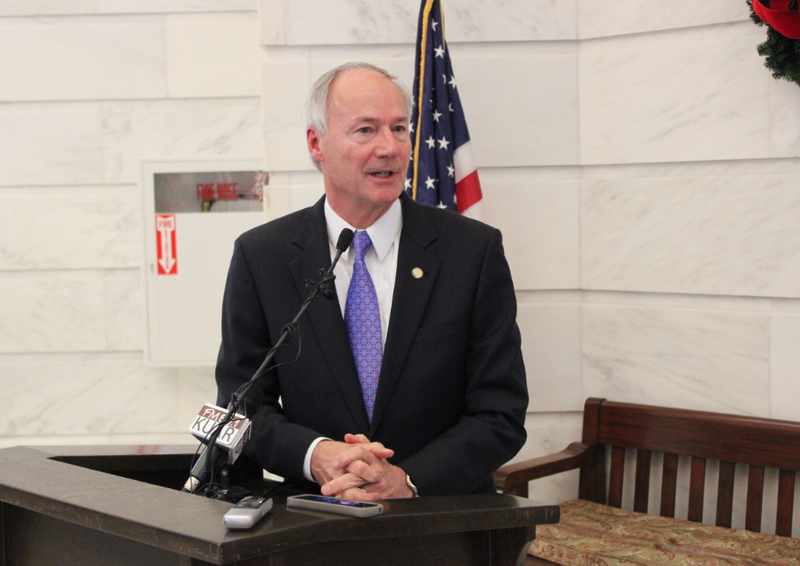

LITTLE ROCK — Incoming Arkansas Gov. Asa Hutchinson's call to reduce taxes on the middle class by $100 million a year will dominate any tax cut debate in the Legislature next year, lawmakers say, though several other proposals are likely to be on the table.

House and Senate leaders have said they plan to put forward legislation enacting the tax cut that Hutchinson made a focus of his successful bid for governor, and are predicting the plan will easily win support early on in the session that begins Jan. 12. Hutchinson, a Republican, is heading into office with his party enjoying expanded majorities in both chambers of the Legislature.

"I think there will be broad-based support and I think it'll be bipartisan," said Senate President Jonathan Dismang, R-Beebe, who has filed a shell bill, to which the language will be added later, with incoming House Speaker Jeremy Gillam that he says will detail the incoming governor's tax cut plan.

Hutchinson has promised to reduce the income tax rate from 7 percent to 6 percent for people earning between $34,000 and $75,000 and from 6 percent to 5 percent for people earning between $20,400 and $33,999. He has said the reduction would cost the state $50 million in the first fiscal year, with it taking effect Jan. 1, 2016, and $100 million the following year when fully implemented.

Democratic Gov. Mike Beebe, who is leaving office due to term limits, has warned lawmakers that the state cannot afford some of the tax cuts approved last year, and has suggested the Legislature delay $29.4 million in already-approved tax reductions. Dismang and Gillam say they haven't heard much support among lawmakers for delaying the tax cuts.

Instead, they're likely to face competing ideas from lawmakers.

Rep. Charlene Fite, R-Van Buren, said she plans to file legislation exempting veterans' retirement pay from the state income tax. Supporters of the exemption estimate it would cost the state between $14 million and $17 million a year, but argue it could help attract veterans to the state.

Another tax cut idea floated is a proposal to give farmers an exemption on parts and repairs for their machinery. Rep. Joe Jett, D-Success, said the proposal he's working on would cost the state $16 million a year.

Hutchinson has already tried to tamp down a push for more breaks targeting specific industries. Hutchinson told the Arkansas Farm Bureau last month that his cut "will help every industry in Arkansas because it impacts everyone who pays individual income taxes."

The head of the Senate committee that will look at the tax cut bills said he expected Hutchinson's would be approved early in the session, but others won't be considered until later.

"I don't want to get a bunch of stuff out there irresponsibly early and then have to deal with it on the back end," said Sen. Jake Files, R-Fort Smith, who chairs the Senate Revenue and Taxation Committee.

Gillam left open the possibility that other tax cuts or exemptions could make it through the session.

"You've got 135 members that would love to cut taxes and keep more money in the pockets and bank accounts of citizens throughout the state," he said.

Advocacy groups worry that lower revenues could threaten essential state services. One of those groups, Arkansas Advocates for Children and Families, is calling for any tax cuts to be offset by tax increases elsewhere.

"We may be the only group saying that," said Executive Director Rich Huddleston.