Shares of Windstream Holdings Inc. dipped 3.4 percent Thursday after the company reported a 65 percent drop in second-quarter profit.

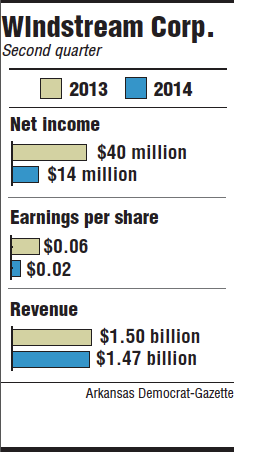

Windstream had a net income of $14 million for the quarter, or 2 cents per share, down from $40 million, or 6 cents per share, in the same period a year ago.

Excluding a 2 cent charge for after-tax merger and integration, restructuring and other expenses, Windstream had earnings per share of 4 cents for the quarter.

The Little Rock-based company missed analysts' earnings-per-share estimates of 8 cents.

Windstream shares fell 39 cents to close Thursday at $11.16 in heavy trading on the Nasdaq stock exchange. The telecommunication company released its second quarter financial results before the markets opened.

Windstream reported $1.47 billion in revenue for the period that ended June 30, down from $1.5 billion during the same period a year ago.

Windstream's revenue was helped by improved results in its consumer services, which includes residential broadband and voice services, Chief Executive Officer Jeff Gardner said during the company's conference call Thursday morning.

Revenue was also less influenced by Federal Communications Commission reforms of charges carriers pay each other to transport their voice and Internet traffic, he said.

"Year-over-year service revenue trends improved by roughly 30 basis points reflecting better results in our consumer business and the diminishing impact from intercarrier compensation reform," Gardner said.

Consumer service revenue was $317 million in the period, up 1.2 percent from the first quarter.

"[The second quarter] was the first sequential improvement in 11 quarters" for Windstream's consumer service revenue, said Barry McCarver, an analyst with Stephens Inc.

Windstream announced last week it plans to convert its copper and fiber optic networks, along with other assets, into a publicly traded real estate investment trust.

The company said the independent trust would lower the company's debt by about $3.2 billion and free up cash for investments in broadband and transitioning to a faster Internet network.

"This transaction will unlock significant value and result in lower leverage for Windstream," Gardner said. "In addition, it will enable increased capital investments to strengthen Windstream's network and provide faster broadband speeds, and enhance services to our customers."

The taxfree spinoff is expected to be completed in 2015, pending regulatory approval. Once completed, the trust will lease the property to Windstream on a long-term contract for about $650 million per year.

Business on 08/08/2014