The Arkansas Insurance Department dissolved one division and created another one Wednesday as responsibility for helping govern Arkansas' federally run health insurance exchanges shifted this week to a nonprofit organization created by the state Legislature.

The changes are part of a plan to establish state-run exchanges that will replace the ones set up by the federal government under a partnership with the state.

Referring to the shift of responsibilities from the Insurance Department's Health Connector Division to the Arkansas Health Insurance Marketplace, Insurance Commissioner Allen Kerr told the Legislature's Insurance and Commerce committees, "We have bequeathed that unit to them very happily."

Under the 2010 Patient Protection and Affordable Care Act, health insurance exchanges allow consumers to shop for coverage and apply for subsidies to help pay for it.

Sixteen states and the District of Columbia have set up their own exchanges, including some that rely on federally run enrollment systems.

Arkansas is among 34 states that are considered to have federal exchanges. That includes seven states that, like Arkansas, help with some exchange functions under a partnership with the federal government.

Act 1500, passed by the Legislature in 2013, created the Arkansas Health Insurance Marketplace and authorized it to take over responsibility for the states' insurance exchanges Wednesday.

Enrollment in an Arkansas marketplace-run exchange for small businesses is expected to begin Nov. 1 for coverage that will start Dec. 1.

Sign-ups in a state-run exchange for individual consumers are expected to start in 2016 for coverage that will start in 2017.

The marketplace is setting up the exchanges with money from a $99.9 million federal grant.

Kerr told legislators that establishing state-run exchanges will allow the state to "fight for the maximum amount of flexibility from the federal government" as a legislative task force explores changes to the state's Medicaid program and will "ensure our state's Insurance Department remains the chief regulator" of health insurance in the state.

Created by the Legislature this year, the Health Reform Legislative Task Force is expected to recommend a program that will replace the private option, which uses Medicaid funds to purchase insurance for low-income Arkansans through the state's federally run exchange for individual consumers.

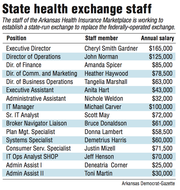

Noting missteps by some other states that have established exchanges, Rep. Deborah Ferguson, D-West Memphis, told Cheryl Smith Gardner, the Arkansas marketplace's executive director, "We need some assurance that our state exchange is not going to [experience] those same kind of failures."

Gardner said the marketplace board has been studying exchanges in other states, including those that it considers to be successful.

She added that the state will need control over the exchange if it wants to craft another program that provides subsidies for private insurance coverage.

"You're going to have to have some type of mechanism for people to shop for their plans," Gardner said.

During the open enrollment period for individual consumers, the Insurance Department will continue to field questions from consumers, provide training for outreach workers and insurance agents and report on enrollment totals, according to an agreement between the department and the Health Insurance Marketplace.

Meanwhile, the marketplace will develop training materials for insurance agents on the small-business exchange and, through a contractor, field questions from agents, business owners and consumers about that exchange.

The Insurance Department will continue to help regulate plans on both exchanges.

As part of the transition, the Insurance Department on Wednesday eliminated its Health Connector Division, replacing it with the Regulatory Health Link Division.

According to its website, the Regulatory Health Link Division will "provide regulation and guidance in relation to the federal health insurance market reforms enacted under the Patient Protection and Affordable Care Act" and ensure consumers are "given accurate and dependable information."

The new division has seven employees, all of whom were transferred from the Health Connector Division.

The department will use money from its own budget to pay the salaries of division Director Zane Chrisman, who will make $92,500 a year, and those of two other employees, Insurance Department spokesman Ryan James said.

Using federal grant money, the marketplace will pay the salaries of four other division employees through February 2016.

The positions of other Health Connector Division employees, including those of Deputy Insurance Commissioner Cynthia Crone and Debbie Willhite, the division's chief operational officer, were eliminated, James said.

As recently as March, the Health Connector Division had 18 employees and an annual budget, funded by federal grants, of about $4.4 million.

The Insurance Department plans to transfer about $19 million in federal grant money to the marketplace later this month.

Kerr has said the federal government won't allow the department to spend the money on expenses incurred after Tuesday, but will allow the marketplace to spend it for up to one additional year to support the transition to state-based exchanges.

Metro on 07/02/2015