Top executives of America's Car-Mart said loan defaults and heavy competition were reasons why the company missed analysts' estimates for its fourth quarter, reporting both net income and revenue down compared with the same time last year.

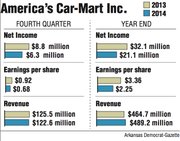

According to a release after market close Tuesday and a Wednesday morning conference call, the buy-here, pay-here used-car dealer reported net income of $6.3 million, or 68 cents per share, for the quarter that ended April 30, down from $8.8 million, or 92 cents per share, for the fourth quarter of fiscal 2013.

A consensus of four analysts predicted earnings of 78 cents a share. It was the fourth-consecutive quarter that Car-Mart fell short of analysts' earnings-per-share estimates.

The Bentonville-based company reported revenue of $122.6 million for the fourth quarter compared with $125.5 million in the same period a year ago. Two analysts had predicted revenue of $133.4 million for the fourth quarter of fiscal 2014.

Shares tumbled in trading Wednesday, falling more than 7 percent, or $2.89 a share, to close at $37.64 in trading on the Nasdaq. Shares have traded between $34.56 and $47.93 over the past year.

Hank Henderson, president and chief executive officer of Car-Mart, said higher sales numbers would have been welcome, but the company is focusing on establishing deal terms that customers have a good chance of completing and earning the repeat business of those customers.

He said charge-offs were higher than normal in the fourth quarter and the company is trying to take steps to improve that metric. Net charge-offs were 8.3 percent of average finance receivables for the quarter, up from 7.1 percent for the same quarter in fiscal 2013. A charge-off is declared when a creditor decides its unlikely a debt will be collected.

On the upside, the average down payment percentage was 9.7 percent for the quarter, up from 8.7 percent for the fourth quarter of 2013 and at the highest level in six years. Henderson said higher down payments equate to more buyer equity in the cars, which encourages customers to stick with the vehicle until the purchase terms are complete.

Retail unit sales dropped 1.9 percent to 10,565 in the fourth quarter from 10,767 in the same period a year ago. On average, dealerships sold 26.9 vehicles per month, down from 29.4 from the fourth quarter of 2013.

The sale price per vehicle dropped $178 to $9,785, down about 2 percent from the same period last year. Same-store revenue, or revenue in stores open at least a year, was down 7.1 percent compared with an increase of 5.3 percent for the fourth quarter of 2014.

For the year, Car-Mart reported net income of $21.1 million, or $2.25 per share, compared wit $32.1 million, or $3.36 cents a share, in 2013. Revenue for the year was $489.2 million, up 5 percent from $464.7 million for 2013. Same-store sales-revenue growth was down 0.8 percent compared with a gain of 3.3 percent for 2013.

In fiscal 2014, the company added 10 stores, growing from 124 to 134. It sold 4.5 percent more cars in 2014 with a total of 45,551 vehicles, an average of 27.7 cars per month. The company plans on adding eight stores in 2015.

During the year, Car-Mart bought back $12.8 million in stock and decreased its debt by $2.5 million.

Jeff Williams, Car-Mart's chief financial officer, said the company's core customers are facing stiff economic challenges and they're fearful of making a major capital purchase like a car. He said Car-Mart also is seeing more competition in the marketplace.

Tax refund time, typically a good period for Car-Mart, was not as lucrative in the fourth quarter compared with last year, Williams said. Looking forward, Williams said the company should focus on what it can control -- making good deals, offering quality cars and earning repeat business.

"Taking care of good, hardworking people is what we do," Williams said.

During the question-and-answer period of the conference call, both Henderson and Williams said competition is fierce and includes both new- and used-car dealers.

Williams said new-car dealerships are offering aggressive zero down, low interest loans with terms up to 72 months. Henderson said the result is some Car-Mart customers are making deals at new-car lots and leaving their cars to be picked up by Car-Mart.

Henderson said the company plans to stick with its plans to keep terms short whenever possible and to keep down payments higher, even if it means occasionally passing on some sales.

"We're focused on the long term," Henderson said.

Business on 05/29/2014