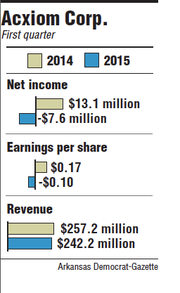

Acxiom Corp. reported a $7.6 million loss in the first quarter of its 2015 fiscal year, the second quarterly loss in a row for the Little Rock company.

Revenue fell almost 6 percent in the quarter as a result of a decline in Acxiom's information technology infrastructure business and restructuring in Europe.

The company reported revenue of $242.2 million for the first quarter, compared with $257.2 million during the same period last year.

Daniel Salmon, an analyst for BMO Capital Markets, said in a report earlier this year that Acxiom's revenue in fiscal 2015 will decline about 5 percent.

"There has been a considerable pick-up in incoming questions of the legacy marketing services business of late, and this suggests good reason for that, as it remains sluggish," he said in the report.

Earnings per share for the period that ended June 30 were a loss of 10 cents, compared with a gain of 17 cents per share a year ago. Acxiom missed analysts' estimates of a gain of 45 cents per share.

The company said noncash compensation expenses and unusual items that include expenses associated with "restructuring activities, separation and transformation initiatives, and the acquisition LiveRamp, Inc." affected earnings per share by 21 cents during the quarter.

Acxiom said earlier this year that it was purchasing marketing services company LiveRamp for $310 million in cash. It completed the acquisition during the quarter.

"The integration of LiveRamp is off to a great start," Scott Howe, Acxiom's chief executive officer, said in a statement.

He said the company is "in the process of introducing LiveRamp to our customer base. Exciting opportunities lie ahead as we build toward a connected ecosystem of customers, publishers and marketing applications."

Acxiom said it sold a call center in the United Kingdom to Parseq Ltd., a business process outsourcing company. It has not disclosed the amount of the sale.

Acxiom signed several new database contracts with Ace Insurance Group in Zurich, Switzerland, and Sevenwest Media Group in Australia. It renewed contracts with Virgin Media and First National Bank of Omaha during the quarter.

Shares of Acxiom rose 21 cents, or 1.1 percent, to close Monday at $18.60 in heavy trading. The company released its financial results after the markets closed.

Business on 08/05/2014