Oil prices have collapsed before -- the 2008 financial crisis is a recent example.

Even so, this time it's different -- and severely so, according to Murphy Oil Corp. Chief Executive Officer Roger Jenkins.

"It's catastrophic compared to the '08 price [collapse]," he said in an interview last week.

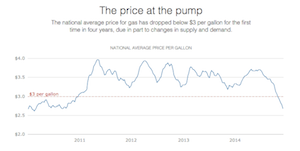

Unrest in the Middle East, slowing economies in Europe and Asia, a stronger U.S. dollar, OPEC production plans, and a possible nuclear deal with Iran have weighed on oil prices that have tumbled more than 50 percent since mid-2014.

And all of this comes during the height of the U.S. shale boom, with energy companies producing record amounts of oil from shale formations and becoming the main contributor to the global oil glut, which has been the primary driver behind the drop in prices.

"All of these factors at once are causing a severe collapse," Jenkins said.

Oil prices started to fall last summer as the global oil market became oversupplied and demand waned.

But prices have started to recover a bit. On Friday, Brent crude rose $1.30 to $57.87 on the ICE Futures Europe Exchange in London, and West Texas Intermediate, the domestic benchmark, gained 85 cents to $51.64 on the New York Mercantile Exchange. But the market remains volatile.

For Jenkins, current prices have been a shock. He didn't think oil would go below $70 a barrel.

"I was surprised at the pullback," Jenkins said. "We are working it the best we can."

Murphy Oil is responding to prices as other energy companies are cutting investments and idling drilling rigs.

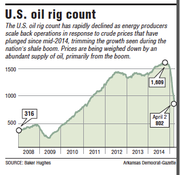

The number of oil drilling rigs operating nationwide has been cut in half since last year. There are only 802 oil rigs operating nationwide this month, according to Baker Hughes, an oil-field services company.

There's a lag between rig activity and well production so U.S. oil production hasn't declined yet.

"While the decline in the U.S. rig count has been faster than we expected, it remains insufficient in our view to balance the U.S. market in 2016," said an analyst report released last week by Goldman Sachs.

"We therefore view the stabilization in the U.S. rig count over the past two weeks as indicative that prices need to stay low for longer to achieve a sufficient and sustainable slowdown in U.S. production growth," the bank said.

Murphy Oil of El D0rado plans to spend $2.3 billion this year, a 33 percent decrease from 2014.

"We are trying to reduce [capital spending] to as much as we can to only commitment level," Jenkins said.

Murphy Oil's cut in spending includes a 46 percent reduction in spending in the Eagle Ford Shale in Texas. This includes reducing the number of rigs operating in the formation from seven to four.

Murphy Oil's total capital spending cuts were modest compared with some other energy companies, analysts said.

What has been more surprising, they said, was the projected 20 percent decline in production in the Eagle Ford Shale.

"That's a pretty drastic decline for a company like Murphy," said Carlos Newall, equity research associate for Raymond James and Associates.

While Murphy Oil is being affected by the decline, it is also being helped by the recent sale of its holdings in Malaysia and the United Kingdom.

"We're a little different from others because we have a very strong balance sheet," Jenkins said.

During the 2014 fourth quarter, Murphy Oil closed on the first phase, about 20 percent, of the $2 billion sale of a 30 percent stake of its Malaysian oil and gas assets.

The company also sold its U.K retail gasoline business during the period and last month found a buyer for its remaining facilities in the United Kingdom, including its closed refinery in Wales.

Analysts had expected Murphy Oil to use the proceeds from the transactions to make some type of acquisition -- either land or another company -- in the Eagle Ford Shale or another formation in North America.

Those plans now have been put on hold, but the company is still watching locations in the U.S. and overseas, Jenkins said.

"We have an ability to add to our portfolio in those places; we're still looking to do that," he said, adding "It's been deterred with this sudden price collapse."

Jenkins said the company is still actively looking at what is "the best thing to do with those proceeds for all of the shareholders."

What makes this price drop different from 2008 -- when prices fell from $150 to $40 a barrel -- is that the current decline is the result of abundant supply rather than declining demand, said Newall, adding that there was a quick price recovery seven years ago.

"Frankly we had it coming with the amount of oil we were producing," he said. "The difference between now and 2008 is this is more drawn out. It's a slow bleed as oppose to a quick punch in the gut."

Industry members and analysts said there is a benefit to the price slump: it is forcing companies to cut costs when they are used to higher operating expenses.

"The general sentiment is that this is good for the industry," Newall said. "It's going to weed out inefficiencies."

Jenkins said that despite the current scale-down in activity, shale areas are going to remain attractive for energy producers. Murphy likely will get more drilling rigs back online if prices reach the mid-$60s again.

Just don't expect companies to rush rigs back when prices rebound, he said.

"I think you'll find the industry a little more cautious," Jenkins said.

SundayMonday Business on 04/13/2015