Motorists filling up their vehicles this week are paying about a dollar a gallon less at the pump compared with last year despite a recent jump in gasoline prices.

But rather than spending the savings, as retailers had hoped, U.S. consumers are using it to pay down debt or build up reserves -- throttling the economic growth economists expected to see as a result of the drop in energy prices.

Analysts say consumers still feeling the effects of the 2008 financial crisis are cautious and worried about another economic downturn.

"It shows you that even though the job market is supposedly getting better and the economy is getting better, I don't think the consumer has fully recovered from what happened in 2008," said Phil Flynn, an energy analyst with Price Futures Group.

He said that while retail gasoline demand has increased, consumers are skeptical about lower gasoline prices.

"Prices are volatile," Flynn said. "It's going to take more stability in gasoline prices ... for [consumers] to spend more money" on other things.

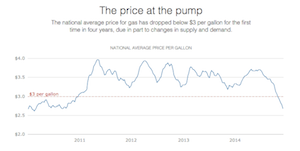

The decline in oil prices since last summer has resulted in lower retail energy prices, especially the price of gasoline, which earlier this year hit the lowest level in six years.

Gasoline prices, mirroring crude, have rebounded but remain about a dollar lower than they were in 2014.

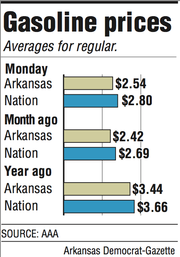

On Monday, the average price of gasoline in Arkansas was $2.54 a gallon, up from $2.42 a month ago. The national average is $2.80 a gallon, compared to $2.69 last month, according to auto club AAA's fuel gauge report.

At current prices, the average U.S. household is expected to spend about $700 less on gasoline this year compared with 2014, according to the U.S. Energy Information Administration.

A majority of consumers -- 57 percent -- say lower prices at the pump are making a difference in their household finances, according to a recent Gallup poll.

But consumers, such as Woody Simmons of Little Rock, aren't spending the extra money.

Simmons, 48, said he's noticed the savings in gasoline costs, but he was "probably just putting away" the extra money.

"You aren't saving a whole bunch," Simmons said as he filled up his white Ford truck Monday morning at Doublebee's Exxon Store at 2402 Cantrell Road.

Shae Chandler, 44, who was filling up a work vehicle at the same station as Simmons, said it now costs about $25 to fill up his white Toyota Rav4, compared with the $38 to $40 at last year's prices.

He said his employer, Modern Lawns Inc., has used the savings to invest in the business, such as updating equipment.

Chandler said that while he lives only a few miles from where he works, he is saving about $60 a month on his personal gasoline expenses.

"I just keep it," he said, about the extra cash. "I just haven't spent it."

In the Gallup poll, many consumers -- about 42 percent -- said they were using the savings from gasoline to pay off bills. Another 28 percent of the consumers surveyed said they were saving the extra money.

The poll was conducted via telephone interviews June 2-7. The survey sample was 1,527 adults living in the United States. The margin of error is about 3 percentage points, according to Gallup's website.

Because consumers lack confidence in job security and wages, they are putting any extra cash they may have into into reserves and retirement accounts instead of spending it, said Rob Lutts, president and chief investment officer for Cabot Wealth Management.

"I think what they are doing is being very conservative," he said. "Maybe this is because we've had a decade where the economy had two kinds of downturns ... so there's less confidence that we can go for 10 to 15 years without trouble like that."

He said middle-income earners have continued to struggle since the recession ended, with most seeing little in the way of pay raises while costs, such as housing and health care, are increasing.

This has curbed most of the retail spending that a decline in energy costs would normally spur, he said, adding that it could also be slowing economic growth as a whole by about a percentage point.

"Debt is like a noose and it kind of holds back the economy," Lutts said. "People have to pay off the debt. ... For all economies that have a lot of debt that's problematic. That may be why we are experiencing lower growth."

A Section on 06/16/2015