The state government accumulated a $78.7 million general-revenue surplus in fiscal 2014, which ended Monday.

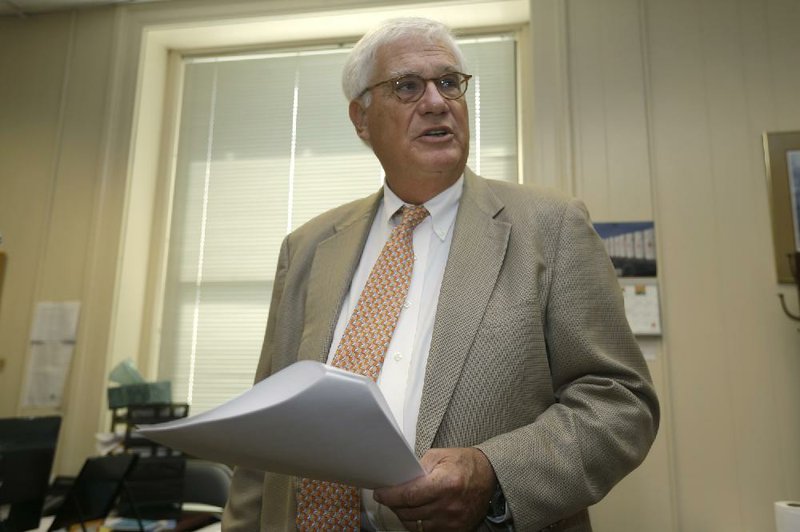

That surplus resulted from stable general-revenue collection and lower-than-expected individual income tax refunds and other deductions, the state's chief fiscal officer, Richard Weiss, said Wednesday.

The state's budget administrator, Brandon Sharp, said he's projecting that the 2015 Legislature will have about $180 million in surplus funds to consider spending during its regular session starting Jan. 12.

In addition to the fiscal 2014 surplus of $78.7 million, the state already had $95.8 million in unobligated funds. It's expected to collect $5 million more in interest during fiscal 2015.

The fiscal 2014 surplus is less than the $299.5 million surplus for fiscal 2013.

The largest surplus, at least in the past two decades, was the $409.3 million left at the end of fiscal 2007.

Gov. Mike Beebe, a Democrat, said his "conservative budgeting" helped the state amass the fiscal 2014 surplus.

The 2013 surplus spiked, in part, because of an increase in federal income tax rates, state officials said. People paid their individual income taxes early so that they'd beat the tax increase, leading to a one-time windfall.

During fiscal 2014, the state's total general revenue increased by $28.4 million (0.5 percent) over fiscal 2013 to $6.242 billion, the state Department of Finance and Administration said in its monthly revenue report.

That exceeded the state's forecast by $14.2 million (0.2 percent).

The fiscal 2014 collections are a record, exceeding the record $6.214 billion generated in fiscal 2013, said department tax analyst Whitney McLaughlin.

Weiss said the 0.5 percent increase in gross general-revenue collections in fiscal 2014 "was not anything robust at all.

"When you factor in all of that income tax stuff last year, it is not as quite as surprising," he told reporters, referring to the state's surge in individual income tax collections in fiscal 2013.

Arkansas law prohibits deficit spending.

"We always have to come in with a surplus, not a negative, or I go to jail [for deficit spending], and we don't want that to happen," Weiss said. "It shows that we are continuing to slowly come out of the recession and the recovery period."

Tax refunds and several government expenditures come off the top of "gross" general revenue, leaving a "net" amount that is available for distribution to state agencies.

During fiscal 2014, the net declined by $4.5 million (0.1 percent) from fiscal 2013 to $5.022 billion, the finance department said. The surplus of $78.7 million (1.6 percent) emerged because that's how much the net exceeded the budgeted amount for state agencies.

Weiss, who works for Beebe, said the state's general-revenue surplus from fiscal 2014 "is a little higher" than he expected. He said he had expected a multimillion-dollar surplus "probably in the upper fifties and low sixties just by eyeballing things."

Richard Wilson, who answers to lawmakers as assistant director of research for the Bureau of Legislative Research, said he expected a general-revenue surplus of about $100 million from fiscal 2014. "To miss the number by $21 million is not going to cause sleepless nights," he said.

"In other words, we had 99.66% accuracy when we provided a forecast estimate that included a $100 million surplus," Wilson wrote in an email, referring to a projection he made months ago.

Beebe, whose eight-year tenure as governor ends in January, said the 2015 Legislature and the next governor will have about $180 million in surplus funds to consider spending on emergency needs and construction projects. Some of money also could go to the governor's Quick-Action Closing Fund for economic development projects "assuming the next governor wants to continue that.

"I would hope that the economic development aspect of state government that's so important to create jobs, to maintain jobs and expand jobs would cause them to want to continue to fund the Quick-Action Closing Fund," he said.

According to the finance department, the state's general revenue in fiscal 2014 included:

• A $48.6 million (2.3 percent) increase in sales and use tax collections over fiscal 2013 to $2.17 billion.

That's $34.6 million (1.6 percent) below the state's forecast.

These sales and use tax collections reflect "limited economic growth in most indicators over the year," the department said.

• A $33.2 million (1.1 percent) decline in individual income tax collections from fiscal 2013 to $3.11 billion. That's $10 million (0.3 percent) above the state's forecast.

Individual income tax withholding increased by $47.7 million (2 percent) over fiscal 2013 to $2.42 billion, $17.5 million (0.7 percent) below the forecast.

Collections from individual income tax returns and extensions declined by $75.4 million (18.2 percent) from fiscal 2013 to $338.8 million -- $11.7 million (3.6 percent) above the forecast.

Collections for estimated payments made by self-employed individuals and others for other income not subject to withholding declined by $5.5 million (1.6 percent) from fiscal 2013 to $342.9 million -- $15.8 million (4.8 percent) above the forecast.

• A $9.1 million (2.1 percent) increase in corporate income taxes over fiscal 2013 to $440.2 million -- $11.2 million (2.6 percent) above the forecast.

During the last month of fiscal 2014, gross general revenue declined by $5.1 million (0.8 percent) from June 2013 to $616.4 million. That fell $2 million (0.3 percent) below the forecast, the finance department reported.

The state's record for June's total general revenue collections is the $621.4 million collected in June 2013, McLaughlin said.

June's sales and use tax collections dipped by $3.7 million (2 percent) from the same month last year to $180.2 million.

That fell $10.4 million (5.5 percent) below the forecast.

"That was a disappointing number and one that causes concern obviously," said Weiss.

The state's chief economic forecaster, John Shelnutt, added: "We had another bad month for [sales tax payments paid on utility bills]. We don't have an explanation for that."

June's individual income tax collections increased by $1.4 million (0.5 percent) over the same month last year to $286.8 million, which matched the state's forecast.

Last month's individual income tax withholdings increased by 2.9 percent over a year ago and "that's not bad," Shelnutt said.

Arkansas' unemployment rate declined in May for the eighth-straight month, falling to 6.4 percent, the U.S. Bureau of Labor Statistics said two weeks ago. The rate dropped from 6.6 percent in April and is more than 1 percentage point lower than the 7.5 percent rate in May 2013. The national unemployment rate in May was 6.3 percent.

One reason for the drop in Arkansas' unemployment rate isn't a burgeoning economy as much as it is to the continuing shrinkage of the state's labor force, according to economists.

A section on 07/03/2014