El Dorado-based Murphy Oil Corp. reported a 56 percent drop in profit during its first quarter of 2014, according to a financial report released by the company Wednesday.

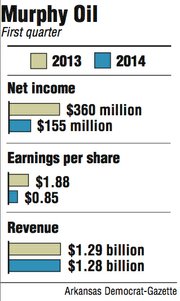

The company reported net income of $155.3 million for the quarter that ended March 31, down from $360.6 million during the same period a year ago.

Murphy Oil had earnings per share of 85 cents, missing analysts’ estimates of 97 cents. A year ago, the company earned $1.88 per share in the first quarter.

Justin Jenkins, a research associate for Raymond James and Associates, said Wednesday before Murphy Oil released its quarterly report that he expected the company to post earnings per share of $1.07.

Excluding discontinued operations and other items that affect the ability to compare the current quarter with the same period a year ago, Murphy Oil said its income would have been $174.8 million, or 96 cents per share.

The company separated its retail gasoline and marketing business from its exportation and production operations in the second half of 2013.

Murphy Oil released its earnings after markets closed Wednesday. Shares of the company fell $1.10 to finish at $63.43 on the New York Stock Exchange.

The company’s revenue for the quarter was $1.28 billion, a slight decrease from $1.29 billion in the same quarter a year ago.

Murphy Oil mentioned in its release Wednesday that the “consultation period” for its Milford Haven refinery in Wales will end this month. In April, the company’s Murco Petroleum subsidiary said it was deciding whether to close the refinery after talks with a potential buyer fell through.

Murphy Oil has been trying to sell the refinery for several years to exit the refining market in the United Kingdom.

The company has had difficulty finding a buyer because the refining industry is struggling in Europe, analysts have previously said.

Murphy Oil has already classified its refinery business in the United Kingdom as discontinued.

The company also said it has initiated a $250 million share repurchase, raising its total repurchases of common stock under its buy-back program to $1 billion.

Jenkins said he is looking for an update from the company during its conference call today about its production guidance, which was reduced earlier this year, and any plans for production growth.

Roger Jenkins, president and chief executive officer of the company, said in a prepared statement that the company was “on track to establish record production this year, which will be the third consecutive year we have achieved record volumes.”

Murphy Oil’s annual production guidance is 225,000 to 230,000 barrels of oil equivalent per day, reflecting reductions at two nonoperating properties.

Murphy Oil will hold a conference call at noon today to discuss its financial results. The call can be accessed by dialing (800) 750-4984.

The telephone reservation number for the call is 5617007.

Live audio from the call can be accessed on the company’s website at: http://ir.murphyoilcorp.com.

Business, Pages 25 on 05/01/2014