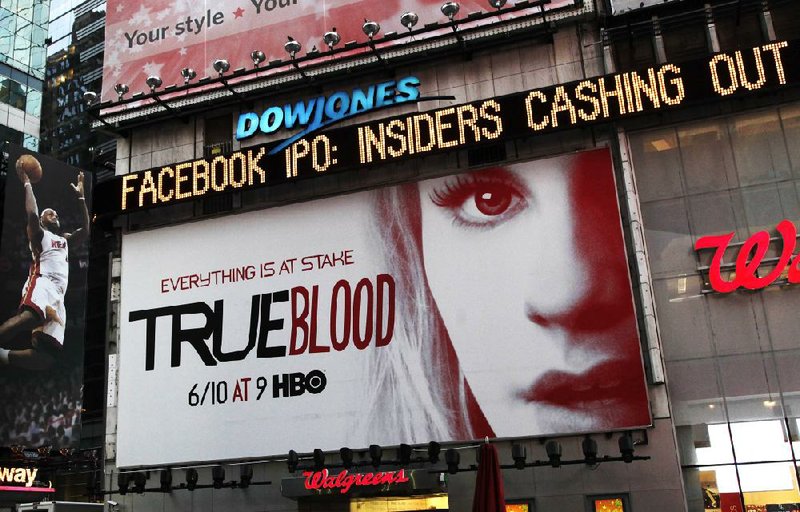

NEW YORK — Facebook priced its initial public offering of stock Thursday at $38 per share, at the high end of the expected range. It means investor demand is strong for the world’s largest online social network.

Facebook Inc. and its early investors now stand to reap as much as $18.4 billion from the IPO, if the extra shares reserved to cover additional demand are sold as part of the transaction. Without the extra shares, the offering raises $16 billion. The IPO values the company at $104 billion, above Amazon.com, Disney and Kraft.

The offering is shaping up to be one of the largest in history - a huge payoff for a company that started out eight years ago with no way to make money.

The $38 price tag is what the investment banks orchestrating the offering will charge their clients for the stock. Facebook’s stock is expected to begin trading on the Nasdaq Stock Market sometime this morning under the ticker symbol “FB.”

Facebook is the third-highest valued company ever to go public, according to data from Dealogic, a financial data provider. Only two Chinese banks have been worth more.

For the Harvard dorm born social network that reimagined how people communicate online, the stock sale means more money to operate the data centers that hold the trove of status updates, photos and videos shared by Facebook’s 900 million users. It means more money to hire the best engineers to work at its sprawling Menlo Park, Calif., headquarters, or in New York City, where it opened an engineering office last year.

And it means early investors, who took a chance seeding the young social network with startup funds six, seven and eight years ago, can reap big rewards. Peter Thiel, the venture capitalist who sits on Facebook’s board of directors, invested $500,000 in the company back in 2004. He’s selling nearly 17 million of his shares in the IPO, which means he’ll get some $640 million.

The offering values Facebook, whose 2011 revenue was $3.7 billion, at as much as $104 billion. The sky-high valuation has its skeptics. Google Inc., whose revenue stood at $38 billion last year, has a market capitalization of $207 billion.

There are a few reasons for the exuberance. One is the IPO’s sheer size. Investor appetite for the stock will likely propel Facebook’s valuation to the $104 billion mark.

Secondly, it’s personal.

“It’s probably one of the first times there has been an IPO where everyone sort of has a stake in the outcome,” said Gartner Inc. technology analyst Brian Blau.

And then there’s Chief Executive Officer Mark Zuckerberg, 28, who celebrated a birthday Monday. He has emerged as the latest in a line of Silicon Valley prodigies who are alternately hailed for pushing technology in new directions and reviled for overstepping bounds. He’s counted the late Apple CEO Steve Jobs among his mentors and he became one of the world’s youngest billionaires - at least on paper - well before Facebook went public. A dramatized version of Facebook’s founding was the subject of a Hollywood movie that won three Academy Awards last year, propelling Zuckerberg even more into the public spotlight.

Though Zuckerberg is selling about 30 million shares, he will remain Facebook’s largest shareholder. He set up two classes of Facebook stock, building on the model Google co-founders Larry Page and Sergey Brin created as part of the online search leader’s 2004 IPO.

The dual class structure helps to ensure that he and other executives keep control as the sometimes conflicting demands of Wall Street exert new pressures on the company.

As a result, with the help of early investors who’ve promised to vote their stock his way, Zuckerberg will have the final say on how nearly 56 percent of Facebook’s stock votes.

Business, Pages 27 on 05/18/2012