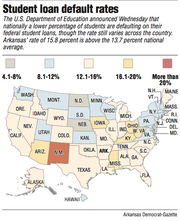

WASHINGTON -- The number of Arkansas students defaulting on their federal student loans dropped from one in four last year to about one in six this year, the U.S. Department of Education announced Wednesday.

At 15.8 percent, Arkansas' default rate is still higher than the national average of 13.7 percent.

Several university officials said Wednesday that Arkansas' drop comes from increased student counseling and new programs that track students for years after they graduate and remind them to pay.

The rates announced Wednesday represent student borrowers who began repaying their federal loans during the fiscal year that began Oct. 1, 2010, and had defaulted by Sept. 30, 2013. The rate includes students at public, private and for-profit institutions.

Most federal loans are considered in default after a person misses payments for 270 days, or about nine months.

Of the 37,355 Arkansas students from 65 schools who began repaying loans in October 2010, 5,922 of them had defaulted by September 2013, according to the U.S. Education Department.

Nationally, more than 4.7 million student borrowers from 5,908 schools began repaying loans in October 2010, and about 650,000 defaulted within three years.

The national default rate this year dropped 1 percentage point from 14.7 percent last year, according to the department.

"While it's good news that the default rate decreased from last year, the number of students who default on their federal student loans is still too high, and we remain committed to working with postsecondary education institutions and borrowers to ensure that student debt is manageable," Secretary of Education Arne Duncan said in a statement.

Defaults affect more than individual students and their credit. The federal government determines which institutions are eligible to receive federal financial aid by calculating how many of their students default on their loans within three years. Institutions with default rates at or above 30 percent can lose the ability for their students to get federal student loans.

The University of Arkansas at Pine Bluff is on that cusp of that rate, interim Vice Chancellor for Finance and Administration Carla Martin said. With 407 defaults from the 1,360 students who began repaying loans in October 2010, the university has a 29.9 percent default rate.

"Even though the students aren't directly tied to us anymore, it still impacts us and has the ability to impact other students," she said. "For three years you are tied to us, and that's a lot of power, whether you know it or not."

The university has hovered near the 30 percent default mark for the past three years and has made lowering the rate a priority, she said.

"This is the closest we've ever been," Martin said. "It is foremost and front and center on our radar."

In August, UAPB enlisted the help of a U.S. Department of Education consultant to work with the university's default management task force to help identify what the university could do to decrease the rate and which students may be more likely to default, she said.

The university doesn't require students to go through financial-aid counseling but is considering it, she said.

"When you know more, you make better decisions," Martin said.

Counseling has made a difference at Crowley's Ridge College in Paragould, Student Financial Services Director David Goff said.

"I personally counsel every student before they take out loans and try to talk them out of it," Goff said.

Last year, the college hired an out-of-state company to track students' whereabouts once they leave and contact them about options if they default.

In October 2010, 53 students began repaying loans and 12 defaulted, giving Crowley's Ridge a 22.6 percent rate this year, according to the Education Department. Two years ago, the rate was at 32 percent, with 17 defaults out of the 53 students who began repaying loans in October 2008.

Arkansas State University in Jonesboro saw a similar drop in its default rate after it participated in a student-tracking program through the Arkansas Student Loan Authority, said Rick Stripling, vice chancellor for student affairs. The loan authority is a state agency that provides student-loan-related services and planning help.

Of the 4,673 ASU students who began repaying loans in October 2010, 686 had defaulted by 2013, giving the university a 14.6 default rate this year. The year before, 18.5 percent, or 649 of the 3,490 students who began repaying loans in October 2009, had defaulted.

Stripling said university officials noticed the default rate increasing about five years ago. He said they want to get the default rate closer to 10 percent.

"We took it serious, and we wanted to so that this would not be a burden to our students once they got out," he said.

Efforts include financial counseling while students are attending the university and quarterly reminders for those who have defaulted.

"It's keeping it on their radar that this is important so that it doesn't become a debt burden that goes way beyond anything else and creates additional problems," he said.

Stripling said the university worked with the Arkansas Student Loan Authority to implement "a very aggressive program of phone calling" students who leave the university and counseling them about their options.

Student Loan Authority Executive Director Tony Williams said six schools have signed up for its default management program: ASU, the University of Arkansas at Batesville, Pulaski Technical College in North Little Rock, National Park Community College in Hot Springs, Arkansas Tech University in Russellville and the University of Arkansas at Monticello.

Williams said that while Arkansas still exceeds the national average for defaults, its rate also is dropping more rapidly.

"Our target is to get below the national average," he said. "We're definitely trending in the right direction."

At the University of Arkansas at Fayetteville, financial-aid counseling begins before enrollment and continues with individual counseling and group presentations that occur repeatedly until students leave, Vice Provost for Enrollment Management Suzanne McCray said.

Of the 3,071 UA-Fayetteville students who began repaying loans in October 2010, 206 of them had defaulted on their loans by September 2013, a default rate of 6.7 percent.

"The state as a whole has struggled a little bit, but I think we've done a really good job," McCray said. "The individual counseling is probably the most helpful. They try to get students to be really smart about what they need to borrow and then really just take that amount."

A section on 09/25/2014