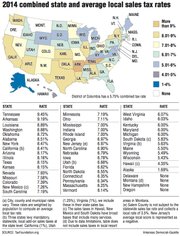

Arkansas has the second-highest combined state and local sales-tax rate on average in the nation for the second year in a row, according to the Washington, D.C.-based Tax Foundation.

The foundation, a nonpartisan research group that monitors federal, state and local fiscal policies, released an annual report Tuesday updating numbers released last July when several states changed their sales tax rates.

Arkansas' rate increased slightly from 9.18 percent to 9.19 percent -- made up of a 6.5 percent state sales tax and a 2.69 percent average local sales tax -- according to the report. The report ranked Arkansas below only Tennessee, which had a 9.45 percent average combined sales tax.

"This is looking at the overall combined sales taxes for each state," said Scott Drenkard, a foundation economist. "There's such a difference between each state. Using the tax code to pick winners and losers is a fool's errand and it's not an effective way to collect revenues for government."

A little more than a year ago, the foundation ranked Arkansas sixth-highest for combined sales tax nationally. Drenkard said the increase was due to a 0.5 percentage-point increase in statewide sales tax that started being collected in July after voters approved a ballot measure in November 2012.

The increase, which will last for 10 years and help pay for highways and roads, increased the state's sales-tax rate from 6 percent to 6.5 percent. A handful of local sales-tax initiatives passed between July and March, increasing the local sales-tax average by 0.01 percentage point, Drenkard said.

To determine a state's average local sales-tax rate, the foundation said it uses quarterly sales-tax information that's published by the Sales Tax Clearinghouse by ZIP code. It then weighs those numbers against 2010 U.S. Census population figures.

But state officials said Tuesday that looking only at the state's sales tax does not provide a full picture of the tax revenue or tax burden placed on residents.

Arkansas Department of Finance and Administration officials said the state uses a U.S. Census Bureau compilation that gathers information on all of the major tax sources for each state, making it easier to compare the overall tax burdens among states.

"It gives a very different picture than the Tax Foundation's report," said John Shelnutt, an economist with the state agency's Economic Analysis and Tax Research division.

"In general, a snapshot look at state and local sales-tax rates does not consider the timing aspects as to major road improvement programs or the conditions of other core responsibilities of state government, such as educational spending adequacy," he said.

According to the fiscal 2011 census report, Arkansas ranked 38th nationally for total state and local taxes per capita. Arkansans pay $3,386 on average compared with $4,296 nationally. Both numbers increased between 2010 and 2011, Arkansas by about $138 annually and the U.S. by about $191 annually.

The census report also tracks the total taxes as a percentage of income. Arkansas ranked 20th among the states with taxes making up about 10.3 percent of the average resident's income, compared with 10.5 percent nationally.

As a comparison, the Tax Foundation study ranks Alaska as 46th in the nation for sales tax, but the census report ranks Alaska first in terms of the total taxes per capita and the percentage of income at $10,074 and 21.6 percent.

Drenkard said part of the reason the foundation began tracking sales tax was to show there were major discrepancies across the country in how much citizens are charged for goods and services.

"Look at Colorado. They have a 2.9 percent state sales tax, but they rely on local governments to pick up a lot of services," he said. "This is the state of sales taxes around the country, and they're not uniform. They apply to different things in every state. Ideally, you'd have one sales-tax rate that applies to all final transactions whether that's goods, or food or services."

Arkansas' ranking should decrease in the next few years. Act 1450, passed in the 2013 General Session, set up the mechanisms to phase out most of the state's 1.5 percent sales-tax on groceries. The tax rate would eventually drop to 0.125 percent.

The cut is contingent on the state paying off bond obligations that won't end for years or resolving a decades-old lawsuit that required the state to pay millions for desegregation efforts. Earlier this year, a U.S. district judge approved a settlement negotiated by Arkansas, three Pulaski County school districts and two groups of intervenors representing school employees and black students.

Sen. Jason Rapert, R-Conway, who introduced the bill in the Senate last year, said he plans to sit down with Department of Finance and Administration officials and look at whether the settlement triggers the grocery sales-tax decrease.

"Obviously as we weigh all of the fiscal needs of the state -- education, prisons, jail support and others -- if we are still in a position where we are going to be able to throw the rest of that sales tax out, that is what I want to see happen," he said Tuesday. "In my opinion, when families are already struggling, it's not appropriate to be taxing the necessities of life. If we are at a place that we feel like fiscally we can do it, I will introduce legislation next session if necessary."

The Legislature can pass sales taxes by a simple majority, but the last sales tax approved in the state was in 2004 when the Legislature raised the state sales tax from 5.125 percent to 6 percent and expanded the tax to cover 15 additional services. At that time, the higher tax was projected to raise about $360 million a year for public schools as part of the state's effort to comply with a 2002 state Supreme Court ruling on public-school funding.

Arkansas enacted its first statewide sales-tax in 1935-- five years after Mississippi enacted the first statewide sales tax in the country-- according to tax research done by the University of Tennessee College of Business and Administration.

Metro on 03/19/2014