NEW YORK -- The stock market Thursday had its worst one-day drop since February, driven down by a confluence of worries, from weak company earnings to the looming end of stimulus from the Federal Reserve.

The Standard & Poor's 500 index dropped 39.40 points, or 2 percent, to 1,930.67, its biggest loss since April 10. The drop pushed the index to its first monthly loss since January.

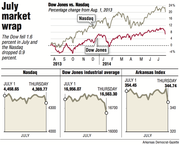

The Dow Jones industrial average plunged 317.06 points, or 1.9 percent, to 16,563.30. The Nasdaq composite fell 93.13 points, or 2.1 percent, to 4,369.77. The Russell 2000, an index of small-company stocks, fell 26.50 points, or 2.3 percent, to 1,120.07.

The stock market has been on a bull run for more than five years, with the most recent leg of that surge pushing the S&P 500 to an all-time high a week ago. Investors are now getting concerned that stocks may have climbed too far and reflect too much optimism on the outlook for growth.

"We've been on a strong run," said Jerry Braakman, chief investment officer at First American Trust. "There's just more concern that stock valuations are rich compared to historical norms."

Stocks started the day lower after a dose of bad earnings news, and the losses accelerated throughout the day.

Whole Foods Market and Exxon Mobil were among companies that fell after reporting results or forecasts that disappointed investors.

Exxon Mobil stock fell $4.31, or 4.2 percent, to $98.94 after the energy company said that oil and gas production slipped 6 percent, disappointing analysts. The decline was driven by the expiration of rights to a field in Abu Dhabi and natural field declines.

Investors are also concerned about the outlook for growth in Europe as tensions escalate between the European Union and Russia after the downing of a passenger plane over Ukraine. The EU on Thursday revealed the details of broad economic sanctions against Russia.

The main driver behind Thursday's selloff was a reassessment of the outlook for interest rates in the U.S., said Paul Zemsky, chief investment officer of Multi-Asset Strategies and Solutions at Voya Investment Management.

Fed policymakers Wednesday said that the central bank would make further cuts to its monthly bond purchases, a program that is intended to keep long-term interest rates low and encourage borrowing and spending. Policymakers are also becoming more optimistic about the outlook for the U.S. economy after growth expanded at a better-than-expected pace in the second quarter.

"We're closer to the first move higher in interest rates," Zemsky said. "And there's definitely a camp that believes that the only reason that we're at these levels is because the Fed has kept the rates at zero."

Wayne Wilbanks, who oversees $2.5 billion as chief investment officer at Wilbanks, Smith & Thomas Asset Management LLC in Norfolk, Va., said the market is going to see more days like Thursday, where investors are quicker to liquidate.

"The Fed is stepping out of the way, and the market's valuation is high enough that people are quick to take profit," Wilbanks said. "Everybody knows a correction is coming and it will come."

Alan Whitman, a managing director with Morgan Stanley, said Thursday's drop was "not a major run to get out" of stocks.

"Buyers are being very, very disciplined. They're not chasing after things, just making sellers drop prices to come down to their level," he said. "The volume is low; it isn't like there's a panic to get to the exits."

The U.S. economy as measured by the gross domestic product expanded at a 4 percent annual pace in the second quarter, confirming the central bank's view that a first-quarter contraction was a blip related to a harsh winter. Data Thursday showed fewer Americans filed applications for unemployment insurance benefits over the past month than at any time in more than eight years, signaling employers are hanging on to workers as demand improves.

"The Fed may have to change course sooner than expected if reports continue to show the economy is gaining some strength," said Bruce Bittles, chief investment strategist at Milwaukee-based RW Baird & Co., which oversees $110 billion.

Despite Thursday's weak earnings reports, the overall outlook for company profits is still strong, analysts said.

Company earnings are still at record levels and expected to grow by 8.6 percent in the second quarter, according to data from S&P Capital IQ. That compares with growth of 4.9 percent in the same period a year ago and 3.4 percent growth in the first three months of this year.

Gold fell $13.60, or 1.1 percent, to $1,281.30 an ounce. Silver fell 19 cents, or 0.9 percent, to $20.41 an ounce.

Benchmark U.S. crude fell $2.10 to close at $98.17 a barrel in New York, its lowest level since March 17. Oil's high for the year was $107.26, set on June 20; its low was $91.66, set on Jan. 9.

Brent crude, a benchmark for international oils used by many U.S. refineries, fell 49 cents Thursday to close at $106.02 in London.

Prices for U.S. government bonds were little changed. The yield on the 10-year Treasury note edged up to 2.57 percent from 2.56 percent on Wednesday.

Information for this article was contributed by Steve Rothwell and Kay Johnson of The Associated Press; by Lu Wang, Anna Hirtenstein, Jacob Barach and Joseph Ciolli of Bloombeg News; and by Tiffany Hsu of the Los Angeles Times.

A Section on 08/01/2014