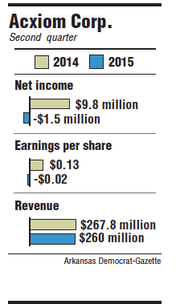

Acxiom lost $1.5 million in its second quarter that ended Sept. 30, down from a profit of $9.8 million in the same period last year, the Little Rock data broker said Monday.

Acxiom lost 2 cents per share in the quarter, down from a profit of 13 cents per share in the same period last year.

Excluding one-time items in the quarter, Acxiom earned 18 cents per share, beating the consensus expectation of 17 cents per share by analysts who cover the company.

Revenue declined slightly to $260 million in the second quarter compared with about $268 million in the second quarter last year.

The company, which collects consumer information by monitoring shopping habits and using client data, reported a loss of $7.6 million in its first quarter that ended in June.

Acxiom shares fell 15 cents in trading on the Nasdaq exchange Monday, closing at $18.69. The quarterly report was released after the market closed.

"We think the quarter was a good quarter, and the company is progressing as we expected positively on a number of fronts," said Brett Huff, an analyst with Stephens Inc.

In the second quarter, Acxiom signed 15 agreements for the firm's new audience operating system, software that helps Acxiom's third-party data to be distributed more easily to clients.

"We thought the 15 new agreements [for the audience operating system] shows that [Acxiom] is gaining momentum in that new product," Huff said.

Also, with the addition of LiveRamp, a marketing services company, Acxiom's partner network expanded substantially, Scott Howe, Acxiom's chief executive officer, said in a statement.

Acxiom acquired LiveRamp Inc. earlier this year for $310 million. Acxiom signed 20 new deals through LiveRamp in the quarter.

"We think that also showed good momentum for that brand-new asset," Huff said.

During the quarter, Acxiom said it signed deals with Duke Energy; Dennis Publishing; TD Bank Group; AT&T Inc.; Toyota Motor Co.; Starcom Mediavest Group; Hakuhodo Inc., Japan's second-largest advertising agency; Weibo Corp., China's leading social media platform; a top-three credit card issuer; a leading insurance company; and a global retailer.

Acxiom also bought 529,000 shares of its stock for $9.9 million in the quarter. Since August 2011, Acxiom has repurchased 12.9 million shares for $202 million.

Business on 11/04/2014