WASHINGTON - Americans’ confidence in the economy fell this month to the lowest level since April, as many worried about the effect of a 16-day partial government shutdown. The decline stands to weigh on spending and economic growth.

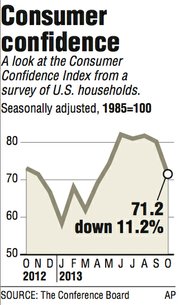

The Conference Board said Tuesday that its index of consumer confidence dropped to 71.2 in October, down from 80.2 the previous month. September’s figure was slightly higher than initially reported.

In separate reports Tuesday, the Labor Department said a drop in food prices helped hold down wholesale inflation in September and the Standard & Poor’s/Case-Shiller 20-city home price index showed a jump in home prices in August, compared with a year ago.

“Consumers continue to hold in despite all the uncertainty going into the shutdown,” said Millan Mulraine, director of U.S. rates research at TD Securities USA LLC in New York. “We ended the quarter on a fairly solid note. Whether this buoyancy can be sustained remains a question after the hit to consumer confidence from the shutdown.”

Consumers grew particularly pessimistic in their outlook on the economy six months from now, while their assessment of current economic conditions declined by much less. They also expect less hiring in the months ahead. Consumers’ confidence is closely watched because their spending accounts for 70 percent of economic activity.

Americans were more confident in the spring as job gains were healthy and economic growth improved. The Conference Board’s measure reached 82.1 in June, the highest in 5 ½ years. That’s still below the reading of 90 that is consistent with a healthy economy.

Confidence has dropped in three of the four months since June. The shutdown already caused a drop this month in the University of Michigan’s measure of consumer sentiment. Americans made more negative references to the federal government’s effect on the economy in October than at any time in the 50-year history of the survey, the university said.

Weaker job growth also is weighing on consumers’ outlook. Employers added an average of just 143,000 jobs a month from July through September. That’s down from 182,000 a month in April through June and 207,000 in the first three months of the year.

Sluggish spending could slow economic growth. Most economists predict growth slowed in the July-September quarter to an annual rate of about 1.5 percent to 2 percent, down from a 2.5 percent rate in the April-June quarter.

A big decline in food costs helped hold down wholesale prices in September, contributing to a 0.1 percent decline, the first drop since April.

The slight dip followed a 0.3 percent rise in prices in August, the Labor Department said Tuesday. Wholesale food prices fell 1 percent, led by a drop in vegetable prices.

The lower food costs helped offset a 0.5 percent rise in energy prices. That increase reflected higher prices for home heating oil, diesel fuel and natural gas. Gasoline prices, which had shot up 2.6 percent in August, dipped 0.1 percent in September.

Excluding volatile food and energy, so-called core prices rose a slight 0.1 percent in September and have risen 1.2 percent over the past 12 months.

Aside from sharp swings in gasoline prices, consumer and wholesale inflation has barely risen in the past year. Overall wholesale prices were up just 0.3 percent for the 12 months that ended in September. It was the slowest increase since the 12 months that ended in October 2009, a period that included the recession.

The report on wholesale prices was delayed by the shutdown. It had been scheduled to be released Oct. 11.

The government will report today on retail prices, a report that had originally been scheduled for release Oct. 16.

U.S. home prices rose in August from a year earlier at the fastest pace since February 2006. But the price gains slowed in many cities from July, a sign that the spike in prices over the past year may have peaked.

All 20 cities in the Standard & Poor’s/Case-Shiller 20-city home price index released Tuesday showed year-over year gains, equaling a 12.8 percent rise over the 12 months ending in August.

However, a measure of month-over-month prices for the 20 cities rose just 1.3 percent in August. That’s’ down from a 1.8 percent month-over month gain in July. And 16 of the 20 cities reported more modest price increases in August than in July.

Greater demand and a tighter supply of homes for sale have helped drive prices higher over the past year. But over the summer, mortgage rates jumped from their record lows. And weaker job growth also is discouraging potential home buyers.

Prices in Las Vegas rose 29.2 percent from a year earlier, the fastest pace in the nation.

Prices in Denver and Dallas hit record levels in August. No other cities on the index have returned to where they were before the real-estate collapse.

The Case-Shiller 20-city index covers roughly half of U.S. homes. It measures prices compared with those in January 2000 and creates a three month moving average. The August figures are the latest available.

Information for this article was contributed by Christopher S. Rugaber, Martin Crutsinger and Paul Wiseman of The Associated Press and by Shobhana Chandra of Bloomberg News.

Business, Pages 25 on 10/30/2013