LITTLE ROCK — More than half of flood insurance policyholders in the tiny northern Arkansas city of Norfork face premium increases, but Mayor Jim Reeves says the hardship will be felt by everyone.

Norfork, population 500 and change, is located at the confluence of the White and Norfork rivers. Of its 77 policies, 48 face premium increases by as much as 18 percent for primary homeowners and a mandatory 25 percent for businesses and vacation homes.

The federal government had for years subsidized flood insurance on homes and businesses constructed in the days before there was a laundry list of rules about building close to the water.

Premiums collected haven't been sufficient to cover the payouts, leaving the National Flood Insurance Program billions of dollars in debt.

In 2012, Congress passed a law requiring 1.1 million policyholders to start paying rates based on the true flood risk at their properties. The overhaul was scaled back in face of a public outcry, and President Barack Obama signed that measure into law Friday.

"It's going to cut the market for houses down there, just not going to be able to sell them," he said.

The mayor said he is worried about property values if prospective homebuyers are socked with the full price of flood insurance instead of the subsidized rates current homeowners pay.

"If you buy a house and the government is giving you a special rate on insurance, you don't think they're going to pull it away from you, [but] they are," Reeves said.

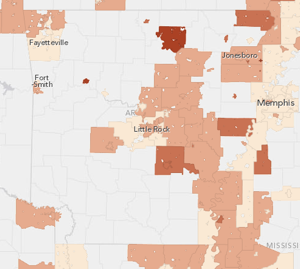

In Arkansas, more than 2,300 policy owners for businesses and vacation homes face a mandatory 25 percent increase each year, according to an Associated Press analysis of the National Flood Insurance Program. More than 5,300 policy owners of primary residences face up to an 18 percent increase each year.

Allen Kerr, an insurance agent in Little Rock, said the increases may affect real estate sales for homes that haven't had previous problems with flooding but are touching a flood plain.

"The cost is so much more to own that house rather than one maybe across the street or on the next block that isn't in the flood plain. You may not be able to sell your house," he said.

The increase may also affect insurance businesses, because consumers think the rate increase is an extra fee or surcharge tacked on by agents, Kerr said.

"Their neighbor who may live next door to them says their flood insurance is $500 a year, and then we give them a rate for $750 or $800 and they say that can't be right, so they start searching around for other agents, only to find out that's a federal program and not something driven by the insurance companies," he said.