The stock market closed out the first three months of the year Tuesday on a down note, erasing much of the gains from the previous day's big rally.

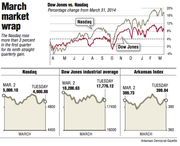

The Dow Jones industrial average fell 200.19 points, or 1.1 percent, to 17,776.12. It's now down 0.3 percent for the year.

The Standard & Poor's 500 index slid 18.35 points, or 0.9 percent, to 2,067.89. The index is now up 0.4 percent for the year. The Nasdaq composite lost 46.56 points, or 0.9 percent, to 4,900.88. The tech-heavy index ended the quarter up 3.5 percent.

The broad decline came as traders seized on the final day of the quarter to do some profit-taking and prune their portfolios. Health care stocks were among the biggest decliners. Oil prices extended their slide.

"It's the end of the quarter," said Anwiti Bahuguna, senior portfolio manager at Columbia Threadneedle Investments. "Today the markets are probably driven by that quite a bit, because people are rebalancing their portfolios."

Traders often look to close out positions to make their books look as healthy as possible at the end of a quarter.

Other factors also contributed to the stepped-up selling on Tuesday.

"There's also rising concern about oil prices, especially as the U.S. gets closer to a deal with Iran," said Paul Christopher, head of international strategy at the Wells Fargo Investment Institute. "There's some speculation that Iran will be able to release a lot of oil into the world."

That could stoke fears of deflation, which can hurt corporate profits, he added.

The price of oil fell Tuesday as talks between the U.S. and Iran progressed, which could lead to more crude on the global market in the coming months.

Benchmark U.S. crude fell $1.08 to close at $47.60 a barrel in New York. Oil finished down $2.16, or 4.3 percent, for the month. Brent crude, a benchmark for international oils used by many U.S. refineries, fell $1.18 to close at $55.11 in London.

The major stock indexes' anemic quarterly performances reflect lowered investor expectations for corporate earnings because of concerns over the effect falling oil prices and a strong dollar may have on big companies.

"It's a pretty weak start for the S&P 500 because the market is pricing the very sharp decline in earnings that has been coming through the entire quarter," Bahuguna said.

Companies will begin reporting financial results for the first three months of the year next week. Earnings for companies in the S&P 500 index are expected to be down 3 percent overall, according to S&P Capital IQ.

U.S. government bond prices rose. The yield on the 10-year Treasury note slipped to 1.92 percent from 1.95 percent late Monday.

In metals trading, gold fell $1.70 to $1,183.10 an ounce, silver fell 8 cents to $16.60 an ounce and copper fell 4 cents to $2.74 a pound.

Synta Pharmaceuticals tumbled 16.7 percent after the biotechnology company priced a public offering of 22 million shares below the previous day's closing price. The stock shed 39 cents to $1.94.

Business on 04/01/2015