Bentonville-based buy here, pay-here auto dealer America’s Car-Mart reported net income of $1.5 million for its third quarter, significantly missing analysts estimates because of a one-time charge for credit losses.

Hank Henderson, the company’s president and chief executive, told analysts on a conference call Wednesday that Car-Mart faces increasing competition for its core customers, and those customers are under pressure from a lagging economy. Many of the company’s key customers have poor credit or no credit records and often don’t have access to traditional vehicle financing.

Shares fell in trading Wednesday on the Nasdaq, closing at $35.72, down $1.83, or 4.87 percent, from Tuesday’s close - almost a 52-week low. Shares have traded as low as $35.63 and as high as $50.59 over the past year.

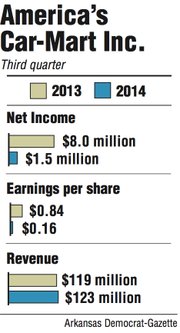

The company reported earnings per share of 16 cents for the period ending Jan. 31, because of a $4.9 million noncash after-tax charge from an increase in allowances for credit losses, compared with earnings of $8 million, or 84 cents per share for the same period a year ago. Without the charge, earnings per share would have been 68 cents. A consensus estimate of five analysts surveyed expected earnings of 70 cents per share.

Revenue for the third quarter in fiscal 2014 was $123 million, up 3.4 percent from $119 million for the same period last year. Two analysts predicted revenue of $127.6 million.

This marks three quarters in a row that Car-Mart has not met earnings estimates from analysts.

The company increased its allowance for credit losses to 23.5 percent, from 21.5 percent. The last time the allowance was adjusted was in April 2012 when it was moved downward from 22 percent to the 21.5 percent figure. Credit-loss provisions are expected losses from delinquent or bad debt.

Jeff Williams, Car-Mart’s chief financial officer, said during the call that taking the one-time hit in the third quarter for the higher credit losses should stabilize later results.

According to a 2013 third quarter report from Experian Information Solutions Inc., the most recent available, buy-here, pay-here lenders made up 13.36 percent of the used-car loan market, down 6.5 percent from the same period last year.

Banks made up 36.45 percent of the segment, down 4.3 percent; credit unions held 22.48 percent of the market, up 2 percent; and finance operations made up 19.69 percent, an increase of nearly 4 percent.

Melinda Zabritski, senior director for automotive finance for Experian Automotive, said the deep sub prime and sub prime markets have become more attractive to finance companies in recent years, noting the markets have potential for higher risks but also higher profits.

Henderson said the competition was particularly stiff at its more established lots that tend to sell more expensive cars and are in areas that have many car dealers. He said competitors are selling cars for longer terms than Car-Mart, sometimes as long as 60 months on newer vehicles and often with 48-month terms on more comparable vehicles. Car-Mart loans tend to be in the 30-month range.

Henderson said sometimes customers are making deals at rival dealerships and simply abandoning their cars for Car-Mart to pick up later.

Still, he said, he’s confident Car-Mart’s philosophy of keeping customers in cars they can afford and pay off with a reasonable expectation of success will earn the company repeat business. He added the fourth quarter should get a boost from income-tax refunds, a busy time for the used-car dealer, noting refund checks had not gone out in January of this year but had been a factor in third-quarter numbers in 2013.

Car-Mart sold 10,735 cars in the quarter, an increase of 3.2 percent when compared with the third quarter of last year. Average retail sale price dropped $58 to $9,739.

The company bought back 200,000 shares or 2.2 percent of its outstanding shares. Since February 2010 the company has repurchased 3.1 million shares, or 27 percent.

Car-Mart opened two new dealerships during the quarter, raising its total to 131 in 10 states.

Business, Pages 25 on 02/20/2014