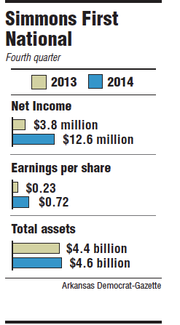

Simmons First National Corp. had net income of $12.6 million in the fourth quarter last year, more than triple the $3.8 million it earned in the same period of 2013, the Pine Bluff bank said Thursday.

The bank earned 72 cents per share for the quarter, up from 23 cents in the fourth quarter of 2013.

Simmons had 64 cents of core earnings per share, just missing the projection of analysts covering the bank who expected it to make 65 cents of core earnings per share. The core earnings excluded about $1.3 million in after-tax earnings, the bank said.

Simmons was hit hard by merger-related costs in the fourth quarter of 2013. Without the costs of the purchase of Metropolitan National Bank in the last quarter of 2013, Simmons would have earned $7.7 million instead of $3.8 million.

Shares of Simmons rose $2.15, or 5.8 percent, to close Thursday $39.42 in trading on the Nasdaq exchange.

For the year, Simmons earned $35.7 million, up from $23.2 million in 2013.

Simmons had $4.6 billion in total assets at the end of 2014, up from $4.4 billion at the close of 2013.

Two large acquisitions announced by Simmons in May have not closed -- Community First Bancshares of Union City, Tenn., with $1.9 billion in assets, and Liberty Bancshares of Springfield, Mo., with $1.1 billion in assets.

Shareholders on all sides have approved both purchases, said Matt Olney, a banking analyst with Stephens Inc. Simmons just needs Federal Reserve approval.

"The longer it lasts [to close the banks], it's not good for forecasts or for the stocks," Olney said. "It's a near-term concern but doesn't change the long-term earnings power of the company."

The bank has gotten no firm timeline from regulators on a decision about the deals, said George Makris, chairman and chief executive officer of Simmons. The applications are being processed, the Federal Reserve has told the bank, Makris said.

"We have not received any request for information that we believe would have any negative impact on the Fed's approval," Makris said. "We assume they are going to be approved unconditionally. All our indications are that there are no issues, but it has just taken longer than we anticipated."

If the two deals are approved by the end of March, Simmons still would have time to convert the banks to Simmons' systems on schedule -- April 24 for Liberty Bancshares and Labor Day weekend for Community First, Makris said.

When the two deals close, Simmons will have about $7.6 billion in assets, making it the second-largest bank in the state behind Arvest Bank, which has almost $15 billion in assets.

Home BancShares of Conway, which owns Centennial Bank, has $7.4 billion in assets. Little Rock-based Bank of the Ozarks has $6.8 billion in assets.

Simmons is continuing to pursue acquisitions, Olney said.

"I think they want to get [the Missouri and Tennessee banks] closed," said Olney, who owns no stock in Simmons. "Once they get these closed, I think there are more out there they are talking to."

Olney anticipates Simmons will make another acquisition this year.

"Their [coverage area] is a lot bigger than it used to be," Olney said. "In-market deals now include Missouri and Tennessee. There's probably a lot of opportunity in Arkansas and outside of Arkansas."

Simmons has branches in Arkansas, Kansas and Missouri.

Business on 01/23/2015