VAN BUREN -- Members of the Crawford County Quorum Court voted Monday to ask voters to continue a 1 percent countywide sales tax for eight years.

According to an ordinance and a resolution passed during a special meeting Monday, voters will be called to the polls May 12 to decide whether to extend the tax expiration date from Sept. 30, 2015, to Sept. 30, 2023. The tax went into effect in 2007.

Twelve of the 13 Quorum Court members voted to pass both measures. Quorum Court member David Rofkahr was absent.

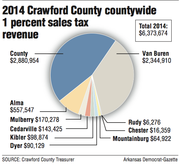

Last year, the tax generated almost $6.4 million, according to county treasurer figures. County Judge John Hall said 55 percent of the tax money collected was distributed to nine cities in the county, according to population.

Van Buren, the most populous city in Crawford County, received more than $2.3 million last year. The smallest, Rudy, got $6,276, according to the county's figures.

County government received more than $2.8 million from the tax last year based on the population in the county's unincorporated area.

The tax "is the lifeblood for county government," Hall said.

If residents vote to continue the tax, 45 percent of the county's share of the proceeds will continue to go to the county road department, 40 percent to public safety and 15 percent for general county operations.

The road department's tax share is spent on materials and supplies, such as gravel and fuel, to improve and repair the 1,100 miles of county roads, Hall said.

The public-safety share is divided among the Crawford County sheriff's office, the Department of Emergency Management, the coroner's office, county juvenile officers and the county's rural fire departments, Sheriff Ron Brown said.

He said if voters rejected the tax, it would not affect funding for the jail because he is required by law to adequately fund it. But he would have to draw money from other uses in the department to fund the jail.

The problem would possibly be compounded by the loss of tax funds by cities in the county, which could force them to reduce their own services, such as police staff, and increase the sheriff's office's workload, he said.

The general county operations revenue keeps the doors of the courthouse open and provides funding for county offices, Hall said.

Cities can use their shares of the tax for whatever they want, Hall said.

Mulberry Mayor Gary Baxter encouraged voters to approve continuation of the tax because the services it pays for directly benefit the public.

County figures show Mulberry received $170,278 from the countywide sales tax last year.

"That's a lot of money for a small community like Mulberry," he said.

He said the loss of the tax money could mean the loss of a police officer or the inability to purchase a new firetruck.

Mulberry spends 65 percent of its share of the tax for general city needs and 35 percent on streets, Baxter said.

Loss of the tax would have effects throughout the county. Hall said the Quorum Court, in trying to balance the general budget, had to use the $165,000 in-lieu-of-tax payment the county gets from the U.S. Forest Service that was to be used for county roads. The county would have a harder time balancing the budget if it lost the sales tax revenue, he said.

County election commission Chairman Bruce Coleman said the special election could cost the county as much as $50,000.

Hall announced that Quorum Court member Cathy Gifford and Rusty Myers, who is retired from the Western Arkansas Planning Development District, will head the election education campaign committee.

Metro on 01/28/2015