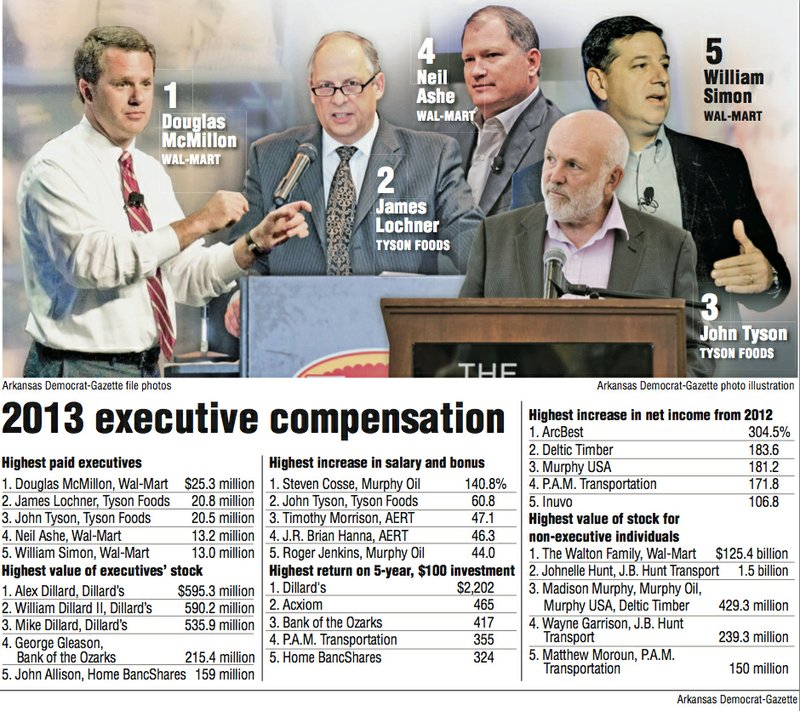

Douglas McMillon, who took over as chief executive officer at Wal-Mart in February, was the highest-paid public company executive in Arkansas last year.

McMillon received a compensation package valued at $25.3 million last year, about double the $12.8 million he got in 2012 when he was an executive vice president for Wal-Mart, the largest retailer in the world.

Two Tyson Foods executives -- James Lochner, chief operating officer, and John Tyson, chairman -- trailed McMillon by almost $5 million. Lochner earned $20.8 million in 2013, and Tyson made $20.5 million.

Neil Ashe, a Wal-Mart executive vice president, made $13.2 million, and William Simon, Wal-Mart's chief executive officer of U.S. operations, made $13 million last year.

Wal-Mart likes to point out that its incentive packages are paid only if Wal-Mart meets performance goals.

The Arkansas Democrat-Gazette determines executive compensation using The Associated Press' method of adding salary, bonus, incentives, perks, above-market returns on deferred compensation, and including the estimated value of stock options and awards granted during the year.

The information is gleaned from the companies' annual proxy statements, which notify shareholders of the timing for annual meetings, highlight topics to be voted on and outline income of the companies' top officers.

As high as those Arkansas executives' incomes are, they are not uncommon for officers at large public companies, said Joshua Henke, managing director for Longnecker & Associates, an executive-compensation consulting firm in Houston.

"Those numbers are not out of line, even if you compare them nationally to similarly sized companies," Henke said. "For those sized companies, that seems to be in the ballpark for what you would expect an executive at that rank to earn. And Wal-Mart is a worldwide company."

Some of the energy companies in the Houston area have executives making much more than Wal-Mart or Tyson executives, Henke said.

For example, Charif Souki, chief executive of Cheniere Energy of Houston, made $142 million last year. An estimated 65 chief executives earned more than $20 million last year, according to research by the Stanford Graduate School of Business.

The 88 executives listed in the proxy statements for 19 Arkansas public companies earned about $306 million last year, 13.6 percent less than the $354 million earned in 2012. Fifty-two of the officers made more than $1 million last year.

The average income was about $3,500,000. That pay level is enough to pay the annual salary of about 160 Arkansans earning the state's average per capita income of $22,007, according to the U.S. Census Bureau.

Another reason for the high pay, Henke said, is an attempt to retain key executives.

"There has been a huge push for retention at the senior executive ranks and down through what I would consider middle management," Henke said. "One particular reason is the talent gap.

"As the baby boomer generation starts to retire, there is a pretty big gap between the senior executives in place and wanting to retire and those coming up through the ranks, from an age perspective and from an experience perspective. Companies are trying to retain their senior talent as long as they can while they are training the up-and-coming younger generation."

The best-performing stock among the 19 public companies was Dillard's, by a wide margin.

A $100 investment in Dillard's stock at the close of its 2009 fiscal year was worth more than $2,200 on Feb. 1. Dillard's stock in 2009 was near its all-time low at $3.96 and it closed at $87.20 on Feb. 1 this year. Since then, Dillard's stock has reached an all-time high of $120.99.

The next highest return on investment was Acxiom, which increased to a value of $465 after a $100 investment five years ago.

Much of Dillard's growth is attributable to timing, said Bob Williams, senior vice president and managing director of Delta Trust Investments Inc. in Little Rock.

"It's a five-year look back to the heart of the recession, going from the bottom of the cycle to the top," Williams said. "In 2009, people were not sure the economy was going to [recover] at all. People were scared to death of stocks and real estate and everything else."

Much of the value of Dillard's lies in its ownership of most of its store locations, many in upscale shopping centers.

"Now real-estate valuations have improved massively," Williams said.

Some of the proxy statements disclose more than just income for the top executives.

Members of the extended Murphy family are on the boards of directors of Murphy Oil, Deltic Timber and Murphy USA. Deltic Timber was spun off from Murphy Oil in 1996, and Murphy USA was spun off from Murphy Oil last year.

According to Deltic Timber's proxy, more than 100 individuals of the extended family, covering four generations, own about 26 percent of Deltic, worth about $200 million.

Madison Murphy is on all three boards and owns a total of $429 million in the three companies. First cousins of his on the Murphy Oil board are Claiborne Deming and Caroline Theus. Deming and Murphy are former chairmen of the board of Murphy Oil.

Murphy's first cousins on the Deltic board include the Rev. Christoph Keller and Robert Nolan, Deltic's chairman of the board. Hunter Pierson is the husband of a first cousin of Murphy, Keller and Nolan.

Murphy is chairman of Murphy USA. His first cousins on the Murphy USA board are Deming and Keller.

Murphy Oil, Murphy USA and Deltic consider most of the directors of their companies to be independent under the rules of the New York Stock Exchange.

"It is not uncommon to see a couple of 'legacy' family members on long-standing public companies," Henke said. "They often want to try and preserve the historical culture or the original business direction of the founding family members. However, it is important that public companies still abide by the established rules of electing independent board members in addition to any nonindependent board members."

The New York Stock Exchange requires all members of a firm's compensation committee, which determines the pay for top executives, to be independent board members, Henke said.

Family relationships are common in Arkansas companies.

Four of the five highest-paid executives at Dillard's are siblings -- William Dillard II, Alex Dillard, Mike Dillard and Drue Matheny. Their sister, Denise Mahaffy, is a Dillard's vice president and made about $770,000 last year.

William Dillard III is also a Dillard's vice president and made almost $800,000 last year.

Two daughters of Alex Dillard -- Alexandra and Annemarie -- are managers of the company. Alexandra made almost $250,000 last year and Annemarie earned about $195,000.

Two sons-in-law of Kirk Thompson, chairman of J.B. Hunt, work for the company. One was hired in December and had no reportable 2013 income. The other son-in-law earned about $410,000 last year.

Lori Haynie is the sister of Wal-Mart CEO Douglas McMillon and an executive officer of Mahco Inc. Wal-Mart paid Mahco $13.4 million last year for sporting goods and related products.

Eric Scott is the son of H. Lee Scott, a Wal-Mart director, and the chairman of Cheyenne Industries Inc. Wal-Mart paid Cheyenne and its subsidiaries about $32 million last year for the purchase of home furnishings and related products.

Nichole Bray, a senior manager in Wal-Mart's information systems division, is McMillon's sister-in-law. Wal-Mart paid Bray about $175,000 last year.

Greg Bray is a senior director in Wal-Mart's finance department and is McMillon's brother-in-law. Wal-Mart paid Greg Bray about $240,000 last year.

Stephen Weber is a senior manager in Wal-Mart's information systems division and the son-in-law of Michael Duke, a Wal-Mart director. Wal-Mart paid Weber about $175,000 last year.

Timothy Togami, a senior director in Wal-Mart's human resources department, is the brother-in-law of Rollin Ford, a Wal-Mart executive officer. Togami earned about $250,000 last year.

Jessica Salmon, a senior manager at Sam's Club, is Ford's daughter. Salmon earned about $105,000 last year.

Last year, Arvest Bank, which is owned by Jim Walton, Rob Walton and a trust of which Jim Walton is the trustee, and some Arvest subsidiaries paid Wal-Mart about $1 million for the rent of supercenter and Neighborhood Market space.

David Martin is vice president of direct sales for Windstream and is the brother-in-law of Brent Whittington, Windstream's chief operating officer. Martin made almost $250,000 last year.

Andrew Einhorn is an account executive for Windstream and the brother of Eric Einhorn, a Windstream senior vice president. Andrew Einhorn made about $115,000 last year.

SundayMonday Business on 07/20/2014