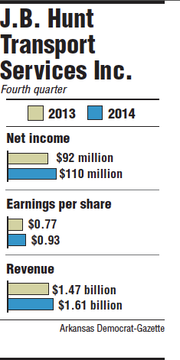

J.B. Hunt Transport Services Inc. reported net earnings of $110 million in the fourth quarter, a 19 percent increase from a year ago.

Earnings per share for the trucking and transportation company were at 93 cents, beating analyst estimates by 4 cents and increasing from 77 cents in 2013. Analysts that cover J.B. Hunt were projecting 89 cents per share.

Revenue of $1.61 billion also represented an increase for the Lowell-based company. In 2013, J.B. Hunt reported $1.47 billion in fourth-quarter revenue.

J.B. Hunt also reported results for the full year, showing 10 percent increases in both revenue and operating income. Revenue for the year was $6.2 billion and income was $631.5 million with earnings per share of $3.16, up from $2.87 in 2013.

"Results were strong," Stephens Inc. analyst Brad Delco said. "The demand environment remains strong, which is driving pricing higher."

J.B. Hunt's brokerage division, called integrated capacity solutions, was the largest gainer, reporting a 36 percent jump in revenue and an income increase of 158 percent compared with 2013. The division reported revenue of $197 million and income of $9.1 million.

A 25 percent increase in load volume helped the company to increase its year-over-year revenue. Increases came from a mix of contractual and per-transaction business.

In addition to rate increases, the company pointed to "margin discipline in the transnational business" as key to the additional profit. Those increases came despite additional personnel costs and a 16 percent increase in total employees within the segment. J.B. Hunt was operating with five additional branches compared with the final quarter of 2013.

Revenue was up 5 percent in intermodal, growing to $958 million. Income grew 6 percent to $128.8 million despite the segment continuing to face challenges from limited capacity and rail service concerns.

J.B. Hunt's dedicated contract services division reported a 25 percent increase in operating income to $37 million. Revenue improved 10 percent to $363 million through a combination of rate increases, better use of equipment and higher customer demand.

The dedicated fleet had an additional 473 trucks compared with the final quarter of 2013. J.B. Hunt said the increase was due primarily to "new contract implementations."

For the fourth quarter, J.B. Hunt saw growth in its trucking division, reporting income of $8.1 million. A year ago the division lost $1 million.

Revenue for J.B. Hunt trucking was up 6 percent to $96 million. The company increased its trucking fleet size by 2 percent and said it made gains in profit and revenue through "increased asset utilization, intentional freight mix change and core customer rate increases of approximately 9.0 percent compared to fourth quarter 2013."

"Favorable changes from increased rates per loaded mile, rapidly declining fuel prices and higher utilization of company owned assets were partially offset by increased driver and independent contract costs per mile, increased hiring costs and higher safety and insurance costs compared to fourth quarter 2013," the company said in a news release.

Total capital expenditures for 2014 were $660 million, up from $443 million in 2013. Much of the increase came from equipment costs, including new trucks and trailers and intermodal containers.

Shares of J.B. Hunt stock ended Thursday trading at $84.23, up $2.19, or nearly 3 percent, in trading on the Nasdaq.

Business on 01/23/2015