Shares of Wal-Mart Stores Inc. closed at a record high of $82.94 per share Thursday after the company posted its first positive same-store sales at U.S. stores in seven quarters. Profits of $1.15 per share beat the Wall Street prediction by 3 cents.

The previous record per-share closing price was $81.21, on Dec. 3. Lower gasoline prices and solid Halloween and back-to-school sales in the U.S. helped buoy the company's revenue in the third quarter, executives said when they reported sales and earnings to a worldwide audience Thursday.

Top management at the Bentonville-based retailer isn't celebrating yet. Foot traffic in the U.S., the retailer's largest operating segment, remained in decline, and grocery sales were relatively flat for the 13-week period period that ended Oct. 31. Wal-Mart is the nation's largest grocer.

"I'm encouraged ... but we're still not satisfied," Wal-Mart President and Chief Executive Officer Doug McMillon said in a recording for analysts. McMillon is in his first year leading the company.

"Overall, I would characterize the quarter's sales performance as mixed," said Greg Foran, the new president and CEO of Wal-Mart U.S. The retailer's same-store U.S. sales inched up 0.5 percent.

"As we enter the fourth quarter, we see both opportunities and challenges ahead of us," he said, highlighting what is expected to be a highly competitive Christmas shopping season.

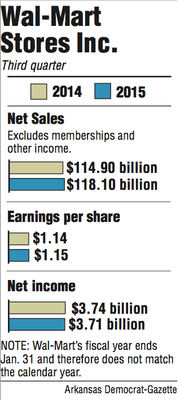

Net sales for the company's fiscal third quarter were $118.1 billion, a 2.8 percent increase of $3.2 billion over the $114.9 billion reported for roughly the same period last year. Net income in the quarter was $3.71 billion this year -- a 0.4 percent drop from $3.74 billion reported for last year's third quarter.

Earnings per share of $1.15 was a penny over what the retailer reported for the third quarter of fiscal 2014. The discrepancy is attributed to fewer shares outstanding.

"The traffic is still a red flag, but for some reason the stock is now telling us the worst is passed," said Brian Gilmartin, portfolio manager at Trinity Asset Management Inc. in Chicago.

"The news didn't have to be great, it just had to be less bad," said Randy Koontz, first vice president of investments for Pinnacle Wealth Management of Raymond James & Associates Inc. in Rogers. The report "gave shareholders and potential shareholders confidence that the management team has the ability to "turn the ship."

"I noticed some of the same tone from McMillon and Foran. ... 'We're visiting stores, whether it be in China or Chicago, and we're hearing the same things from our customers, which is give them a good product at a good value and have the shelves stocked,'" Koontz said.

"This new management team has a focus on improving customer experience," including stocking, cleanliness and staffing, he said. "It's some low-hanging fruit and these guys were smart enough to figure it out, and that's good."

Global eCommerce sales were up 21 percent for the third quarter, and management is looking toward a 25 percent increase for the full year. Wal-Mart's tax rate was 32 percent, lower than the anticipated 34 percent. The company marked a 3.5 percent rise in operating expenses, attributed largely to health care cost inflation, investments in eCommerce and wage increases, though the extra payroll was not quantified.

Same-store comparable sales for Neighborhood Market stores rose 5.5 percent in the quarter, a trend that's expected to continue. The retailer opened more than two dozen new Neighborhood Markets in the quarter, including its 5,000th store -- in Greenbrier -- last week. More than 100 markets are scheduled to open in the fourth quarter.

Wal-Mart revealed Tuesday that it would bump its Black Friday sales up to Thanksgiving Day, creating a five-day stretch of deals and tailored events. The aggressive strategy to grab Christmas shoppers includes free shipping on the top 100 items and price cuts on 20,000 items. Starting today, Wal-Mart will match online prices -- such as Amazon.com's -- in stores, a maneuver that was already instituted in half of Wal-Mart's outlets.

Foran predicted that entertainment items -- which traditionally sell well during the holidays -- will be especially challenging because of falling prices of games and electronics, as well as a lack of new products.

"[The] unanswered question at this point is how much more promotional the holiday season will be this year versus last year," researchers for Barclays PLC said in a note Thursday.

Wal-Mart International grew operating income faster than sales and market share in most of its largest international markets, said David Cheesewright, president and CEO of the segment. International sales rose 1.7 percent to $33.7 billion, and revenue at Sam's Club was lifted 2.3 percent to $14.39 billion.

The retailer expects positive same-store sales to continue for the current quarter yet lowered its forecast to $1.46-$1.56 per share. The retailer narrowed its fiscal 2015 earnings forecast to $4.92-$5.02 per share from $4.90-$5.15 per share.

Money spent on investigating allegations that Wal-Mart violated the Foreign Corrupt Practices Act in Mexico and other countries was tallied for the year at $137 million, much less than the $200 million to $240 million predicted. Figures include what the retailer has spent on organizational changes and compliance hiring to ensure against any possible future violations. The company now says it believes it will spend an amount near the lower end of that price range on investigating violations of the Foreign Corrupt Practices Act and compliance-related costs for the full year.

Wal-Mart's good news garnered some negativity from watchdog groups, particularly those concentrating on labor issues.

McMillon's goal of improved customer experience isn't inching closer but slipping further away, said Janet Sparks, a customer service manager at a Wal-Mart store in Baker, La. She's a member of OUR Walmart, or Organization United for Respect at Walmart, an independent nonprofit organization supported by the United Food and Commercial Workers International.

"The retailer's model of low wages and insufficient hours hurts the company's bottom line, leaves shoppers unhappy and dissatisfied and makes it impossible for workers to make ends meet at home," Sparks said. "Understaffing at the stores is contributing to wasted food and dirty shelves in our grocery department, making for an unpleasant experience for our customers."

An Oct. 2 memorandum from Foran to store managers advises the managers to address food stocking and focus on strategies to increase the sale of grocery items. The memorandum, leaked to the public by a store manager, also urges managers to reduce backup inventory to trim costs and warns them not to exceed budgets for their stores, according to The New York Times. The memo also calls for comprehensive markdowns across 32 departments and for stores to find creative ways to merchandise clearance items, the Times article said.

While McMillon and others have acknowledged a need to add more labor hours to improve sales and customer experience, Wal-Mart workers aren't seeing a change in the stores, OUR Walmart said in a statement released after the article was published.

Business on 11/14/2014