Windstream Holdings Inc. on Thursday reported a profit of $241 million for its 2013 fiscal year, a 43 percent jump from 2012.

The Little Rock telecommunications firm saw its total revenue for the year decline slightly from $6.1 billion in 2012 to $5.98 billion.

“[It]was a solid year for Windstream,” Jeff Gardner, the company’s president and chief executive officer, said in a statement. “Our business team finished the year strong, generating sequential revenue growth again, and our consumer team continued to grow broadband revenue and deliver steady results, all of which better position us to achieve our goals and deliver value to shareholders.”

Shares of Windstream rose 7 cents to close Thursday at $8 on the Nasdaq exchange. Windstream released its fourth quarterfinancial results before the markets opened Thursday.

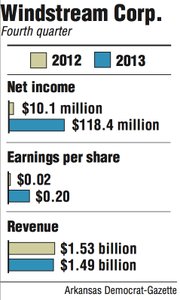

The company turned a profit of $118.4 million for the fourth quarter, compared with $10.1 million in the same period in 2012.

Windstream reported earnings per share of 20 cents for the quarter, up from 2 cents in the same period a year ago. That beat estimates of about 9 cents from analysts polled by Bloomberg News.

Windstream said its earnings were helped by a noncash benefit of 13 cents per share related to a gain realized on the telecommunication’s pension plan. Windstream said it also included 2 cents in after-tax merger and integration, restructuring and other expenses.

Excluding those items, Windstream’s adjusted earnings per share would have been 9 cents for the period that ended Dec. 31.

During the fourth quarter, Windstream sold its PAETEC software business for about $30 million in cash, making it a discontinued operation, said Bob Gunderman, senior vice president and treasurer, during the conference call Thursday morning.

For the fourth quarter, Windstream took in $1.49 billion in revenue, down slightly from $1.53 billion during the same period in 2012.

“Overall business trends were good,” said Barry McCarver, an analyst for Ste-phens Inc. “We were hoping for a little better growth than that.”

He said Windstream’s consumer service operations saw a bigger decline in revenue than was expected.

Windstream took in $318 million in consumer service revenue during the quarter, a 5 percent drop from the same period a year ago. For the year, Windstream had $1.3 billion in revenue from total consumer service operations, down 3 percent from 2012.

Windstream saw revenue from its business services increase by $4 million during the fourth quarter to $920 million.

McCarver said Windstream’s $1 regular dividend should no longer be a concern for investors.

Windstream said it had an adjusted free cash flow of $891 million for the year and paid $594 million in dividends to shareholders, giving the company a payout ratio of 67 percent.

“Throughout this evolution we continue to generate strong free cash flow and paying attractive dividend, which we believe is the best way to create value for our shareholders,” said Gardner, during the company’s conference call. “We recently declared our quarterly dividend of 25 cents per share, which we have paid consistently for over seven years.”

The company said it expects to see between a 2.5 percent decline to a 1 percent increase in total revenue in the 2014 fiscal year.

Business, Pages 27 on 02/28/2014