WASHINGTON -- In recent months, the stage seemed set for American consumers to do what they've traditionally done best: spend money -- and drive the economy.

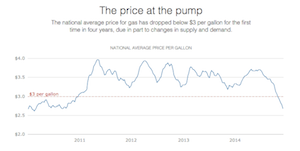

The lowest gas prices in five years had given people more spending money. Employers added more than 1 million jobs from November through January, the best three-month pace in 17 years. Businesses even raised pay in December. Economists had forecast that last week's retail sales report for January would show a healthy rise.

And yet -- to the surprise of analysts -- consumers have held their wallets closely.

Even though Americans spent $6.7 billion less at gas stations in January than they had two months earlier, the extra cash didn't get spent anywhere else: Retail sales, excluding gas, fell slightly from November to January.

The unexpected pullback provided evidence that drivers had used their extra money to further rebuild their savings and reduce their debts -- a trend that began after the financial crisis and recession.

In the long run, deeper savings and shrunken debts benefit individual households -- and, eventually, even the economy as a whole, because they supply fuel for a sustained flow of future spending.

For now, though, the slowdown in consumer spending likely means the economy will grow more slowly in the first quarter of the year than economists had previously envisioned. Their forecast now is for annualized growth of 2.5 percent from January through March, down from an earlier estimate of about 3 percent.

In the meantime, many Americans are finding more money in their pockets. In January, the national average gas price fell to $2.03 a gallon, according to AAA, the lowest since 2009. Though the average has since risen to $2.24, it's still nearly $1.10 cheaper than 12 months ago. As a result, the typical household will have $750 more in hand this year, according to an estimate by the government's Energy Information Administration.

So why aren't Americans spending more?

One key reason: The deep damage to Americans' finances from the recession has continued to leave households more frugal than many economists had expected. Americans have reduced their debt loads but still aren't ready to spend as freely as they did before.

"Even more than five years after the end of the Great Recession, the U.S. consumer is still exhibiting a degree of caution," Michael Feroli, an economist at JPMorgan Chase, said in a note to clients.

Americans saved 4.9 percent of their income in December, up from 4.3 percent in November, according to government data. Feroli estimates that the savings rate rose again last month to 5.3 percent. That would be the highest rate in nearly a year and a half.

In a report released Wednesday, the Labor Department said U.S. wholesale prices fell by a record amount in January, led by the biggest drop in gasoline prices in six years.

The producer price index declined 0.8 percent last month, the biggest drop in a data series that goes back to November 2009 when the government changed the calculation methods for its wholesale price index.

Excluding volatile food and energy costs, wholesale prices edged down 0.1 percent in January after a 0.3 percent rise for core prices in December.

Overall prices fell a revised 0.2 percent in December and were also down 0.2 percent in November. The string of declines reflects tumbling energy costs.

The 0.8 percent drop in overall wholesale prices was bigger than the 0.5 percent decline that many economists had been expecting. Much of the decrease reflected a record drop in energy costs. However, food costs also showed a sizable drop.

Economists said they expected further declines in prices in coming months as falling energy prices work through the economy.

"Inflation pressures remain muted," said Jennifer Lee, senior economist at BMO Capital Markets.

Over the past 12 months, the government's producer price index, which measures inflation before it reaches the consumer, was unchanged while core wholesale prices were up 1.6 percent.

For all of 2014, wholesale prices rose a moderate 1.1 percent, slightly below the 1.2 percent increase seen in 2013.

U.S. homebuilders slowed the pace of construction in January, breaking ground on fewer single-family houses ahead of the spring buying season.

Housing starts slipped 2 percent to a seasonally adjusted annual rate of 1.07 million last month, down from 1.09 million in December, the Commerce Department said Wednesday.

Leading that decline was a sharp 6.7 percent monthly drop in starts for single-family houses. Still, a healing economy has caused building activity to move at a faster clip, with single-family starts climbing 18.7 percent over the past 12 months.

Despite the monthly decline, the broader economy should help home sales and apartment construction this year.

"We have strong job growth, strong consumer confidence, still low borrowing costs," Lee said.

U.S. factory production edged up last month as manufacturers cranked out more computers, clothing, steel and other metals, offsetting declines in autos and aerospace.

Factory production increased 0.2 percent in January after a flat reading in December, the Federal Reserve said Wednesday. December's reading was revised down from a 0.3 percent gain. The data suggest manufacturing is still supporting the economy, even though it is growing at a weaker pace than last year.

Information for this article was contributed by Christopher S. Rugaber, Martin Crutsinger and Josh Boak of The Associated Press.

Business on 02/19/2015