Arkansas' three major publicly traded banks have been on a shopping spree over the past four years, buying more than 30 banks in 11 states.

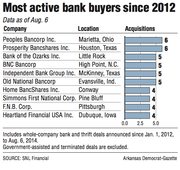

Bank of the Ozarks of Little Rock, Conway-based Home BancShares and Simmons First National of Pine Bluff are among the top 10 banks in the country in the number of acquisitions of healthy banks since 2012, according to SNL Financial of Charlottesville, Va.

Bank of the Ozarks has bought five healthy banks since 2012, according to SNL. Home BancShares and Simmons have bought four banks each since 2012. Home BancShares bought another healthy bank in late 2011.

The totals don't include purchases of failed banks sold with the aid of government regulators. The three Arkansas banks bought a total of 18 failed banks from 2010-12.

"Right now there are some great deals at great prices. But it won't last forever," said Matt Olney, an analyst with Stephens Inc. of Little Rock who owns no stock in the three banks. There have been some good-quality banks available for purchase in the past few years, he said.

Just last month, Bank of the Ozarks and Home BancShares announced additional acquisitions that have not been completed.

Bank of the Ozarks said it would spend $228 million to buy Intervest Bancshares of New York, which has $1.6 billion in assets with one office in New York and six in west-central Florida. It's the biggest bank purchase Bank of the Ozarks has made.

Home BancShares said it would buy Broward Financial Holdings of Fort Lauderdale, Fla., which has about $170 million in assets.

All three banks are headed to $10 billion in assets, what Olney calls a "line in the sand" where the federal Dodd-Frank Act calls for increased regulatory scrutiny, a significant expense for the larger banks.

When current acquisitions close, Simmons will have about $8 billion in assets, Bank of the Ozarks will have about $7.9 billion and Home BancShares will have about $7.1 billion.

Banks' compliance costs associated with the Dodd-Frank Act when they exceed $10 billion in assets are much greater than what the banks would pay if they had less than $10 billion in assets, said Garland Binns, a Little Rock banking attorney.

Those costs probably will exceed $10 million at a minimum for each bank, said John Allison, Home BancShares chairman.

But none of the three banks seem concerned about Dodd-Frank. All three anticipate passing $10 billion in assets and moving well beyond the threshold.

"We have no concerns about getting to $10 billion," said George Makris, chairman and chief executive officer at Simmons. "We have had questions. So we've already started meeting with advisers and regulators to understand how the regulatory environment will change when we pass that $10 billion mark."

Home BancShares wants to get close to $10 billion -- maybe about $9.6 billion -- and then establish a strategy for passing it, Allison said.

"That is fish-or-cut-bait time," Allison said. "The decision then is, 'Do we want to be [over $10 billion] or do we not want to be?' Everybody has to take a pause at that $10 billion level.

"You don't want to be at $11 billion or $12 billion. You have to be at $13 [billion] or $14 billion to [justify] that expense of Dodd-Frank."

George Gleason, chairman and chief executive of Bank of the Ozarks, said reaching $10 billion in assets "is just a natural continuation of what we've been doing for the past 35 years."

Federal regulations will result in some loss of revenue and increases in compliance, Gleason said.

"With that benchmark clearly in our sights now, we are taking the steps that we need to prepare," Gleason said.

Randy Dennis, president of DD&F Consulting Group of Little Rock, a bank-consulting firm, said he would be surprised if any of the three banks were sold in the next several years.

All three banks -- particularly Bank of the Ozarks and Home BancShares -- are trading at high multiples of book value, Dennis said.

Bank of the Ozarks shares are trading at about 3.5 times its book value, according to SNL. Home BancShares is trading at about 3.4 times book value. Simmons is trading at about 2 times book value.

That means that buying one of the Arkansas banks would be expensive for a possible suitor, Dennis said.

"With their stock prices being so high, I'd be a little surprised if they sold," Dennis said.

It has never been a consideration for Simmons to sell, Makris said.

Allison, however, said Home BancShares will do what is in the best interest of the company's shareholders.

When the bank was first founded in the late 1990s, Allison said his plan was to grow the bank to about $2 billion in assets and then sell it. He isn't interested in selling it now, Allison said.

But if the bank ever decides to sell, it might be as part of a merger and not an outright sale, Allison said.

"I would prefer that we find another good partner that is like us," Allison said. "There are about eight or 10 banks in the country that have separated themselves from the pack and are all looking at the same thing. We all know each other, and we like each other. So would a bank in Mississippi hook with a bank in Arkansas? Would a bank in South Carolina hook with us? Do we hook with a Texas bank?"

Among the similar banks are Bank of the Ozarks, First Financial Bankshares of Abilene, Texas; Renasant Bank of Tupelo, Miss.; Home BancShares and "Simmons is becoming part of that group," Allison said.

"Eight or 10 of these are well-run, quality banks that perform at the level that this group performs," Allison said. "It could make sense that somebody in that elite group would know the quality of the stock they would be getting."

If that were to happen, it would put the combined bank well over $10 billion in assets, Allison said.

"I actually believe that you will see some of that group coming together and forming an $18 [billion] or $20 billion bank," Allison said.

Right now, the three Arkansas banks' high values are attracting other banks to sell, Binns said.

Home BancShares' purchase of Broward Financial Holdings is reflective of smaller banks being willing to be bought, Binns said.

"That is, in part, because of the overhead expense in complying with banking regulations," Binns said. "So long as the pricing of banks stays at the current level, this trend in the sale of smaller banks will continue."

For several years, Allison said he has used a sales pitch that promotes the strength of Home BancShares' stock price and not the purchase price of the bank being sold.

"Now I have a chart," Allison said. "It shows the banks that have sold in Florida and what happened to the stock price of [the acquirer]. If they were bought by Home [BancShares], the stock has gone up by about 200 percent and if they were bought by another bank, the stock may be down as much as 30 percent."

Since Bank of the Ozarks went public in 1997, its stock has had about a 23.5 percent annual return, including the reinvestment of dividends, Gleason said.

"The fact that our stock has been one of the top-performing stocks in the nation over the past 17 years has certainly made it attractive to sellers of other banks," Gleason said.

SundayMonday Business on 08/17/2014