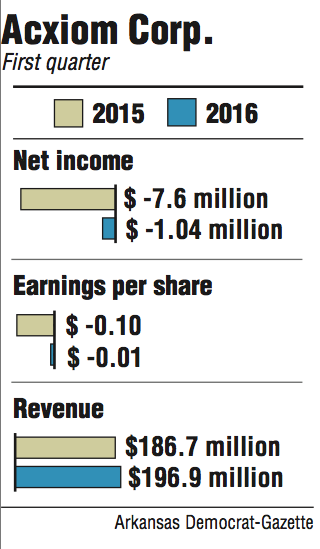

Acxiom Corp. reported a loss of $1.04 million in the first quarter of fiscal 2016, an improvement from the $7.6 million loss the company posted a year ago.

Earnings per share for the Little Rock-based company was a loss of 1 cent, compared with a loss of 10 cents during the same period a year ago. Analysts expected to company to report earnings per share of 5 cents.

"We keep seeing losses on a GAAP [Generally Accepted Accounting Practices] basis because they continue to invest in their new product, LiveRamp," said Brett Huff, an analyst with Stephens Inc. "We expect the losses from that product to abate through the year and through fiscal [2016]."

Acxiom purchased LiveRamp -- a startup tech company -- for $310 million in cash in 2014. LiveRamp is a marketing services company that is expected to help Acxiom collect offline data for marketing applications.

Acxiom said in its earnings release Wednesday that the company added 30 new customers during the first quarter and added 10 new products that allow marketers to convert information to a digital format and distribute data.

The company reported revenue of $196.9 million for the period that ended June 30, up from $186.7 million the company brought in last year.

Acxiom said that during the first quarter, the company "realigned its organizational structure to better reflect its business strategy." Those segments are marketing services, audience solutions and connectivity, according to the release.

"The first quarter was a solid start to fiscal 2016," said Scott Howe, chief executive officer, in a statement.

"Our results this quarter demonstrate the continued strength of Connectivity," he said. "A growing list of customers and synergies from our combination with LiveRamp contributed to dramatically expanding revenue, gross margin and bottom-line performance."

Acxiom shares on Wednesday rose 35 cents, or 2 percent, to close Wednesday at $18.35 on the Nasdaq. The company released its quarterly financial results after the market closed.

The company bought back about 832,000 shares for $15 million during the first quarter.

Acxiom completed the sale of its information-technology infrastructure management operations on July 31 to two private-equity firms, Charlesbank Capital Partners and M/C Partners, the company said.

Acxiom said in May that it would retain a 5 percent interest in the value of the business. Under the deal, the company receives $140 million in cash at the close of the sale and up to $50 million in contingent payments subject to performance requirements that have not been detailed.

A recording of Acxiom's Wednesday afternoon conference call discussion of the quarterly report is available at the investor section at www.acxiom.com.

Business on 08/06/2015