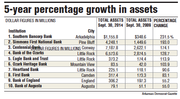

Arkadelphia-based Southern Bancorp has more than tripled its assets in the past five years, the largest percentage increase of any bank in the state.

The bank has grown by about 231 percent from about $348 million on Sept. 30, 2009, just after the recession ended, to about $1.2 billion on Sept. 30, 2014.

The majority of Southern Bancorp's growth has been in acquisitions, said Dominik Mjartan, executive vice president of Southern Bancorp Inc.

In the past five years, Southern Bancorp acquired $458 million in assets, including Timberland Bank of El Dorado, which had $139 million in assets; First Delta Bankshares Inc. of Blytheville, which had $309 million in assets; and a Simmons First National Bank branch in Eudora, which had almost $10 million in assets.

Southern Bancorp is one of the few community development banks in the country. Its primary mission is to develop the economy of the rural areas it serves, not to make money for its stockholders.

Despite its growth, Southern Bancorp is not focusing on growing its assets now, Mjartan said.

"We're focusing on growing our loans and improving the quality of our assets," Mjartan said. "The majority of our loans are in low-income and very low-income areas, but they're good, good loans to good borrowers. That model seems to be working."

Southern Bancorp has earned more than $8.5 million through nine months this year, up from $6.2 million through the same period last year and $1.6 million in nine months in 2009.

One example of a successful loan in a distressed area is with Hoffinger Industries in Helena-West Helena, Mjartan said. The company has about 130 employees.

When a foreign company offered to buy Hoffinger, the maker of high-quality Doughboy above-ground swimming pools, its employees wanted to buy the company instead.

"[The foreign company] just wanted to buy the [Hoffinger] just for the name and the equipment," Mjartan said. "We stepped in and partnered with Arkansas Capital Corp., provided a loan and now those jobs are staying in Phillips County."

Southern Bancorp not only has a development mission, "it also is a heck of a good bank," said Randy Dennis, president of DD&F Consulting Group, a Little Rock-based bank consulting company.

"Years ago, the bank struggled before [former chief executive officer] Phil Baldwin came there," Dennis said. "They had gotten confused that the community development side was the banking side and that doesn't work very well. Banks are required [by regulators] to maintain safety and soundness and not take unusual risks."

The key to the operation is to have a solid bank, but with the flexibility to buy a tiny bank in a poor area of Mississippi, such as the Bank of Bolivar County, which has only $16 million in assets, Dennis said. Southern Bancorp closed on the purchase this month.

"It is a great bank, but it was too small to make any loans over $300,000," Mjartan said. "They couldn't even make crop loans to their farmers. So by selling to us, we kept the same management but we expanded their lending capacity and the products and services they can offer."

Simmons First National Bank had the second-largest percentage increase in assets, 193 percent, from $1.4 billion in 2009 to $4.2 billion in the third quarter this year.

Mathematically, it is easier to have a large percentage increase when beginning with a smaller denominator. For example, a bank with $1 million in assets in 2009 that had $5 million in assets this year would have a 400 percent increase but a dollar increase of only $4 million.

Centennial Bank of Conway had the largest dollar increase in assets since Sept. 30, 2009, a $4.6 billion increase from $2.6 billion in Sept. 30, 2009, to almost $7.2 billion at the end of September 2014.

Fayetteville-based Arvest Bank had the second-largest increase in assets, $4.5 billion in September 2009, from $10.5 billion to almost $15 billion at the end of the third quarter this year. Bank of the Ozarks of Little Rock had a $3.7 billion increase over the same period.

Through its holding company, Centennial has 12 bank acquisitions from September 2009 through September 2014. Arvest bought two banks and 29 Bank of America branches during the period, and Bank of the Ozarks had 12 bank acquisitions in the past five years.

SundayMonday Business on 12/28/2014