worst thing we could do to the country,” Mc-Connell said.

Next week, the GOP-run House will approve tax cuts nearly identical to the $405 billion Republican plan the Senate rejected Wednesday.

“With the Senate’s vote, the House Republicans are now the only people left in Washington holding hostage the middle-class tax cuts for 98 percent of Americans and nearly every small business owner,” Obama said in a written statement after the vote.

House Speaker John Boehner, R-Ohio, restated his plan for next week’s vote, citing the Democratic measure’s tax boosts on higher earners. Republicans say those increases sap money from business owners who would otherwise create jobs, which Democrats say is overblown.

“The House will vote next week to stop that tax hike, and until the Senate does the same, the threat to our economy remains,” Boehner said in a written statement.

Congress’ bipartisan Joint Committee on Taxation has said just 3.5 percent of taxpayers with business income filing individual returns would be exposed to higher taxes next year under the Democratic bill. But such taxpayers account for 53 percent of reported business income on those returns.

Under the Senate-passed bill, income tax rates for couples’ earnings over $250,000 would rise from 33 percent to 36 percent. Tax rates on income over about $390,000 would rise from 35 percent to 39.6 percent. The rate on most dividends and capital gains would rise from 15 percent to 20 percent for incomes over $250,000.

The Republican bill would increase the deficit by $408 billion over five years, but that includes $102 billion to stave off an expansion of the alternative minimum tax in 2014, something Democrats say they would do as well. The Senate-passed bill would increase the deficit by $251 billion, but that number would rise if Democrats blunt the return of the 1990s estate tax.

In addition to the incometax cuts, the Senate Democrats’ bill would prevent the alternative minimum tax from affecting more taxpayers when they file their 2012 returns, though it is silent on the alternative minimum tax for 2013. The Republican plan would prevent the alternative minimum tax from expanding in 2013.

That tax accounts for much of the difference in the two proposals’ cost. The Republican plan would cost the government $404.9 billion in lost revenue, compared with the effect of doing nothing, according to the nonpartisan Joint Committee on Taxation. The Democratic plan would cost $249.7 billion in lost revenue.

Democrats also want to extend expiring tax-credit provisions that benefit college students and low-income families.

Republicans haven’t proposed extending those tax credits, and Democrats have labeled that stance a tax increase for the middle class. According to the Tax Policy Center, the Republican plan would mean higher taxes on 15.4 percent of households.

B ecause of divisions among Democrats, the measure didn’t address the estate tax. If Congress doesn’t act, the estate tax in 2013 will have a $1 million per-person exemption and a 55 percent top rate, compared with the current $5.12 million per-person exemption and 35 percent top rate.

“A vote for the Democratic plan is a vote to put these farms and ranches literally out of business,” McConnell said.

Some Democrats who had said they were undecided, including Bob Casey of Pennsylvania and Ben Nelson of Nebraska, voted for the bill that passed. The likely fate of the proposal didn’t bother Nelson, he said.

“We vote on a lot of things that are DOA in the House,” he said. “The House votes on a lot of things that are DOA in the Senate.”

Both parties insisted they had gotten the upper hand in Wednesday’s Senate showdown. Senate Democrats say they have done their part to steer clear of the “fiscal cliff” in 2013, when more than $600 billion in tax increases and automatic spending cuts are to go into effect.

By insisting that richer households pay more, Democrats say they will spread the pain necessary to get the budget deficit under control. “Those who have done very, very well, even in this economy, have a responsibility to help pay off our national debt,” said Sen. Debbie Stabenow, D-Mich., who is running for re-election.

Republicans say they gave their members the vote they wanted — to keep taxes from rising in a slow economy — while forcing vulnerable Democrats like Sens. Claire McCaskill of Missouri and Jon Tester of Montana to cast votes that could be turned against them and portrayed as tax increases in their reelection campaigns.

Information for this article was contributed by Jonathan Weisman of The New York Times; by Alan Fram and Jim Kuhnhenn of The Associated Press; and by Richard Rubin and Kathleen Hunter of Bloomberg News.

Front Section, Pages 1 on 07/26/2012