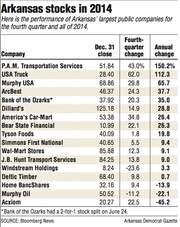

For the second year in a row, trucking companies posted the best returns for investors among Arkansas-based companies.

RELATED ARTICLES

http://www.arkansas…">'14 adds to stocks' six-year upswinghttp://www.arkansas…">Oil price drops 46% in '14 to wrap up at a 5-year low

Shares of P.A.M. Transportation Services, based in Tontitown, jumped 150.2 percent in 2014.

P.A.M. benefited from a combination of strong demand, declining fuel prices and a 5 percent increase in revenue, said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

"Management's focus remains on specific company segments such as the dedicated, automotive and expedited services divisions that have been identified as having the greatest potential for future growth," Williams said.

P.A.M.'s return in 2014 came on top of its stock doubling in 2013. P.A.M.'s stock is up 407 percent over the past two years, or more than five times its price at the close of 2012.

A $1,000 investment in P.A.M. at the close of 2013 would have been worth more than $2,500 at market close Wednesday. The shares rose $2.33 to close Wednesday at $51.84.

Van Buren-based USA Truck's stock rose 112.3 percent in 2014.

Focusing on controlling expenses helped USA Truck, Williams said.

"A 10.5 percent increase in fuel efficiency and an $11 million debt reduction are indicative of a successful management team focused on improving their balance sheet," Williams said.

USA Truck's year was combined with the best stock performance in the state in 2013, a gain of 288 percent. USA Truck's stock price is more than eight times higher than its 2012 close.

Another transportation firm, Fort Smith-based ArcBest, had the fourth-best stock return in 2014. It rose almost 38 percent to go with a return of more than 250 percent in 2013.

All but three of the Arkansas Index stocks posted gains in 2014. Nine of the 17 stocks had better than a 19 percent return in 2014.

The increase in the value of Arkansas stocks reflects the growth of the major national stock indexes. In 2014, the Dow Jones industrial average gained about 7.5 percent, the Standard & Poor's 500 rose 11.4 percent, and the Nasdaq exchange was up 13.4 percent.

The stocks of Arkansas-based publicly traded banks were affected by acquisitions in 2014, said Matt Olney, a banking analyst for Stephens Inc. in Little Rock.

Little Rock-based Bank of the Ozarks' stock had a 35 percent return in 2014, when it announced two of the largest acquisitions in its history -- Summit Bank of Arkadelphia with $1.2 billion in assets and Intervest Bancshares of New York with $1.6 billion in assets, Olney said.

"Bank of the Ozarks had a great year," Olney said. "If you combine those two deals with really good loan growth, that was a recipe for a good performance in 2014."

Home BancShares of Conway lost almost 14 percent for the year. It was difficult to build on its return of 2013, when the stock more than doubled and it announced the purchase of Liberty Bancshares of Jonesboro, with almost $3 billion in assets, Olney said.

"This year they announced a handful of smaller acquisitions," Olney said. "I think the market was looking for a few more transactions or some larger transactions."

The stock of Simmons First National of Pine Bluff rose 9.4 percent in 2014. Simmons announced the purchase of Metropolitan National Bank of Little Rock in 2013. It bought Delta Trust & Bank of Little Rock in 2014 and later announced the purchase of Community First Bancshares of Union City, Tenn., with $1.9 billion in assets, and Liberty Bancshares of Springfield, Mo., with $1.1 billion in assets, though the last two deals won't close until later this year.

"I don't think [Simmons] is getting full credit for those last two transactions that haven't closed," Olney said.

The worst-performing Arkansas stock last year was Acxiom Corp., based in Little Rock, which lost about 45 percent of its value in 2014.

Acxiom reorganized its business operations, which resulted in an operating loss for the firm, Williams said.

But Acxiom officials apparently felt their shares were undervalued, as they announced the extension of a corporate stock buyback program, Williams said.

Acxiom would have been the worst investment of the Arkansas Index stocks over the year. A $1,000 investment in Acxiom at the end of 2013 would be valued at about $550 at Wednesday's close. The shares fell 27 cents to close Wednesday at $20.27.

Murphy Oil's stock price fell about 22 percent in 2014, the second-worst performance of the major Arkansas companies.

Falling oil prices have hurt Murphy Oil more than many industry participants, Williams said.

"Also, after more than four years and two failed deals to sell a refinery in Wales, Murphy Oil threw in the towel and simply closed the plant," Williams said. "Additionally, the company sold off assets in Malaysia."

Business on 01/01/2015