Gov. Asa Hutchinson pitched his $100 million income-tax-cut plan to several hundred city officials Thursday, saying it would improve the economy in the state, and he promised to release his proposed fiscal 2016 budget next week.

RELATED ARTICLES

http://www.arkansas…">Insurance queries take Hutchinson, 4 to D.C.http://www.arkansas…">Legislative summary

Also Thursday, Senate President Pro Tempore Jonathan Dismang, R-Searcy, said he would ask the Senate Revenue and Taxation Committee to approve on Wednesday his bill on Hutchinson's tax cut.

And House Revenue and Taxation Committee Chairman Joe Jett, D-Success, advised his fellow committee members to start studying the tax-cut bill and "be ready to roll" to vote on it soon.

Lawmakers are taking off the next four days and are to return to Little Rock for meetings Tuesday.

Speaking at the Arkansas Municipal League winter conference luncheon, Hutchinson said his proposed income tax cut would mean that a person making $75,000 annually would save about $540 a year.

"That's enough for a better Christmas. That's enough to spend money for a new set of tires. That is helping to drive your economy forward in your city and in your small businesses," the Republican from Rogers told city officials from across the state.

In addition, "you will have a competitive environment in Arkansas in terms of our income tax structure, and that's what we are trying to accomplish. It is not everything. It is a start, and hopefully we will expand it to other income groups," Hutchinson said.

The state's maximum income tax rate is 7 percent, which is higher than all of the surrounding states, and "we stick out as an island of high taxation when it comes to the income tax in Arkansas," he said.

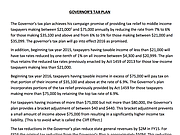

Senate Bill 6 by Dismang would reduce the income tax rate from 7 percent to 6 percent for those making between $35,100 and $75,000, and from 6 percent to 5 percent for those making between $21,000 and $35,099, starting next year.

Under the bill, Arkansans making more than $75,000 would pay a 7 percent rate in 2015 on that portion of their income above $35,100; the rate would fall to 6.9 percent in 2016. Under current law, the rate is to drop to 6.9 percent this year.

Hutchinson said lawmakers are appropriately asking how state government can afford his tax cut, which would reduce state general revenue by $33.7 million in fiscal 2016 and $102 million in fiscal 2017.

He said his income tax plan will be funded through growth in general revenue, and he'll present more details in the proposed fiscal 2016 budget that he'll give to lawmakers next week.

Former Gov. Mike Beebe had earlier recommended that lawmakers delay the implementation of two previously approved tax cuts projected to reduce revenue by $29.4 million in fiscal 2016 and $24.5 million in fiscal 2017. Those cuts would reduce the sales tax on natural gas and electricity used by manufacturers, lower income taxes on capital gains and increase the standard personal income tax deduction.

Hutchinson declined Thursday to detail what he would do in regard to Beebe's recommendations.

Beebe "put those out there. They are thoughtful considerations. We are not going to delay all of those, but we are certainly going to look at those just as we did the 2013 income tax cut, so just wait for our balanced budget we present next week and you'll see exactly what we are going to do in reference to the rest of them," he said.

Sen. Joyce Elliott, D-Little Rock, said she is looking at how the proposed tax cut fits in the state's budget.

"That's really crucial and important to me to know what the impact is going to do and what other needs that we have in the state that might not be funded because of a tax cut," she said. "Like anybody, who is against a tax break? But I think that's weighed against whether we fund many other things like pre-K, what we do about health care, what we do about higher ed and highways and people with disabilities. ... I just have an open mind at this point."

Jett told tax committee members that the committee could consider Hutchinson's income tax cut proposal as soon as Thursday.

"When [House Speaker Jeremy Gillam, R-Judsonia] tells us he's comfortable [with SB6], then I want this committee to be comfortable, so I would ask the tax committee to pull Senate Bill 6 up and start doing your due diligence on it ... and be ready to roll on that when we get this."

Jett said the House tax committee will consider other tax-cut bills toward the end of the legislative session.

"We'll have Rep. Lane Jean [R-Magnolia and co-chairman of the Joint Budget Committee] and his group work through the budget, and we are going to let the smoke settle and dust clear, and if somebody wants to run their tax-cut bill we will hear it, but the chairs will not recognize a motion from any committee members, or we will table it," until the end of the session, he said.

"That's kind of the bottom line. It kind of sounds harsh, but we want to do this thing in a responsible manner and not have a lot of tax cuts and get tied up with the Senate side, and the Senate has promised me that they are going to do the same thing," Jett said.

Earlier, Sen. Larry Teague, D-Nashville, told the Joint Budget Committee, which he co-chairs, that he would rather the committee delay voting on bills appropriating money for state boards and commissions that raise their own money and fund their own operations, until Hutchinson proposes his general revenue budget for fiscal 2016.

But, the committee recommended approval of a few dozen of those appropriating bills.

"I mostly was standing on principle," Teague explained later. "I don't like running budget bills until we have the [governor's proposed] budget. Cash-fund agencies won't matter in the great scheme of things because they raise their own revenue and fund their own operations, but I just thought I would stand on the principle. We need a budget before we do [tax cuts]."

In other action, the Senate voted 34-0 to send to the governor HB1023 to give 1 percent cost-of-living raises to the state's 28 prosecuting attorneys.

Metro on 01/16/2015