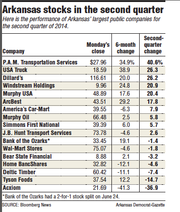

P.A.M. Transportation Services' stock had the best performance of any publicly traded Arkansas company in the second quarter, increasing by more than 40 percent in the 3-month period that ended Monday.

The improvement came despite concerns that larger carriers are taking market share from smaller truckers, said Bob Williams, senior vice president and managing director of Delta Trust Investments Inc. in Little Rock.

"P.A.M.'s announcement in May that it was replacing and expanding its stock repurchase program was well received by Wall Street," which also helped the stock, Williams said.

Arkansas trucking stocks generally performed well in the quarter.

USA Truck had the second-best return since March 31, gaining 26.3 percent. USA Truck's 6-month gain was the best of the Arkansas stocks, up almost 39 percent.

"The management of USA Truck has skillfully executed its turnaround strategy while rebuffing attempts at a company takeover," Williams said. "Successfully accomplishing just one of these is difficult but doing both is exceptional."

ArcBest, the Fort Smith trucker that changed its name from Arkansas Best this year, was up better than 17 percent for the second quarter. J.B. Hunt Transport Services had an almost 3 percent return for the quarter.

Little Rock-based Dillard's gained 26.2 percent for the second quarter, the third-best performance for the period.

Dillard's continued positive same-store sales growth and improved inventory controls throughout the quarter, which is being credited for strong interest in Dillard's shares, Williams said.

"Management clearly believed its stock was too cheap, repurchasing 700,000 shares under a buyback program last quarter and other purchasers concurred," Williams said.

Acxiom had the worst quarter, losing almost 37 percent of its value in the past three months. Apprehension followed Acxiom over the past quarter, Williams said.

"Worries about the unpredictability of early-stage products, government regulation, privacy concerns, data security breaches and the rise of competing alternative data sources weighed down Acxiom's shares," Williams said.

Tyson Foods' stock fell 14.7 percent for the quarter.

"Tyson shares sold off after analysts began to question the time frame necessary for shareholders to realize value from the Hillshire Foods acquisition," Williams said. "While they concur that the purchase makes sense from a strategic perspective, analysts have expressed concern over the ability to rapidly integrate the firms."

Three of Arkansas' four bank stocks were down for the quarter. Home BancShares dropped 4.6 percent, Bear State Financial lost 3.2 percent and Bank of the Ozarks closed down 1.4 percent.

Simmons First National Corp. was the only bank with a gain in the past three months, rising 5.7 percent.

But for the first half of the year, Bank of the Ozarks was up about 19 percent, Simmons was up about 6 percent, Bear State was up 2.1 percent and Home BancShares was down about 12 percent.

The banks have been active in acquisitions.

Simmons has been the most active this year, with three major purchases announced, said Matt Olney, a banking analyst with Stephens Inc. Those purchases are Delta Trust & Bank of Little Rock, Community First Bancshares of Union City, Tenn., and Liberty Bancshares of Springfield, Mo.

Simmons, Bank of the Ozarks and Home BancShares all are still well-positioned for more acquisitions, Olney said.

The Arkansas Index, the index of the largest publicly traded stocks based in Arkansas, grew by 4.6 percent in the second quarter.

The national Dow Jones industrial average was up 2.2 percent for the second quarter.

Business on 07/01/2014