An estimated 74,000 homeowners in Arkansas owed more on their mortgages than their homes were worth in the first three months of the year, according to national online real estate research firm Zillow.

That represents 16 percent of the estimated 465,000 houses in Arkansas with mortgages, Zillow said.

Almost 10 million Americans with mortgages -- about 19 percent of all mortgage holders -- had houses in the first quarter that were worth less than they owe, Zillow said. That was a considerable improvement from about 25 percent for the same period last year. Historically, only about 5 percent of homeowners have had homes that are "underwater," or worth less than the amounts owed on mortgage loans.

Negative equity occurs when there is a decline in the value of a property, an increase in mortgage debt or a combination of both.

"The economic significance is that if you have negative equity or low equity [in a home], it makes it more difficult to sell your home and buy a new one," said Michael Pakko, chief economist at the Institute for Economic Advancement at the University of Arkansas at Little Rock. "It locks you into your current mortgage. So that reduces mobility in the market."

The negative-equity situation limits the inventory of houses for sale, creating a barrier to market improvement, Pakko said.

Zillow said it reached its estimates on negative equity in part by using mortgage data from credit information management firm TransUnion. Zillow calculated negative equity by considering mortgage debt, home-equity lines of credit and home-equity loans.

The report covered more than 870 metropolitan areas and 2,400 counties nationwide, said Seattle-based and publicly traded Zillow.

Recession house-price increases and declines were not as significant in Arkansas as in other parts of the country, Pakko said.

Northwest Arkansas saw some of the biggest drops in house prices in the state, Pakko said. In most cases, those declines were less than 10 percent.

Consequently, a good number of the state's underwater mortgages are in Northwest Arkansas, Pakko said.

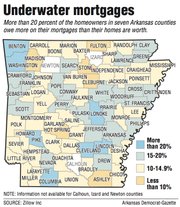

Twenty-two percent of houses in Washington County had negative equity in the first quarter, Zillow said, as well as 20.5 percent in Benton County. That equals about 14,250 houses combined for both counties.

"But I suspect that Northwest Arkansas has also been improving the most because house prices are [increasing] there," Pakko said. "You'll see fewer homeowners in negative equity as house prices are improving."

Benton and Washington counties are also home to the best-performing housing markets in the state as indicated by the Arkansas Tech Business Index, said Marc Fusaro, associate professor of economics at Arkansas Tech University at Russellville.

That inverse relationship is not surprising, Fusaro said, because Northwest Arkansas has seen the most fluctuation in house values over the past decade.

"Northwest Arkansas experienced the housing price run-up of the housing bubble," Fusaro said. "People bought at the top of the market. Then the region saw the price collapse [because] of the [financial] crisis. This is what puts mortgages underwater -- buying at the top, owing a big mortgage and then seeing your value drop. Most other Arkansas communities did not see the run-up or the subsequent collapse, and thus do not have the same extent of negative equity."

There were 11,000 houses with negative equity in Pulaski County in the first quarter, or about 17.1 percent of the houses with mortgages, Zillow said.

Underwater mortgages don't necessarily have much effect on a housing market, said Roddy McCaskill, executive broker with Keller Williams Realty in Little Rock.

A homeowner with negative equity who continues to make payments will have no effect at all on the market, McCaskill said. If the homeowner needs to sell the house, typically he attempts a short sale, where the mortgage lender agrees to take the loss if the house sells for less than is owed on the mortgage, McCaskill said.

"But we're not seeing that wide-reaching effect [of underwater houses] on the market," McCaskill said. "Our home values have perked up considerably from where they were in 2008. [Underwater houses] may slow things down a little bit from a perfect world, but not much."

More than 20 percent of the houses in each of four south Arkansas counties were underwater, Zillow said, including Cleveland County at 26.4 percent, Lincoln County at 21.6 percent, Columbia County at 20.8 percent and Pike County at 20.8 percent. But the total number of houses in such a predicament was relatively small, with fewer than 700 underwater in Columbia County and fewer than 350 in each of the other three counties.

The average price of a house in Benton County has fallen 6 percent, from $192,446 in 2007 to $180,452 in April, according to the Arkansas Realtors Association. On a 30-year mortgage with a 6 percent interest rate -- a common rate in 2007 -- a homeowner who bought the average-priced house seven years ago still would owe more than $174,000, about 96 percent of the April value.

SundayMonday Business on 06/08/2014