FRANKFORT, Ky. - Global thirst for Kentucky bourbon and Tennessee whiskey caused exports to rise beyond $1 billion for the first time ever in 2013, a distilled spirits trade group said Tuesday.

Mixed together, bourbon and Tennessee whiskey exports grew a projected 5 percent, from $956.8 million in 2012 to just past $1 billion last year, the Distilled Spirits Council announced.

Bourbon and Tennessee whiskey revenue shot up even higher at home, rising by a projected 10.2 percent last year, the council said.

Their performance overseas drove overall American distilled spirits exports above $1.5 billion, the council said. It marked the fourth straight year of record exports for American-crafted spirits.

The steady rise reflects a growing reputation for American distilled spirits overseas, the group said.

“There is a genuine affection for ‘Brand America’ as a symbol of quality and taste,” said Christine LoCascio, the council’s senior vice president for international trade.

The council said the export figures are based partly on data from the U.S. International Trade Commission.

Other factors behind the spike in exports include trade agreements in recent years that reduced or eliminated tariffs in several countries and new products by American whiskey-makers, the group said.

Japan was the pacesetter among the top six overseas growth markets for all American distilled spirits, based on dollar value, the group said. Sales there were up a projected $22.7 million last year, to $120.8 million. Germany was next, as sales were up a projected $19.6 million to $140.1 million. Sales in France rose $14.5 million to $130.5 million, while sales in the United Kingdom were up $8.8 million to $159.6 million.

Nigeria had the largest overall increase, at 475.5 percent, putting sales at a projected $5 million. Sales in Panama surged by 99 percent to $11.6 million, while sales in Greece shot up 72.5 percent to $9.2 million.

In the U.S., total revenue for bourbon and Tennessee whiskey reached $2.4 billion, a 10.2 percent increase. Volume was up nearly 7 percent to 18 million cases, the council said.

The domestic numbers reflect sales from producers or suppliers to wholesalers.

The industry lumps bourbon and Tennessee whiskey into one category. Both are produced in the same way and with similar ingredients. The main difference is that Jack Daniel’s and a few other Tennessee whiskeys are charcoal filtered before going into the barrel to age, while bourbon isn’t.

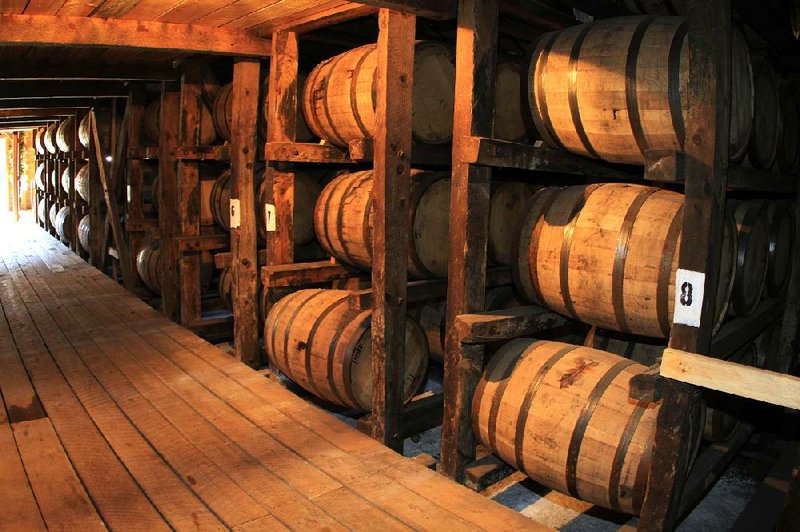

Kentucky produces 95 percent of the world’s bourbon supply, according to the Kentucky Distillers’ Association. The number of bourbon barrels aging in Kentucky outnumbers the state’s population.

Overall, supplier sales of American distilled spirits grew 4.4 percent to $22.2 billion last year in the U.S., the council said. Total U.S. volume growth was up 1.9 percent to about 206 million cases. Overall domestic retail sales in the segment were estimated at more than $66 billion, it said.

The council cited several factors behind the growth, including the popularity of premium spirits and whiskey based cocktails.

“For the first time in decades, all whiskey categories saw some growth,” said David Ozgo, the council’s chief economist. “Whiskey was once the dominant spirit of choice for most Americans. While growth had been picking up over the last few years, 2013 was a banner year.”

U.S. supplier sales of all varieties of whiskeys grew 6.2 percent to 52.7 million cases last year, Ozgo said. Total revenue increased 10.1 percent to just more than $7 billion.

Irish whiskey volumes were up 17.5 percent to 2.5 million cases last year in the U.S., while single malt Scotch volumes rose 11.6 percent to 1.8 million cases, the council said.

Business, Pages 25 on 02/05/2014