While reporting earnings for its fourth quarter and fiscal 2014 Thursday, the world’s largest retailer and king of the Fortune 500 scaled back its outlook for fiscal 2015, which began Feb. 1.

Charles Holley, Wal-Mart executive vice president and chief financial officer, predicted Thursday that first-quarter earnings per share from continuing operations will be $1.10 and $1.20, compared with $1.14 reported for the first quarter of fiscal 2014. Earnings per share for all of fiscal 2015 are expected to fall into the range of $5.10 to $5.45.

“We expect economic factors to continue to weigh on our outlook,” Holley said in a prepared statement. In October, officials forecast a 3 percent to 5 percent net sales increase for this fiscal year. They now say they expect sales to fall more toward the low end. Analysts had predicted earnings of $1.23 for the current quarter and $5.54for this year.

U.S. consumers are facing reductions in government benefits, higher taxes, bad weather and higher group health-care costs, Holley said.

“These concerns, combined with investments in e-commerce, will make it difficult to achieve the goal we have of growing operating income at the same or faster rate than sales,” he said. Movement in currency exchange also plays a role and could negatively affect net sales by as much as $3.5billion in fiscal 2015, he said.

Wal-Mart revised its outlook Jan. 31 to prepare shareholders for the depressed fourth quarter and fiscal 2014 year-end earnings.

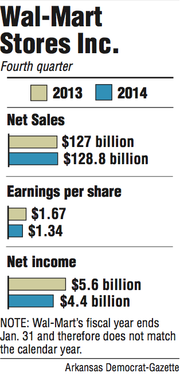

Fourth-quarter net income fell 21 percent to $4.43 billion, or $1.34 a share, from $5.61 billion, or $1.67 a year earlier, the company reported Thursday. Excluding some items, net income would have been $1.60 a share, a penny above analysts’ consensus. Those items included store closures in Brazil and China, disengaging from its former partner in India, and Sam’s Club restructuring.

Earnings per share for fiscal 2014 were $4.85, a 3.2 percent drop from fiscal 2013’s earnings of $5.03.

Net sales, including that of fuel, were $128.8 billion for the fourth quarter and $473 billion for the year, up 1.4 percent and 1.6 percent, respectively.

E-commerce, the fastest-growing part of Wal-Mart’s business, kicked in about $10 billion in sales. It may not seem like much in the overall revenue picture, said Holley, but e-commerce is embedded in every segment of Wal-Mart’s business - Wal-Mart U.S., Wal-Mart International and Sam’s Club. E-commerce sales for fiscal 2015 are estimated at $13 billion.

Same-store sales growth - the industry’s most widely used method for comparing same periods in consecutive years - fell 0.4 percent for Wal-Mart U.S. and 0.1 percent for Sam’s Club. It was the third quarter in a row that same-store sales for Wal-Mart’s grocery business were in the negative, while competitors Safeway and Kroger saw increases in same-store sales.

“Food is the area that continues to stand out as negative, and it’s the biggest part of Wal-Mart’s business,” said Brian Yarbrough, an equity analyst for Edward Jones in St. Louis.

The retailer’s stock (NYSE: WMT) opened at $73.05 in trading Thursday, then dropped to $72.81 after word of its earnings started to circulate. Shares of Wal-Mart stock closed Thursday at $73.52 on the New York Stock Exchange - $1.33 below the previous day’s close.

Wal-Mart is fighting slow sales growth by accelerating plans to build hundreds more smaller-format stores - Neighborhood Markets and Wal-Mart Expresses - this fiscal year. The smaller stores are intended to grab Wal-Mart’s core customers with “fill-in” trips that complement the “stock-up” visits customers make less frequently to Wal-Mart supercenters.

In October, officials said the company would build 120-150 small stores this year but on Thursday increased that number to 270-300. Samestore sales for Neighborhood Markets, when comparing the most recent quarter to the same year-ago period, were up 4 percent, said Wal-Mart U.S. President and CEO Bill Simon.

“These stores are really performing well,” Simon said. “They compete very well against all the small-store formats that are out there, from drug to dollar [stores], to small grocery and convenience.”

Many of the stores will sell gasoline and fresh food, and all will be connected through Wal-Mart’s e-commerce, “so you can get anything you want, even at a small store,” Simon said.

Brian Gilmartin, portfolio manager at Trinity Asset Management in Chicago, said fiscal 2014 saw the lowest rate of year-over-year earnings growth for Wal-Mart since at least 1992. Building smaller stores may be a way for the retailer to break into major urban areas without getting involved in the politics associated with doing so on a larger scale, he said.

“After 2008 [when the recession hit], I think the big box kind of lost its luster,” Gilmartin said. “If you look at Whole Foods and some of these other specialty grocers, they’re definitely building smaller stores. They’re going for more productive square footage.”

In addition to expanding small-store plans, Wal-Mart U.S. expects to follow throughwith plans to open about 115 new supercenters and 17-22 new Sam’s Clubs this year.

Thursday’s earnings release was the first under new Wal-Mart President and CEO Doug McMillon, who took over three weeks ago.

“One of Sam Walton’s fundamental principles that I really like is that we need to serve Wal-Mart customers around the globe as if they’re our boss …. because they are,” McMillon said during an early morning management call concerning earnings. “Listening to our customers and exceeding their expectations are the keys to our success.

“I will lead Wal-Mart with a customer-centric focus,” he said.

Randy Koontz, wealth management specialist and first vice president of investments for Pinnacle Wealth Management of Raymond James & Associates Inc. in Rogers, said it wasn’t so much what McMillon said as how he said it - his tone and inflection.

“With Doug, he means it,” Koontz said. “There are a lot of smart people at Wal-Mart taking care of technology, logistics - all the things that drive efficiency. It’s important to hear a CEO talk about why they do all they do … which is because of the consumer.”

During a conference call with reporters, Simon was asked if Wal-Mart has changed its position on raising the federal minimum wage. Simon said “No.”

Wal-Mart is the nation’s single-largest employer with some 1.3 million “associates,”according to the company’s website. Less than 1 percent of those make minimum wage, Simon said.

“It’s more about how far you can go and less about where you start,” he said.

Front Section, Pages 1 on 02/21/2014