Wal-Mart Stores Inc. reported increased profit in the fourth quarter and stores in the United States saw a bump in foot traffic for the first time in more than two years as the retailer showed signs of improvement to close out Doug McMillon's first year as chief executive officer.

Same-store sales improved 1.2 percent, the second consecutive quarter of growth, as Wal-Mart reported earnings per share of $1.53, just missing analyst estimates of $1.54. Foot traffic in U.S. stores was up 1.4 percent in the fourth quarter of fiscal 2015, the first time that metric saw an increase since the third quarter of 2013.

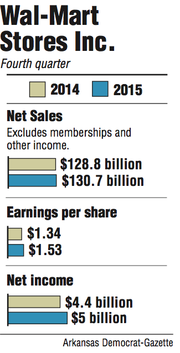

Wal-Mart reported net sales of $130.7 billion for the quarter, an increase of 1.4 percent compared with $128.8 billion for the same period in 2014. Earnings totaled $5 billion for the fourth quarter, up from $4.4 billion a year ago.

Christmas shopping and lower gas prices helped the company improve its performance in Wal-Mart U.S. Executives pointed to initiatives designed to make the customer experience better as a driver of sales in the fourth quarter and said some of those will continue during its current fiscal year.

"There is a lot to be encouraged by, but we're not satisfied," McMillon said. "We've got work to do."

Wal-Mart reported total sales of $485.7 billion for the year, up 2 percent from 2014.

Before releasing its fourth-quarter and year-end earnings, the company announced it would spend more than $1 billion this year to increase pay and provide additional training for its workers. About 500,000 people -- 40 percent of the company's U.S. workforce -- will be affected by a pay-raise effort that will increase starting pay to at least $9 per hour in April and again to $10 per hour by February 2016.

Analysts shared McMillon's cautious optimism about the company's improvement.

Edward Jones retail analyst Brian Yarbrough said the numbers for the final three months of the year were positive, but cautioned against reading too much into a single quarter. Building on the momentum is critical for Wal-Mart to keep investors confident in the company's direction.

"This was one quarter; one quarter does not make a trend," Yarbrough said. "While they've been making headway, they need some sustained, positive same-store sales growth. This is a start. If they can sustain it remains to be seen."

Wal-Mart U.S. reported total sales of $79.5 billion, a growth of 4.1 percent in the fourth quarter. Sam's Club sales increased 1.3 percent to $14.9 billion for the 13-week period, compared with $14.7 billion a year ago.

Neighborhood Markets continued to outperform supercenters and other formats during the fourth quarter. Comparable-store sales increased 7.7 percent for the market format, compared with 2.0 percent for Sam's Club and 1.5 percent overall for U.S. stores.

"Core business is still tough, while smaller formats seem to be doing well," said Randy Koontz, first vice president of investments for Pinnacle Wealth Management of Raymond James & Associates Inc. in Rogers.

Sales and operating income improved each consecutive quarter for Wal-Mart U.S., the largest division of the retailer. Wal-Mart U.S. CEO Greg Foran said his division turned in its best same-store sales comparison in two years, and the traffic increase was up for the first time in nine quarters.

"There is no shortage of room for improvement," Foran said.

International sales grew 3.9 percent to $36.2 billion. Mexico, Canada and Brazil delivered positive comparable-store sales for the fourth quarter, though same-store sales comparison declined in the United Kingdom and China because of what the company described as "food deflation and intense competition in the U.K., and government austerity measures and deflation in key categories in China."

E-commerce sales were up 22 percent for Wal-Mart. McMillon described the online sales increase as "solid, but not quite as strong as we wanted."

Overall McMillon said he was pleased with the way in which Wal-Mart began implementing changes and continued working to blend its 11,000 stores with a growing e-commerce business. Change will continue, he said.

"We've made a lot of progress on bringing strategic clarity and in reinvigorating our commitment to run better businesses today," McMillon said during a prerecorded call for investors. "Retail is changing so quickly that we must move with greater urgency to stay out in front."

Wal-Mart also issued guidance for the first quarter of fiscal 2016, setting earnings per share between between $0.95 and $1.10. That compares with $1.10 the company reported for the first quarter of last year. Yearly earnings per share were projected between $4.70 and $5.05.

Same-store sales are expected to see increases between 1 percent and 2 percent.

"I think Wal-Mart is now making a habit of guiding conservatively," said Brian Gilmartin, asset manager of Chicago's Trinity Asset Management. "The street calls it UPOD -- under-promise, overdrive."

Business on 02/20/2015