WASHINGTON -- The number of people seeking U.S. unemployment benefits dropped significantly last week, a sign of a strong job market despite evidence of tepid economic growth in the opening months of 2015.

Weekly applications for aid fell 20,000 to a seasonally adjusted 268,000, the Labor Department said Thursday. That put joblessness claims near a 15-year low of 267,000 filings in late January. The decrease shows a slowdown in manufacturing and construction has failed to spook employers, who may be anticipating a strong spring rebound after a bleak winter, economists said.

"The claims numbers simply do not support the idea that the first quarter slowdown in growth is indicative of some underlying malaise in the economy," said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

The four-week average, a less volatile measure, tumbled 14,750 to 285,500. Over the past 12 months, the average has fallen 11.7 percent.

Applications are a proxy for layoffs. The relatively low average shows that employers are holding on to workers and may increase hiring. Applications below 300,000 are generally consistent with solid monthly job gains.

Layoffs have stayed close to historic lows, despite a pronounced economic slowdown in recent months.

"One element of the economy that isn't reflecting the weakness seen elsewhere is the job market," said Tom Simons, an economist at Jefferies LLC in in New York. "It indicates consumers will have more purchasing power and thus should be able to increase consumption."

Snowstorms have kept consumers away from stores and open houses. The stronger dollar, which makes U.S. goods more expensive overseas, has hurt U.S. factory exports. Similarly, falling oil prices have cut into the production of pipelines, primary metals and machinery. That has also sliced into the bottom line of manufacturers, even though the savings from cheaper oil should eventually spur more spending by consumers, economists said.

Yet employers continue to hire at a brisk pace.

The government's employment report that is to be released today is expected to show that employers added 248,000 jobs in March, according to FactSet.

That would mark a decrease from 295,000 new jobs in February, but it would still keep the economy on a solid pace to have roughly 3 million new jobs this year.

U.S. factory orders rose 0.2 percent in February, the first increase since July, the Commerce Department reported Thursday.

The climb was a welcome development for manufacturers struggling with disappointing economic growth in major trading partners China, Europe and Japan.

However, the news for February was tempered by a revision in the January figure: Orders fell 0.7 percent, worse than the 0.2 percent drop the government originally reported.

Excluding volatile transportation orders, factory orders rose 0.8 percent, the most since June. Orders for autos and auto parts fell 1.2 percent, and orders for private aircraft and aviation parts dropped 8.8 percent.

Orders for durable goods, meant to last at least three years, fell 1.4 percent. Nondurable-goods orders rose 1.8 percent in February, pulled up by rebounding prices for petroleum products. In another encouraging sign, orders in a category viewed as a proxy for business investment fell 1.1 percent. That was an improvement on the 1.4 percent drop that appeared in a separate, preliminary report last week.

Tim Quinlan, an economist with Wells Fargo Securities, said the "weakness in manufacturing has been overstated by a confluence of one-off factors" including disruptive snowstorms and the shutdown of West Coast ports in a labor dispute. Still, he wasn't particularly impressed with the February numbers.

"I think we're due for a stretch of better reports," Quinlan said. "But today's report wasn't it."

A trade group reported Wednesday that U.S. factories expanded last month but at a weaker pace. The Institute for Supply Management, a trade group of purchasing managers, said its manufacturing index slid to 51.5 in March from 52.9 in February. It was the fifth straight drop. But any reading above 50 signals growth.

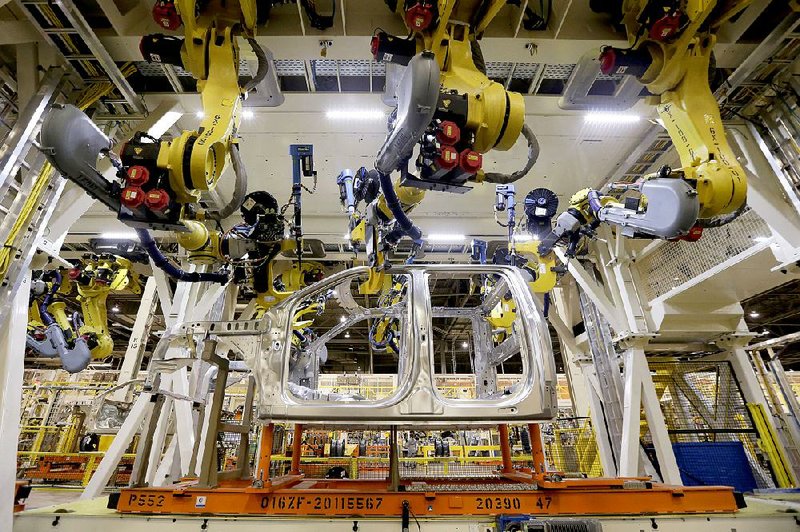

Despite months of dropping orders and slower growth, factories have added jobs for 19 straight months, the longest streak since the mid-1990s. Last year, manufacturers created 215,000 jobs, the most since 1997.

Information for this article was contributed by Josh Boak and Paul Wiseman of The Associated Press and by Shobhana Chandra and Nina Glinski of Bloomberg News.

Business on 04/03/2015