Senate President Pro Tempore Jonathan Dismang, R-Searcy, on Wednesday unveiled details of his bill to enact Gov. Asa Hutchinson's $100 million income tax cut.

RELATED ARTICLES

http://www.arkansas…">Governor sets rule-making, hiring processhttp://www.arkansas…">Legislative summaryhttp://www.arkansas…">Calendar

Dismang filed an amendment to his Senate Bill 6 on Wednesday, adding the tax-cut language.

The governor's office said Hutchinson's proposed income tax cut would reduce state general revenue by $33.7 million rather than $50 million in fiscal 2016 by delaying parts of Act 1459 of 2013, which cuts state income tax rates by 0.1 percentage point. The tax plan also would reduce state general revenue by $102.1 million in fiscal 2017.

Rep. Charlie Collins, R-Fayetteville, who sponsored Act 1459 of 2013, has said he's open to discussing delaying parts of his income tax rate cuts.

Asked whether he supports the bill, Collins said he wants to see the tax lowered.

"I definitely support the governor's goal of giving $100 million in income tax reduction to the middle class," he said.

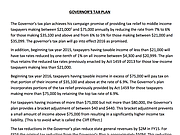

Hutchinson's office said in a news release that Dismang's amendment would achieve the governor's campaign promise of providing relief to taxpayers making between $21,000 and $75,000 a year by reducing the income tax rate from 7 percent to 6 percent for those making between $35,100 and $75,000 and from 6 percent to 5 percent for those making between $21,000 and $35,099.

The rate would affect money earned after Jan. 1, 2016.

In addition, taxpayers having taxable income less than $21,000 a year will have income tax rates reduced by 0.1 percentage point on all income between $4,300 and $20,999, starting this year, to keep the reduced tax rates enacted under Act 1459 of 2013 for these low-income taxpayers, the governor's office said.

Taxpayers having taxable income in excess of $75,000 will pay tax on that portion of their income of $35,100 and above at the rate of 6.9 percent, the governor's office said.

Hutchinson predicts the tax cuts will be popular.

"I think there is tremendous support for it among the people of Arkansas," Hutchinson told reporters. "That's what they voted for me to do and what we intend to accomplish."

Hutchinson said he will talk more today about his proposed income tax "in terms of some of the nuances and the entire budget aspects of it."

He's said about 500,000 Arkansans would benefit from the tax cut.

Dismang said he hopes to have the Senate Revenue and Taxation Committee approve the tax cut as early as next week "and quick passage here in the Senate and send it over to the House and the same thing happening over there."

Passage of the legislation "will change our [state general revenue] forecast and we'll set the [state budget through the Revenue Stabilization Act] accordingly," Dismang said.

Hutchinson has said he would like for lawmakers to approve the tax cut after he unveils his proposed budget for fiscal 2016 later this month.

Asked whether the Senate Revenue and Taxation Committee will approve the proposed tax cut before then, Dismang said he'll check with Hutchinson.

Asked whether he would hold off on a vote on the proposed tax cut until a budget is proposed by Hutchinson, Dismang said "we'll talk to the administration, but ... our plan at this point is to move forward."

House Speaker Jeremy Gillam, R-Judsonia, said that "when we get the bill, we'll start dealing with it appropriately at that time."

"At this time right now, I do expect strong support for the concept. The members are probably just now getting a chance to read the language, so we'll just have to wait and see how that goes," he said.

House Democratic leader Eddie Armstrong of North Little Rock said House Democrats are on board with Hutchinson's tax cut, though he said the governor's plans gave "room for pause but not concern."

"His tax policy plan being presented first, I'm sure it'll raise questions from our members on [ the Revenue and Taxation Committee] to discuss," Armstrong said. "A tax policy plan was talked about, and a balanced budget, before we can talk about how [much] it might cost as it relates to prison reform or education."

Hutchinson has said that education will be fully funded in his budget plan and he wants to make the parole system more effective through various changes.

In other legislative business, the Senate sent to the governor House Bill 1001 by Gillam to appropriate $2.1 million for House employees' salaries and benefits, and for maintenance, operations and expenses.

The House's new chief of staff, former state Rep. Robert Dale, R-Dover, is being paid an annual salary of $115,644, according to House records. Former House Chief of Staff Gabe Holmstrom had an annual salary of $133,824.

The House also has hired Katherine Vasilos, a former employee for the Noble Strategies lobbying firm and a former spokesman for the state Republican Party, to a new position called director of operations and special projects. Her salary is $98,000 a year.

The House sent to the governor SB1 by Sen. Linda Chesterfield, D-Little Rock, to appropriate $650,000 for mileage allowances, per diem and maintenance expenses, and general operations and other expenses; $625,000 for salaries of Senate employees; and $75,000 for their benefits.

The House also approved HB1023 to grant a 1 percent cost-of-living raise to increase 25 prosecuting attorneys' salaries from $123,162 to $124,394 a year.

Information for this article was contributed by Spencer Willems of the Arkansas Democrat-Gazette.

A section on 01/15/2015