WASHINGTON - U.S. poverty remained close to a two-decade high and incomes continued to stagnate as the nation struggled to fully recover from the worst economic slump since the Great Depression, Census Bureau data show.

The proportion of people living in poverty was 15 percent in 2012, while median household income was $51,017. Neither number was stastically different from the previous year.

The data released Tuesday show the economic expansion hasn’t broadened to all Americans. Rising stock prices and home values have boosted the finances of the more affluent, while those on the lowest tiers contend with high unemployment and stagnant wages. If there was any good news, it was that things stopped getting worse in 2012 for the world’s largest economy.

“For the first time in five years, neither median household income decreased nor the percent of the population in poverty increased,” David Johnson, chief of the social,economic and housing division at the Census Bureau, said on a conference call with reporters.

The Census Bureau releases the nation’s official estimates of household income and poverty annually from the Current Population Survey. On Thursday, the bureau will release more detailed income, poverty and health-insurance figures for states and metropolitan areas.

In the U.S., there were 46.5 million people living in poverty, including 16.1 million children, the agency said Tuesday. The poverty rate remains 2.5 percentage points higher than in 2007, the last year before the worst of the recession. It was above 15 percent from 2010 to 2012, the highest since 1993, when it was at 15.1 percent.

The poverty threshold for a family of four in 2012 was $23,283, according to the report.

“The poverty rate is still very high by historical standards,” said Isabel Sawhill, a senior fellow at the Brookings Institution in Washington who studies poverty issues. “The good news is that it is likely to decline as the economy recovers over the next decade. The bad news is that it’s unlikely to get back to its 2007 level - 12.5 percent -until the middle of the next decade, according to our projections.”

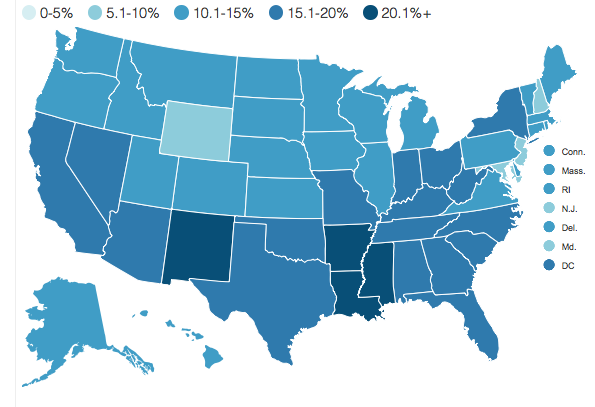

The poverty rate varied widely among racial and ethnic groups, the census data shows. For non-Hispanic whites, it was 9.7 percent, while for blacks it was 27.2 percent, 25.6 percent for Hispanics and 11.7 percent for Asians.

The western part of the U.S. was the only region that showed a statistically significant change in its poverty rate, declining to 15.1 percent from 15.8 percent in 2011.

The Census Bureau also reported that a measure of the gap between rich and poor households wasn’t different in a statistically significant way from 2011. A measurement known as the Gini index was 0.477. A figureof zero means all income is evenly distributed while a 1 represents complete concentration.

The only group that has gained since the June 2009 end of the recession is the group that includes those with the top 5 percent of incomes, said Lawrence Mishel, president of the Economic Policy Institute, a Washington-based research group. Those gains have continued into this year, with a more than 19 percent rise in the Standard & Poor’s stock index, he said.

The census data shows that those top earners - households making more than about $191,000 a year - have recovered most of their losses and took in about as much in 2012 as they did before the recession hit. But those in the bottom 80 percent of the income distribution are, on average, making considerably less.

“The growth of the stock market shows that the recovery is even more unbalanced than the Census Bureau numbers show,” Mishel said after the numbers were released. “But the Census Bureau numbers definitely do show a pretty unbalanced pattern of income growth.”

In an updated research paper published earlier this month by University of California, Berkeley economist Emmanuel Saez found that the top 10 percent of earners - those with household income above $114,000 - collected more than half the nation’s total income in 2012, the largest proportion since the government started gathering such data in 1917.

The study, using preliminary 2012 data, also found that those with the top 1 percent of incomes saw their earnings grow 31.4 percent from 2009 to 2012, while the bottom 99 percent saw growth of just 0.4 percent.

The West was the only region that experienced a statistically significant increase in median incomes, the Census Bureau said. All other regions were essentially unchanged.

The median household income is down about 9 percent from an inflation-adjusted peak of $56,080 in 1999, although the real economy has grown about 28 percent since then. Income is also down about 8.3 percent since 2007, when the economy started to contract.

President Barack Obama noted those trends in a speech Monday marking the five-year anniversary of the financial crisis triggered by the collapse of Lehman Brothers Holdings Inc.

“Even though our businesses are creating new jobs and have broken record profits, the top 1 percent of Americans took home 20 percent of the nation’s income last year, while the average worker isn’t seeing a raise at all,” Obama said. “Most of the gains have gone to the top one-tenth of 1 percent. So in many ways, the trends that have taken hold over the past few decades of a winner-take-all economy, where a few do better and better and better, while everybody else just treads water or loses ground, those trends have been made worse by the recession.”

Unemployment, which hovered at or above 8 percent for much of 2012, dropped to 7.3 percent in August. The slow and uneven recovery has left millions dependent on government assistance.

In one glimmer of improvement, the number of men working full time year round with earnings increased by 1 million between 2011 and 2012, to a total of 59 million.

“We are not where we want to be yet,” Treasury Secretary Jacob Lew said at the Economic Club of Washington before the report came out. “Too many Americans cannot find work. Growth is not fast enough. And the very definition of what it means to be middle class is being undercut by trends in our economy that must be addressed.”

The U.S. Department of Agriculture reported earlier this month that 47.8 million people used food stamps in June, close to a record high and up 2.3 percent from a year earlier.

The program, because of both its rapid growth and fraud allegations, has become a target for Republicans in their fight with Obama and other Democrats over reducing federal budget deficits. Expenditures for what is formally known as the Supplemental Nutrition Assistance Program grew to $78 billion last year, more than double the amount when the recession started in December 2007.

The Census Bureau data also show the number of Americans who lack health insurance declined to 48 million last year from 48.6 million in 2011, as many under the age of 26 took advantage of a provision in Obama’s 2010 health-care overhaul that allowed them to be covered under their parents’ plans.

The percentage of people without health insurance dropped to 15.4 percent from 15.7 percent in 2011. It was the second straight year of improvement in coverage, coinciding with roll out of the Affordable Care Act.

While some parts of Obama’s health-care law have taken effect, the most critical provision - the creation of government-run insurance exchanges - begins to roll out Oct. 1.

The health law, which also will expand state-run Medicaid programs for the poor starting Jan. 1, is projected to extend coverage to at least 25 million uninsured by 2016, according to estimates from the Congressional Budget Office. Information for this article was contributed by Alex Wayne of Bloomberg News; by Annie Lowrey of The New York Times; and by Chad Day of the Arkansas Democrat-Gazette.

Front Section, Pages 1 on 09/18/2013