WASHINGTON - The unemployment rate dropped to a five-year low of 7 percent in November, the Labor Department said Friday, as American employers added more workers than forecast.

The surprisingly robust gain suggested to analysts that the economy may have begun to accelerate. As more employers step up hiring, more people have money to spend to drive the economy.

“It’s strong across the board,” said Gus Faucher, senior economist at PNC Financial Services Group in Pittsburgh. “There is nothing in here not to like.”

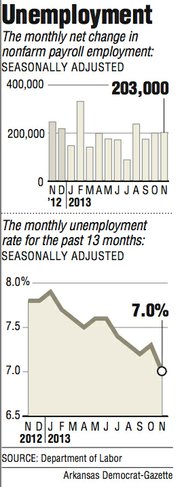

Employers added 203,000 jobs last month after adding 200,000 in October. The median forecast of 89 economists surveyed by Bloomberg called for a 185,000 advance.

“It’s hinting very, very strongly that the economy is starting to ramp up, that growth is getting better, that businesses are hiring,” said Joel Naroff, president of Naroff Economic Advisors.

November ’s job gain helped lower the unemployment rate from 7.3 percent in October. The economy has now added a four-month average of 204,000 jobs from August through November, up sharply from 159,000 a month from April through July. The October unemployment rate in Arkansas, the most recent measurement, rose to 7.5 percent, up from 7.4 percent in September.

Job growth nationally has fueled speculation that the Federal Reserve will scale back its economic stimulus when it meets later this month.

Fed policymakers are considering how and when to reduce $85 billion in monthly asset purchases without triggering a rise in interest rates, which could erode progress in the labor market and slow economic growth.

“What they’ve been waiting for is evidence of faster job growth,” said Sam Coffin, an economist at UBS Securities LLC in New York, who correctly projected the decline in the unemployment rate to 7 percent and predicts the Fed will start tapering its stimulus program in January.

“While they’ve nominally targeted the unemployment rate, it feels from their talks that they’re more focused on payrolls actually, and probably 200,000 a month is what they’re looking for,” he said.

Investors were heartened by the news. The Dow Jones industrial average surged 198.69 points to close Friday at 16,020.20.

The unemployment rate has fallen nearly a full percentage point since the Fed began buying bonds in September 2012 and has reached 7 percent earlier than most analysts had expected.

In June, Chairman Ben Bernanke suggested that the Fed would end its bond purchases after the unemployment rate reached 7 percent. The bond purchases have been intended to keep borrowing rates low.

Bernanke later backed away from the 7 percent target. He cautioned that the Fed would weigh numerous economic factors in any decision it makes about its bond purchases. Many economists still think the Fed won’t begin to cut back until January or later.

While the Fed weighs its options, U.S. employers may finally be gaining enough confidence in the economy, 4½ years after the recession officially ended, to ramp up hiring. In addition to the solid job gain and the drop in the unemployment rate, Friday’s report offered other encouraging signs:

Higher-paying industries are adding more jobs. Manufacturers added 27,000 jobs, the most since March 2012. Construction companies added 17,000. The two industries have created a combined 113,000 jobs over the past four months.

Hourly wages are up. The average rose 4 cents in November to $24.15. It’s risen just 2 percent in the past year. But that’s ahead of inflation: Consumer prices are up only 0.9 percent in that time.

Employers are giving their workers more hours: The average workweek rose to 34.5 hours from 34.4. A rule of thumb among economists is that a one-tenth hourly increase in the workweek is equivalent to adding 300,000 jobs.

Hiring was broad-based. In addition to higher-paying industries, retailers added 22,300 jobs, restaurants, bars and hotels 20,800. Education and health care added 40,000. And after years of cutbacks, state and local governments are hiring again. In November, governments at all levels combined added 7,000 jobs.

The report contained some sour notes: Many Americans are still avoiding the job market, neither working nor looking for work. That’s one reason the unemployment rate has fallen in recent months. The percentage of adults either working or searching for jobs remains near a 35-year low.

And America’s long-term unemployed are still struggling. More than 4 million people have been out of work for six months or longer. That figure was essentially unchanged in November. By contrast, the number of people who have been unemployed for less than six months fell last month.

The steady decline in unemployment, from a high of 10 percent four years ago, is welcome news for the White House. But Jason Furman, President Barack Obama’s top economic adviser, said the plight of the long-term unemployed points to the need to extend emergency unemployment benefits.

About 1.3 million people who’ve been out of work for six months or more will lose unemployment aid if a 5-yearold program to provide extra benefits expires Dec. 28. The Congressional Budget Office has estimated the cost of an extension at $25 billion. Some Republicans on Capitol Hill have balked at the cost.

But on Thursday, House Speaker John Boehner, R-Ohio, said he was willing to consider extending the program.

Friday’s jobs report follows other positive economic news. The economy expanded at an annual rate of 3.6 percent in the July-September quarter, the fastest growth since early 2012, though nearly half that gain came from businesses rebuilding stockpiles. Consumer spending grew at its slowest pace since late 2009.

But if hiring continues at its current pace, a virtuous cycle will start to build: More jobs typically lead to higher wages, more spending and faster growth.

That said, more higher-paying jobs are needed to sustain the economy’s momentum. Roughly half the jobs that were added in the six months through October were in four low-wage industries: retail; hotels, restaurants and entertainment; temp jobs; and home health-care workers.

Information for this article was contributed by Christopher S. Rugaber, Josh Boak and Jim Kuhnhenn of The Associated Press; by Jeanna Smialek of Bloomberg News; and by Nelson D. Schwartz of The New York Times.

Front Section, Pages 1 on 12/07/2013