WASHINGTON - The Federal Reserve said Wednesday that it will reduce its stimulus program for the U.S. economy because the job market has shown steady improvement. The Fed will trim its $85 billion a month in bond purchases by $10 billion starting in January.

RELATED ARTICLE

http://www.arkansas…">Stocks soar on stimulus pullback

The shift could lead to higher long-term borrowing rates for individuals and businesses.

“In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions, the committee decided to modestly reduce the pace” of purchases, the Federal Open Market Committee said at the conclusion of a two-day meeting in Washington.

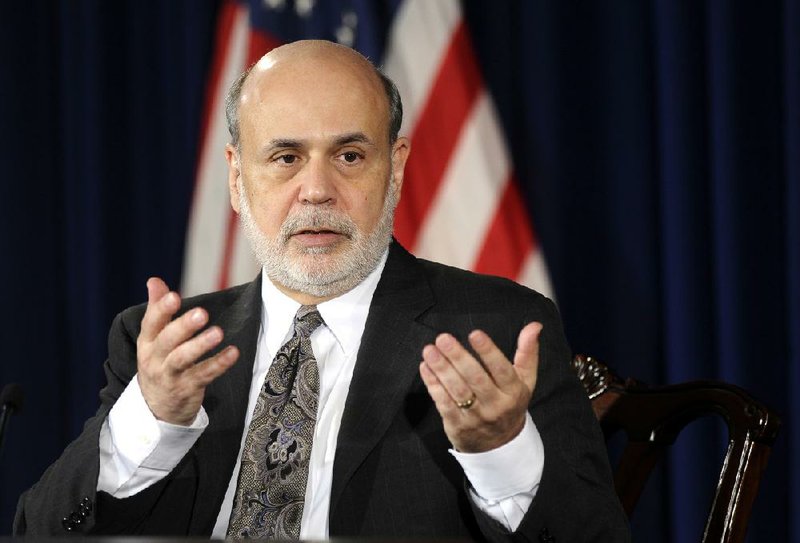

At a news conference after the meeting, Chairman Ben Bernanke said the Fed expects to make “similar moderate” reductions in its monthly bond purchases if economic improvements continue. “I want to emphasize that we are going to be data-dependent,” he said.

Investors responded positively to the Fed’s decision, sending the Dow Jones industrial average up 292.71 points, or 1.8 percent, to 16,167.97.

Bernanke, in the final weeks of his eight-year tenure, is curtailing the purchases that swelled the Fed’s balance sheet almost to $4 trillion as he sought to put millions of jobless Americans back to work. The policy, supported by his designated successor, Vice Chairman Janet Yellen, stirred concern that it risks inflating asset-price bubbles even as its economic benefits ebbed.

Yellen, who is awaiting a Senate vote on her nomination as chairman, has supported Bernanke’s policies.

Asked at his news conference about Yellen’s role in the decision, Bernanke said: “I have always consulted closely with Janet … and I consulted closely with her on these decisions, as well, and she fully supports what we did today.”

In its policy statement, the Fed said it will reduce its purchases of mortgage bonds and Treasury bonds each by $5 billion. Beginning in January, it will purchase $35 billion in mortgage bonds each month and $40 billion in Treasurys.

“It’s a dovish taper,” said Mark Zandi, chief economist for forecaster Moody’s Analytics.

The Fed’s actions were approved in a 9-1 vote. The only member to object was Eric Rosengren, president of the Federal Reserve Bank of Boston. He called the move premature because unemployment remains high and inflation extremely low.

The Fed on Wednesday also said it plans to hold its key short-term interest rate near zero “well past” the time when unemployment falls below 6.5 percent. Unemployment is now 7 percent.

Federal Reserve officials raised their assessment of the outlook for the job market, predicting that the unemployment rate will fall as low as 6.3 percent by the end of next year, compared with a September projection of 6.4 percent to 6.8 percent.

The Fed’s reduction to $75 billion a month in bond purchases is a small but significant step, analysts said. It means Fed policymakers are ready to ease the extraordinary support they’ve provided to the economy since the recession began six years ago.

“We’re really at a point where we’re getting to the self-sustaining recovery that the Fed has been talking about,” said Scott Anderson, chief economist of Bank of the West. “It really seems like that’s going to come together in 2014.”

The move by the Fed “eliminates the uncertainty as to whether or when the Fed will taper and will give markets the opportunity to focus on what really matters, which is the economic outlook,” said Roberto Perli, a former Fed economist who is now head of monetary policy research at Cornerstone Macro.

But Perli said the Fed has not entirely pulled its support for the economy. By still keeping interest rates historically low, the Fed “will continue to remain very supportive of risky assets,” Perli said.

The Fed’s action comes after encouraging reports that show the economy is accelerating.

Hiring has been robust for four straight months, and factory output is up. Consumers are spending more at retailers. Auto sales haven’t been better since the recession ended 4½ years ago.

And Congress gave final approval Wednesday to legislation that reduces federal spending cuts and averts the risk of another government shutdown early next year.

“It eases a bit of the fiscal restraint in the next couple of years, a period where the economy needs help to finish the recovery,” Bernanke said of the congressional deal. “So those things, you know, are positive things.”

The economy is improving consistently, and the Fed is “now recognizing the trend and decided to go with the flow,” said John Silvia, chief economist at Wells Fargo.

One factor of concern for some Fed members is inflation, which remains historically low. For the 12 months ending in October, consumer inflation as measured by the Fed’s preferred index is just 0.7 percent, well below its target rate of 2 percent.

But the Fed sees inflation slowly moving toward its target, according to its most recent economic projections that were released Wednesday. The Fed projects that inflation would range between 1.4 percent and 1.6 percent next year and could reach the Fed’s target in 2015 at the earliest.

Information for this article was contributed by Martin Crutsinger and Josh Boak of The Associated Press; by Joshua Zumbrun, Steve Matthews, Craig Torres and Caroline Salas Gage of Bloomberg News; and by Kevin G. Hall of the McClatchy Washington bureau.

Front Section, Pages 1 on 12/19/2013