Correction: Windstream Holdings Inc. expects a 2.5 percent decrease to a 1 percent increase in total revenue this year, compared with last year. The company’s revenue projection was incorrectly reported this article.

Shares of Windstream Holdings Inc. saw little movement Thursday after the company reported a 69 percent drop in profit during its first quarter of 2014.

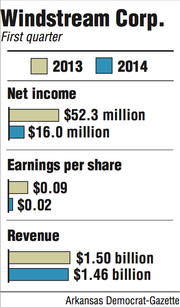

The Little Rock company reported a net income of $16 million during the quarter, compared with $52.3 million during the same period a year ago.

Earnings per share for the quarter were 2 cents, down from 9 cents in same period in 2013. The company missed analysts' estimates of 8 cents.

Excluding about 2 cents in after-tax merger and integration, restructuring and other expenses, Windstream's earnings per share would have been 4 cents for the first quarter.

Shares of Windstream fell 7 cents to close at $9.03 Thursday on the Nasdaq stock exchange in more-than-double the average trading volume.

Windstream also missed analysts' revenue estimates for the first quarter, said Barry McCarver, an analyst with Stephens Inc.

"The results came in below for revenue," he said, adding that the company laid out plans during its conference call Thursday to spend more on marketing campaigns and will consider price increases for its business and customer services.

The telecommunications company reported $1.46 billion in revenue for the period that ended March 31. That was down 2 percent from revenue of $1.5 billion in the first quarter in 2013.

"Total revenue trends improved both year-over-year and sequentially as wholesale pressures began to abate," Windstream President and Chief Executive Officer Jeff Gardner said in a statement. "We are very focused on improving business revenue trends and are taking many proactive steps to accelerate sales and strengthen our competitive position. In addition, we are investing in both the business and consumer network to drive growth opportunities and improve the customer experience."

Windstream said in its financial report that business-service revenue -- $748 million -- was flat in the quarter, but revenue from its data and integrated services grew 3 percent to $414 million.

The company said revenue from its data center and managed services rose 23 percent during the first quarter to about $30 million.

In its financial report, Windstream said it started plans to expand sales to businesses and started an advertising campaign to increase "brand awareness and highlight its integrated value proposition and customized service."

"We are strategically positioning Windstream in the marketplace with refreshed branding and are investing in incremental advertising to support our messaging," Gardner said during the conference call. "Our market position remains centered around our brand promise of 'smart solutions, personalized service.'"

Windstream had an adjusted free cash flow of $314 million and paid $150 million to shareholders in dividends, Gardner said during the company's conference call.

"Windstream is focused on being the premiere enterprise communications and services provider, with the goal of growing revenue and generating stable sustainable free cash flow," he said.

The company expects a dividend payout ratio between 68 percent and 78 percent for the fiscal year.

Windstream said in its report that it expects total revenue in 2014 to fall between 1 percent and 2.5 percent compared with last year.

Business on 05/09/2014