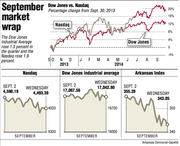

NEW YORK -- A suddenly stormy month on the stock market came to a quiet end Tuesday. Major indexes drifted to a slight loss, leaving the Standard & Poor's 500 down 1.6 percent for September, its third monthly drop this year.

The market spent Tuesday wavering between minor gains and losses, but there were big moves beneath the surface. Crude oil prices plunged, dragging down Chevron and other oil and gas companies.

The Dow Jones industrial average fell 28.32 points, or 0.2 percent, to 17,042.90. The S&P 500 slipped 5.51 points, or 0.3 percent, to 1,972.29. The Nasdaq composite lost 12.46 points, also 0.3 percent, to 4,493.39.

Trading has turned choppy over recent weeks. Lingering concerns over conflicts around the world, corporate profits and the strength of the global economy have all played a role, said Robert Pavlik, chief market strategist at Banyan Partners. Investors are also wary of the fact that some of the market's worst swoons have happened in the months of September and October.

"People are unsure at this time of the year," Pavlik said. "We're heading into October. Like September, it's another typically bad month for the market."

Despite its bad reputation, September has actually been mostly good to investors. Before this year, the S&P 500 turned in a September loss just twice over the past decade: during the financial crisis in 2008 and again after a fight over raising the government's borrowing limit in 2011.

This month looked to be different. The S&P 500, the main benchmark for mutual funds, reached a record high on Sept. 18, supported by news of stronger economic growth in the U.S and reassuring words from Federal Reserve officials about keeping interest rates low. Turbulence hit the following week as investors began questioning whether the stock market was overpriced. Some warned that the market had been calm for too long.

"We're now at a point where we have sharply different opinions in the market," said Jack Ablin, chief investment officer at BMO Private Bank. "It's a tug of war."

Benchmark U.S. crude plunged $3.41, or 3.6 percent, to settle at $91.16. More evidence of plentiful supplies have pushed prices down. Oil has also been dropping as the value of the U.S. dollar rises against other currencies.

Protests continued in Hong Kong where thousands of peopled blocked streets in the business district and surrounding streets. They want the Chinese government to allow open elections for Hong Kong's top office and China wants candidates to be vetted by a panel dominated by supporters of the mainland government.

Hong Kong's Hang Seng Index tumbled 1.3 percent. Tokyo's Nikkei 225 was down as much as 1.5 percent before ending the day with a loss of 0.8 percent. China's Shanghai Composite Index added 0.3 percent.

In Europe, a new batch of economic reports furthered speculation that the European Central Bank might provide more support for the region's economy. The annual inflation rate dropped to 0.3 percent, the weakest rate since October 2009.

Major markets in Europe ended mixed. France's CAC-40 rose 1.3 percent, while Germany's DAX gained 0.5 percent. Britain's FTSE 100 slipped 0.4 percent.

Business on 10/01/2014