Simmons First National Corp., which has acquired two Arkansas banks in six months, reported earnings of $4.4 million in the first quarter, the Pine Bluff bank said Thursday.

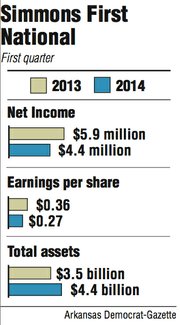

That was a drop of about 26 percent from the $5.9 million earned in the same period last year. Simmons earned 27 cents a share in the first quarter, down from 36 cents a share last year.

Excluding $3.1 million in charges related in part to Simmons’ purchase of Metropolitan National Bank of Little Rock, Simmons had earnings per share of 46 cents, equaling the estimates of analysts surveyed by Thomson Reuters.

Simmons closed at $35.94 Thursday, up 41 cents, in trading on the Nasdaq exchange.

The quarter was the first full quarter for Simmons to benefit from the purchase of Metropolitan. Simmons closed 11 former Metropolitan branches during the quarter.

With the purchase of Metropolitan, Simmons’ total loans were $2.4 billion on March 31, a gain of $518 million, or 28 percent.

“We have experienced loan growth in almost every market that we measure,” George Makris, Simmons’ chairman and chief executive officer, said Thursday during a conference call.

Simmons hired seven new lenders in June in its Kansas and Missouri markets, and its loan balance has increased $85 million since then, Makris said.

Simmons’ six subsidiary banks in Arkansas are up $30 million in loans, Makris said.

Simmons retained about 99 percent of Metropolitan’s deposits after the acquisition, David Bartlett, Simmons’ president, said in the conference call.

In central Arkansas, Metropolitan had about 77,000 accounts and $600 million in deposits. Those resulted in about 76,000 accounts and $590 million in deposits for Simmons, Bartlett said.

In Northwest Arkansas, Metropolitan had about 18,000 accounts and $128 million in deposits. Simmons retained all those accounts and now has $134 million in deposits.

“Loans are doing the same thing for us,” Bartlett said. “We’re doing very good in retention of loan customers.”

Simmons had assets of $4.4 billion in the quarter.

“The overall profitability [for Simmons] went down, but there were a handful of nonrecurring expenses included,” said Matt Olney, a bank analyst with Stephens Inc. of Little Rock. “So when you pull those out, profitability seems to be improving. I expect Simmons’ profitability to keep improving for the next few quarters.”

Simmons also will benefit from the consolidation of its eight bank charters into one charter, said Olney, who owns no stock in Simmons.

Simmons’ second recent acquisition, Delta Trust & Bank of Little Rock, should close in July, Makris said.

“I don’t see any pause at all for Simmons,” Olney said of the acquisitions. He said Simmons should continue its strategy of buying banks.

Simmons will consider deals in markets where it already has branches, including Arkansas, Missouri and Kansas, Olney said.

“I would guess near term there are more chances of Simmons doing a deal in Arkansas,” Olney said.

Simmons’ executives also have discussed buying banks in Oklahoma or Tennessee, Olney said.

Business, Pages 25 on 04/18/2014