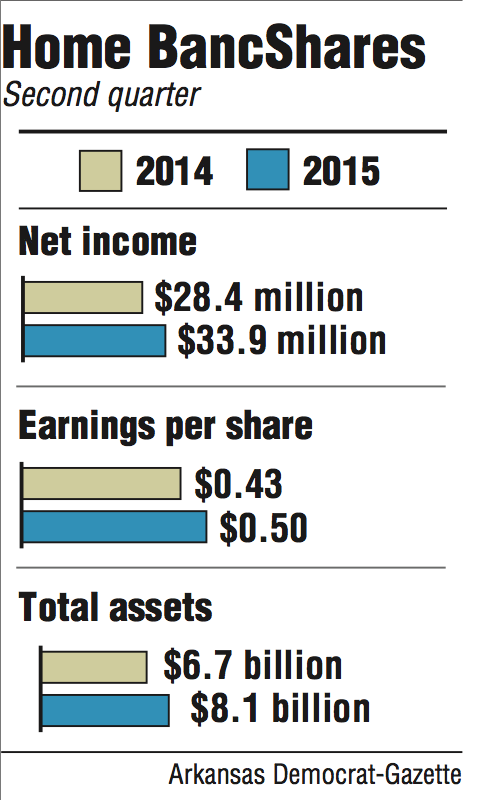

Home BancShares, the owner of Centennial Bank, had record net income of $33.9 million in the second quarter, the Conway-based bank said Thursday.

That was up about 19 percent from $28.4 million earned in the same period last year.

Home BancShares earned 50 cents per share for the second quarter, beating the expectations of 49 cents per share by eight analysts who cover the bank, according to media firm Thomson Reuters.

It was the 17th straight quarter that the bank reported record earnings, said Randy Sims, Home BancShares' chief executive officer.

"We've been doing it for over four years," Sims said.

The company's shares rose 56 cents to close Thursday at $38.56 in trading on the Nasdaq exchange.

"The impressive results were driven by loan growth," Matt Olney, an analyst in Little Rock with Stephens Inc., said in a research brief. Olney does not own stock in the bank. Home BancShares has been a client of Stephens during the past year.

Home BancShares had $569 million in loan growth in the second quarter, well above analysts' projections of $384 million, Olney said.

Not counting purchased loans, Home BancShares' loans grew by $280 million, said John Allison, the bank's chairman. That is from $112 million in growth in Florida, $92 million in Arkansas, $19 million in Alabama and $56 million in the bank's new New York City loan production office, Allison said.

The bank had its biggest single day of loan approvals on Wednesday with $168 million in loans approved. About $40 million of that came from New York City.

Even with the early success of the New York office, Home BancShares isn't likely to consider making a bank acquisition in the New York area to support the office there, Allison said. There could be consideration of buying a branch or two in New York, Allison said.

"Let them get up in the $1 billion [in loans] range and we'll take another look at [an acquisition]," Allison said. "I would be comfortable with them getting to $1 billion to $1.5 billion in loans, and I'd expect they'll get there in the next year or two."

Olney, who has a "buy" rating on the stock, had a target price of $39 on Home BancShares, but the bank passed that before the markets closed Thursday, hitting a 52-week high of $39.50 during the session.

Home BancShares is considering acquisitions, primarily in Florida but also Arkansas and Alabama, where the bank already has locations, Allison said.

"We're so well positioned in Florida, with such good management on the ground in Florida, I would hate to give up on Florida today and don't intend to, quite honestly," Allison said. "We'll continue to acquire in that market."

Home BancShares has been working on one deal in Florida for about 18 months, Allison said.

Still, Home BancShares could make an acquisition outside those markets, Allison said.

"We've been invited lately to look at some pretty good size operations, one in the $4 billion [asset] range and one in the $5 billion range," Allison said. "We probably will go kick the tires."

Centennial Bank closed one branch in Arkansas in the second quarter and plans to close two more in Arkansas, one in Alabama and two in Florida in the third quarter. The branches are closed because of underperformance or being located near another Centennial branch, said Donna Townsell, a bank vice president.

Home BancShares had an efficiency ratio of 40.39 percent in the second quarter. That means Home BancShares spent $40.39 for every $100 it earned.

Centennial Bank has 82 branches in Arkansas, 59 in Florida, seven in Alabama and the loan production office in New York.

Business on 07/17/2015