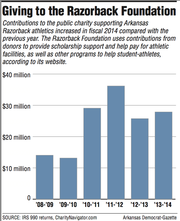

FAYETTEVILLE -- The public charity supporting Arkansas Razorback athletics reported $27.9 million in revenue from contributions and grants for the 12-month period ending June 30, 2014, an increase in giving of about $2.1 million compared with the previous fiscal year.

The foundation closed its fiscal 2014 with $45.2 million in net assets, up from $39.3 million the previous year.

The most recent giving total includes about $3.3 million in noncash contributions, according to the organization's 2013 annual report that's required by the Internal Revenue Service.

Elsewhere in the report, the Razorback Foundation listed having received 26 contributions of publicly traded securities valued at a total of $3,980,483, a figure based on "fair market value."

The foundation listed no other noncash contributions. The time period covered by the return does not include the December land gift of approximately 256 acres from Dallas Cowboys owner and former Razorback football player Jerry Jones and his wife, Gene. The land is owned by a limited liability company organized by the Razorback Foundation's executive director, Sean Rochelle.

Rochelle did not respond to questions about the increase in giving and noncash contributions, referring questions to the foundation's board chairman, Ken Mourton.

In a written statement, Mourton, who, like other board members, is not paid, said: "The Razorback Foundation is grateful for the incredible support of its membership and we are excited about the momentum created from an extremely successful year by more than 460 Razorback student-athletes and the programs they represent."

Mourton's statement continued: "We are poised to close out this fiscal year very strongly and look forward to the University of Arkansas Athletic Department's Annual Report highlighting these and other important accomplishments made possible by the support of our membership through annual and capital contributions."

He did not answer specific questions and concluded by stating that, other than the return itself, "please accept this statement as the position of the Foundation."

Requests from the Democrat-Gazette to speak with Jeff Long, the University of Arkansas at Fayetteville's athletic director, were declined. Some athletic facility projects are nearing completion, including a 55,000-square-foot building to house academic support services.

But as of June 30, 2014, the IRS report notes that $25.2 million of the foundation's net assets are considered unrestricted, meaning they are not tied to a specific project or for use at a specific time.

The foundation's 2013 IRS report stated that it provided $19.1 million in monetary support to UA. Of that total, $3.2 million went for capital projects construction, a notable decrease from the previous fiscal year when $18.5 million went for capital projects.

The foundation's total revenue in fiscal 2014 -- $29.2 million, including, for example, investment revenue -- surpassed its expenses, which totaled $24.7 million, for a yearly surplus of $4.4 million. In contrast, during the foundation's fiscal 2013 with a heavier emphasis on capital projects, expenses outpaced revenue by about $9.3 million.

The university, in a separate 2013-14 report using accounting standards set by the Arkansas Department of Higher Education, counted $11.8 million in athletic department revenue as coming from "foundations/clubs & other private gifts."

Razorback athletics spokesman Kevin Trainor confirmed that this gift revenue almost exactly matches the fiscal 2014 amount transferred from the Razorback Foundation for annual expenditures. The funds helped pay for salaries over line-item maximums set by the state Legislature, cover debt service obligations and pay for scholarship expenses, among other expenditures, according to Trainor.

He explained that in addition to funds for annual expenditures, the foundation provides funding support for capital projects. In addition to the new academic "success center," such recent projects include an indoor baseball and track center and what's known as UA's Basketball Performance Center, a practice facility.

The $11.8 million giving total listed in the report to the Arkansas Department of Higher Education represented about 14 percent of the $81.8 million in revenue reported for 2013-14 by UA's athletic department. Ticket sales of $34 million were the university department's largest revenue source for the year, according to the report.

Yearly expenses for the foundation detailed in the IRS report include staff payroll and payments to coaches for speaking engagements.

Rochelle earned wages and compensation of $152,076, not including a separate IRS category of "other compensation" valued at $26,321. This "other compensation" category, as defined by the IRS, may include deferred compensation.

Associate Director Norm DeBriyn, a former Razorback head baseball coach, earned $109,598, plus "other compensation" of $18,953.

The foundation also paid $87,285 to former executive director Harold Horton, who stepped down from that role in 2012.

The IRS report also listed some information based on calendar year 2013 for payments made by the foundation to coaches and former coaches.

Razorback head men's basketball coach Mike Anderson is listed as receiving $700,000 in speaking engagement compensation, while Razorback head football coach Bret Bielema is listed as receiving $357,346 in speaking engagement compensation.

Anderson earned $2,215,700 in fiscal 2014 -- from UA and the Razorback Foundation -- according to Trainor, not including certain fringe benefits like insurance. His total compensation as reported to the NCAA was $2,501,834.

Bielema earned $3.3 million in fiscal 2014, according to Trainor, plus a $25,000 bonus related to the academic performance of the football program, not including certain benefits. His total compensation as reported to the NCAA was $3,689,557.

Others receiving speaking engagement compensation in calendar year 2013 were former coach and athletic director Frank Broyles, listed as receiving $415,926, and John L. Smith, a former Razorback head football coach, listed as receiving $300,000.

The foundation also listed $410,000 in payment to John Pelphrey as part of a contract buyout. Pelphrey is a former head men's basketball coach.

The IRS return is dated Feb. 12 of this year, with the foundation's chief financial officer, Billye Veteto, listed as signing the document.

Metro on 06/28/2015