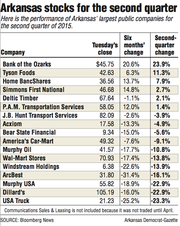

The stock of Little Rock-based Bank of the Ozarks had the best second-quarter performance among the largest publicly traded companies in Arkansas, rising 23.9 percent over the past three months.

That was more than double the return of the No. 2 stock, Tyson Foods, which gained 11.3 percent in the quarter.

There are a couple of reasons Bank of the Ozarks has done so well, said Matt Olney, a banking analyst in Little Rock with Stephens Inc.

First, Bank of the Ozarks announced good first-quarter results in April, beating analysts' expectations, Olney said.

Secondly, Bank of the Ozarks announced the acquisition in May of the Bank of the Carolinas, he said.

"It was a nice transaction, albeit a smaller size," Olney said.

Bank of the Carolinas has $363 million in assets. Bank of the Ozarks agreed to pay almost $65 million in stock and cash for the bank, based in Mocksville, N.C., which was equivalent to about 14 cents a share, according to a filing by the Little Rock bank.

Before Bank of the Carolinas, Bank of the Ozarks last year acquired Intervest Bancshares in New York, which had $1.6 billion in assets, and Summit Bank of Arkadelphia, with about $1.2 billion in assets.

Bank of the Ozarks' stock steadily improved over the quarter, hitting a 52-week high at least eight times in May. It declined about 5 percent in the past week when several investment firms lowered their ratings on the bank.

Home BancShares of Conway had the third-best performance in the second quarter.

"You also saw improving investor sentiment toward banks overall," Olney said. "If you look at the bank index, I think you'd see it outperformed other industries in the second quarter."

Higher interest rates help banks more than other industries, Olney said.

"I think as we get closer to the increase in short-term rates by the [Federal Reserve], I think that bodes well for the banks," Olney said.

In recent years, relatively large banks that have focused on acquisitions also have benefited from increased regulation in the banking industry, said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

The regulatory burden placed on small community banks from the Dodd-Frank Act was immense and has forced consolidation in the industry, Williams said.

"The management of both Bank of the Ozarks and Home BancShares have been able to identify and negotiate purchases that have rapidly and positively impacted their bottom lines," Williams said.

For the first six months of the year, Bank of the Ozarks, Simmons First National and Home BancShares had the three best performances among Arkansas-based public companies.

Bank of the Ozarks was up 20.6 percent for the first half of the year, followed by Simmons, up 14.8 percent, and Home BancShares, up 13.7 percent.

USA Truck, Murphy USA and Dillard's Inc. had the worst performances of the second quarter. USA Truck fell 23.3 percent and Dillard's and Murphy USA both lost 22.9 percent.

Despite a revenue decline by USA Truck for the first quarter, the company posted positive earnings results, Williams said.

The firm lost its chief executive officer to illness but was successful in undertaking a secondary share offering on behalf of selling shareholders Baker Street Capital Management and Stone House Capital Management in May, Williams said.

Knight Transportation also cut its ownership in USA Truck to 6.8 percent during the second quarter, Williams said.

Dillard's stock price has tumbled since topping out at $144.21 in April.

Analysts have generally soured on retail mall anchors such as Dillard's, Williams said, because of concerns about continued softness in consumer discretionary spending.

"While there has been some talk the firm could unlock value and boost its share price by shifting real estate assets into a real estate investment trust, some believe that could be detrimental to the operating company over the long term," Williams said.

Business on 07/01/2015