Fueled by rising individual income and sales tax collections, state general revenue in January surged by nearly 10 percent from a year ago.

Last month's general-revenue collections increased by $55.3 million (9.9 percent) compared with January 2014 to $615.8 million, exceeding the state's forecast by $54.6 million (9.7 percent), the state Department of Finance and Administration reported Tuesday in its monthly revenue report.

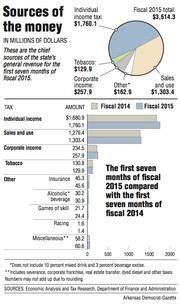

Individual income tax collections in January increased by 11.3 percent from a year ago, and sales-and-use tax collections increased by 8.2 percent. They are the two largest sources of state general revenue.

Gov. Asa Hutchinson said Tuesday that he's "encouraged by the latest revenue report."

"But I would caution that we're only halfway through the fiscal year. It's important that we continue a conservative, responsible approach as we go through the budget process," the Republican from Rogers said in a written statement.

"The more we grow, the better positioned we are to face challenges ahead. My goal is to see further growth as we make job creation and economic development a priority," Hutchinson said.

Earlier in the day, finance department Director Larry Walther said the state had "a very good month" in January, adding that "it's a little out of line with what we have seen over the last six months in fiscal 2015, so we are kind of watching it."

January's general-revenue collections are a record for the month of January, exceeding the previous record of $583 million in January 2013, said department tax analyst Whitney McLaughlin.

John Shelnutt, the state's chief economic forecaster, said the increase in individual income tax collections is partly a result of more people working and more of them working longer hours.

"The employment numbers do look good for the state and they coincide with this, but trying to explain one month like this is difficult," he said. "Compared to forecast, we are surprised."

Tim Leathers, the department's deputy director, said that there is anecdotal evidence that "there are some employees that may have got some large payments [in January], so it could be performance bonuses and that kind of thing."

"Maybe [it's] a sign the economy is picking up," added Leathers.

In addition, Shelnutt said state officials had expected tax revenue to not increase much in January because of income tax cuts that became effective Jan. 1, "so the forecast looks a little low because of that, and there's always some guesswork ... of taxpayer strategy. It could be back to forecast next month."

He said sales taxes remitted by businesses in January from their December sales "was up a lot."

"[But] when you average it with December [sales tax remittances that businesses collected from November sales], it was a moderate result from Christmas shopping," Shelnutt said.

During the first seven months of fiscal 2015, state general revenue has increased by $131.8 million (3.8 percent) compared with same period in the previous fiscal year to $3.61 billion. That exceeds the state's forecast by $79.2 million (2.2 percent).

Tax refunds and some special government expenditures, such as court-mandated desegregation payments, come off the top of gross general revenue, leaving a net amount that state agencies are allowed to spend.

So far in fiscal 2015, the net amount has increased $121 million (4 percent) over the same period in fiscal 2014 to $3.12 billion, which is above the state's forecast by $80.3 million (2.6 percent).

Walther said he doesn't plan at this point to increase the state's general-revenue forecast for fiscal 2015.

"We will be watching it as we move toward the end of the fiscal year, but at this point in time it's just one month that's really jumped out at us, so we'll just see how that tracks in February and March [tax collections]," he said.

The $80.3 million isn't factored into the state's projected surplus of $216 million that lawmakers could decide to spend in this year's regular session, state officials said.

"We are just getting into our refund season, so we'll be watching that as we finish out the [fiscal] year," Leathers said.

Last year, the Republican-controlled Legislature approved a $5 billion general-revenue budget for fiscal 2015 that increased projected spending by $109 million over the previous fiscal year, with most of the increase allocated to public schools, prisons and human services.

That budget anticipates $85 million in general-revenue reductions from tax cuts enacted by the Legislature in 2013 and up to $89 million in savings from the use of federal funds to purchase private health insurance for some low-income Arkansans under the so-called private option Medicaid expansion plan.

According to the finance department, January's general revenue included:

• A $36.2 million (11.3 percent) increase in individual income tax collections from a year ago to $356.2 million, outdistancing the state's forecast by $33.9 million (10.5 percent).

The increase in individual income tax collections includes a $25.7 million increase in individual income tax withholding compared with a year ago to $254.5 million, exceeding the state's forecast by $23.6 million.

According to the latest figures, the unemployment rate in Arkansas fell to 5.7 percent in December -- marking the fourth straight month of declines, the U.S. Bureau of Labor Statistics reported last week.

Arkansas' drop followed the national trend as the U.S. unemployment rate overall fell to 5.6 percent, the bureau reported. Employers in Arkansas added 8,500 jobs in December. While the number of people with jobs in the civilian labor force rose by 9,700 to 1,248,400, the number of unemployed workers fell 1,200 to 75,800.

• A $14.6 million (8.2 percent) increase in sales-and-use tax collections from the year-ago period to $193.2 million, which exceeds the state's forecast by $10.9 million (6 percent).

• A $2.6 million (8.3 percent) increase in corporate income tax collections from a year ago to $33.5 million. That's $7.3 million (27.8 percent) above the state's forecast.

Richard Wilson, assistant director of research for the Bureau of Legislative Research, said the state collected record tax revenue in January, noting that the nation's gross domestic product is expanding, unemployment is down and consumer spending is improving "somewhat boosted by low gasoline prices."